- On the fifth GCC Summit 2025 in Bengaluru (organised by ICAI), business leaders dropped some critical intel.

- “A CA incomes ₹1 lakh month-to-month in a conventional firm can earn 2–3x extra in a GCC.” mentioned Raghu Ok, Former ICAI President.

- However right here’s the truth verify; upskilling isn’t elective. Grasp IFRS and AI-driven finance workflows, or get left behind.

GCCs used to deal with solely again workplace work

There was a time when finance roles inside World Functionality Centres have been predictable, and albeit, menial.

Most professionals in GCCs have been targeted on:

- Journal entries and ledger upkeep

- Month-end shut help

- Primary MIS and variance reporting

- Compliance documentation and audit help

Then they moved up the Worth Chain

However because the years glided by, finance roles inside GCCs more and more turned extra advanced.

What was help work is now decision-making work.

What was execution is now evaluation, judgment, and technique.

At this time’s GCC finance groups are dealing with:

- World tax and statutory reporting

- Valuations and M&A help

- ESG and sustainability reporting

- Advisory, danger, and cross-border structuring

Sanjib Sanghi, convener of the GCC meetup, summed it up completely:

“GCCs have expanded from tech-heavy operations to strategic management centres. With AI taking up routine duties, the actual worth lies in cross-border tax planning, sustainability reporting, valuations, mergers, and fund initiation. Over one lakh CAs already work in GCCs, many in senior management.”

And as soon as the work modifications, one thing else at all times follows.

The cash.

GCC compensations quietly skyrocketed

Now, let’s speak numbers.

A Tax Chief at a US-based GCC shared some on-ground intel. And it confirms what many professionals are already seeing firsthand.

GCC compensation has shifted, drastically.

- Over 5 years, whole compensation for a lot of professionals has reached ₹70–80 lakh, together with RSUs.

- Even semi-qualified CAs with multinational publicity are incomes ₹30–35 lakh for Document-to-Report (R2R) roles.

- And get this: In lots of instances, that’s larger than what absolutely certified CAs earn in conventional Indian corporations.

That’s simply base pay.

Should you be part of a listed multinational GCC, fairness payouts alone (RSUs and ESOPs) can exceed an worker’s annual take-home wage.

Additionally learn: Trump’s $100K H-1B price: A blow to Indian IT…or a boon for GCCs & offshoring?

