The Division of Schooling has moved to terminate considered one of former President Joe Biden’s hottest pupil mortgage forgiveness plans — impacting tens of millions of People — by means of a proposed joint settlement with the state of Missouri on Tuesday.

The pending settlement ends the Saving on a Worthwhile Schooling or “SAVE” plan, which is dwelling to over 7 million pupil mortgage debtors. It marks a significant victory for the Trump administration’s efforts to claw again Biden-era insurance policies, together with Biden’s quite a few efforts to implement pupil mortgage debt cancellation.

Officers within the Trump administration’s Schooling Division, who’ve decried these insurance policies for months, steered that the administration is righting a mistaken by ending the “misleading scheme” of pupil mortgage forgiveness.

The Biden administration touted the plan for together with $0 funds for anybody making $16 an hour or much less, decreasing month-to-month funds for tens of millions of debtors, and defending debtors from runaway curiosity if they’re making their month-to-month funds.

“The regulation is obvious: when you take out a mortgage, you need to pay it again,” Beneath Secretary of Schooling Nicholas Kent mentioned in a launch from Secretary of Schooling Linda McMahon’s division on Tuesday. “Because of the State of Missouri and different states preventing in opposition to this egregious federal overreach, American taxpayers can now relaxation assured they’ll now not be compelled to function collateral for unlawful and irresponsible pupil mortgage insurance policies.”