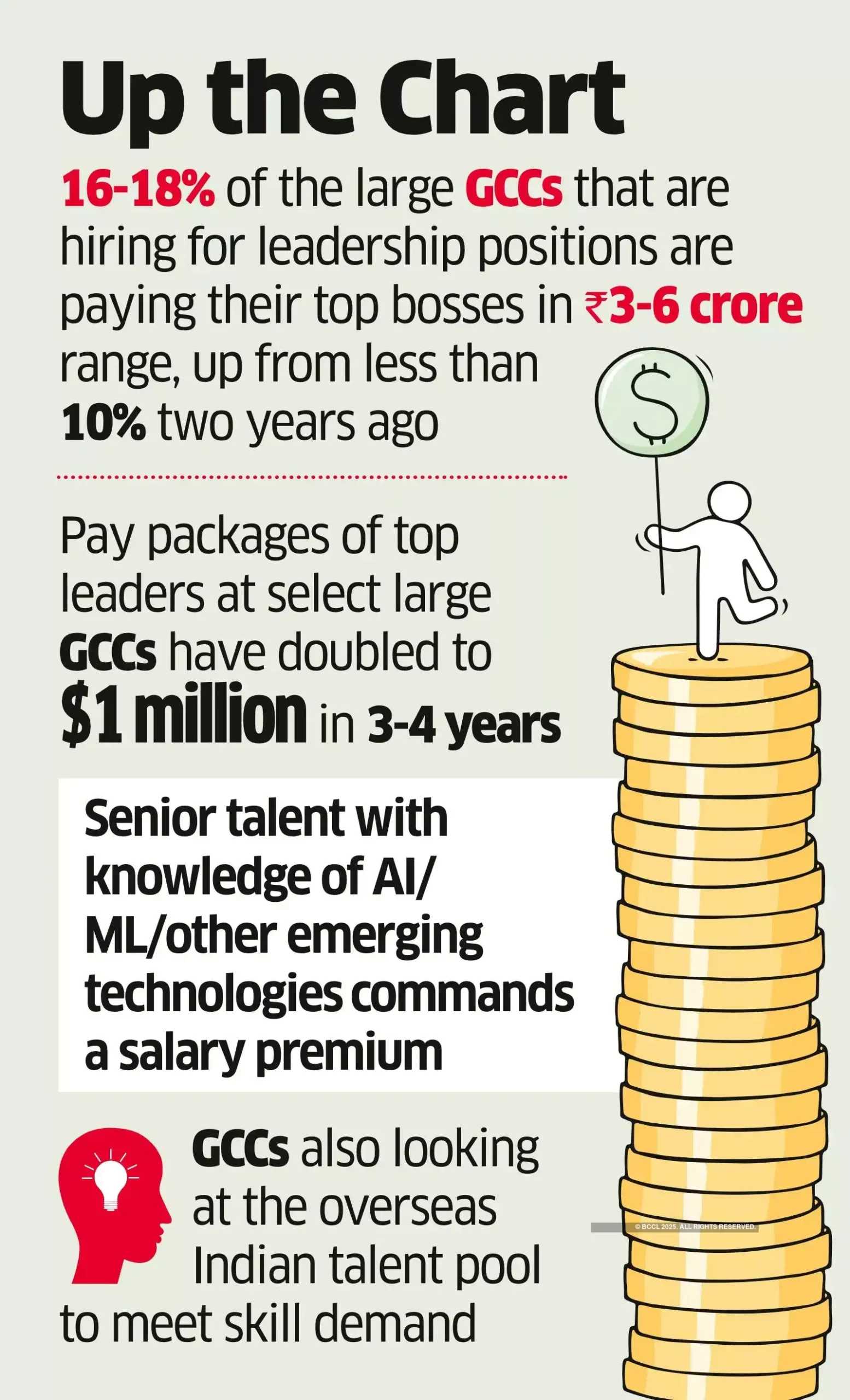

CXO and senior management salaries are surging

Now let’s transfer to the highest of the pyramid.

And sure, management compensation inside GCCs is materially larger than even some IT providers corporations.

Executives with 18–25 years of expertise at the moment are incomes in crores, as per an ET article:

- CTOs earn between ₹1.6–2.0 crore each year, round 14% larger than comparable roles

- CFOs command ₹1.5–2.0 crore, relying on scale and international publicity, roughly 12% larger

- CHROs earn ₹1.5–1.8 crore yearly, with compensation as much as 25% larger because the position turns into extra strategic

- Managing Administrators and Nation Heads at mature GCCs earn over $1 million yearly (round ₹8.3 crore)

These ranges are practically double what related roles paid only a few years in the past.

Funding banking-led GCCs sit on the high

And right here is one other attention-grabbing stat to blow your thoughts.

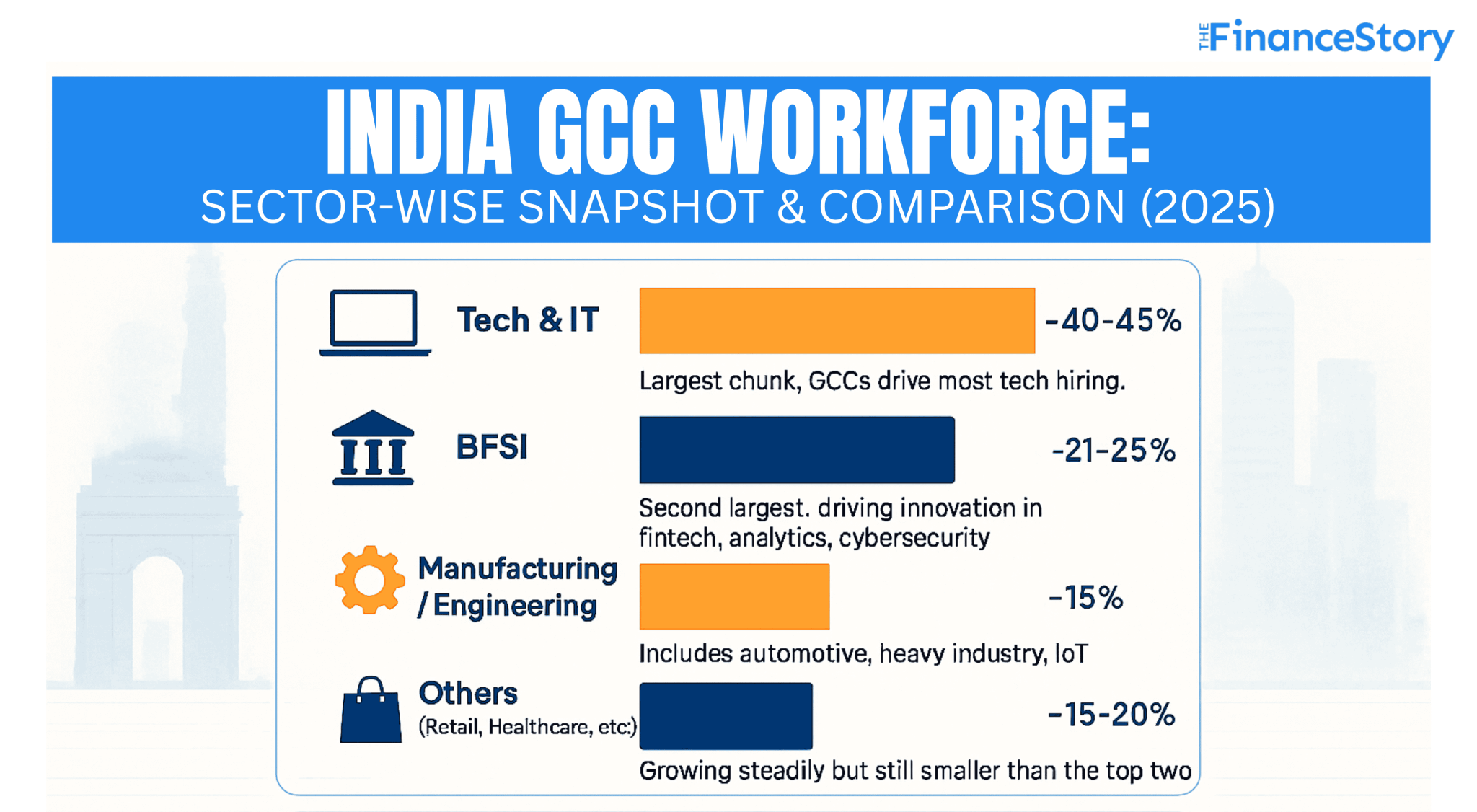

20–25% of all GCC workers in India work within the BFSI (Banking, Monetary Companies, Insurance coverage) sector, using over 380K professionals.

However even inside BFSI GCCs, there’s one section that persistently leads the compensation curve…

Funding banking–led GCCs.

- Knowledge Scientists earn ₹22.1–46.9 LPA, pushed by superior analytics and AI demand

- Full-stack builders command ₹20.7–47.5 LPA as banks prioritise digital possession

- Threat Analysts, Compliance Associates, Senior Threat Managers, FRM Leads, Heads of Compliance, and World

- Finance Administrators earn anyplace between ₹6–90 LPA

- Specialised danger and FRM talent units ship 25–40% larger compensation than conventional finance roles

Indian GCCs: Sector clever comparability

It’s not simply wage

That is the place GCCs quietly win over workers.

Past compensation, they provide:

- Complete well being and OPD protection

- Wellness and sports activities reimbursements

- Progressive maternity and paternity go away

- Versatile and distant work insurance policies

- Workplace meals, transport help, and home-office budgets

The place are these roles paying probably the most?

Compensation ranges range sharply by metropolis.

Throughout India’s main enterprise hubs:

Bengaluru clearly leads the pack, with over 25,000 Chartered Accountants and the best focus of GCCs within the nation. Bengaluru’s compensation ranges sit about 24% above the remainder of the market.

Hyderabad presents pay ranges about 19% larger, powered by its fast-growing tech and BFSI GCC base

Mumbai mirrors this at 19% above market, notably sturdy in IT providers and monetary providers roles

Delhi/NCR stands out at round 21% above market, pushed by management, regulatory, and enterprise-facing roles

Whereas GCCs proceed to pay the best salaries in metro places, they’re more and more increasing into Tier-2 and Tier-3 cities for expertise and scale.

However upskilling is non-negotiable

Now, right here comes the truth verify.

Sure, GCCs are paying greater than conventional corporations. Nevertheless it’s not that simple.

Raghu Ok, former President of ICAI, put it bluntly: upskilling is now not elective.

As AI takes over repetitive duties, CAs should grasp:

- IFRS and international accounting frameworks

- RPA, analytics, and ERP techniques

- Blockchain and cybersecurity

- AI-driven finance workflows

Adapt, and also you’re prone to transfer sooner than ever.

And those that don’t sustain, might be left behind.

Additionally learn: India’s GCC income $64.6 Billion Up By 40% – Rising alternatives Tax Companies

Wrapping up

India now hosts greater than 1,800 GCCs, accounting for over 55% of the worldwide whole. The market is booming.

In response to ET and NLB Companies’ report India’s Expertise Takeoff,

- GCCs are anticipated to ship 9.8% wage development over the following 12 months alone.

- FY25 income is projected at $178 billion, supporting 1.9 million professionals and 10.4 million jobs total.

- By FY30, India might see 2.8–4 million new GCC jobs, with the market projected to succeed in $110 billion.

By 2030, the GCC market in India is projected to develop to $99-105 billion (GCCs income in FY 24 was $64.6 billion, up from $46 billion, a 40% rise.

With top-tier compensation, high-value work, and international publicity on the desk, the query isn’t whether or not GCCs are engaging anymore.

The query is, “Can conventional corporations sustain?”

FAQs

Q: How will AI influence GCC finance roles?

AI will considerably influence GCC finance roles, however in a transformative approach.

GCCs are prioritising AI adoption and upskilling; an EY survey present about 70% are investing in generative AI and associated capabilities, with finance, operations, and analytics being key focus areas.

AI is reshaping job duties: routine, repetitive duties (reminiscent of guide reconciliations) are more and more automated, whereas GCCs are hiring for higher-value analytical, strategic, and tech-enabled finance roles.

Q: How huge is the GCC market in India?

The GCC market in India is booming. Income jumped from $46B to $64.6B in FY24. That was a 40% surge.

And the income is projected to hit $99–105B by 2030.

Leave a Reply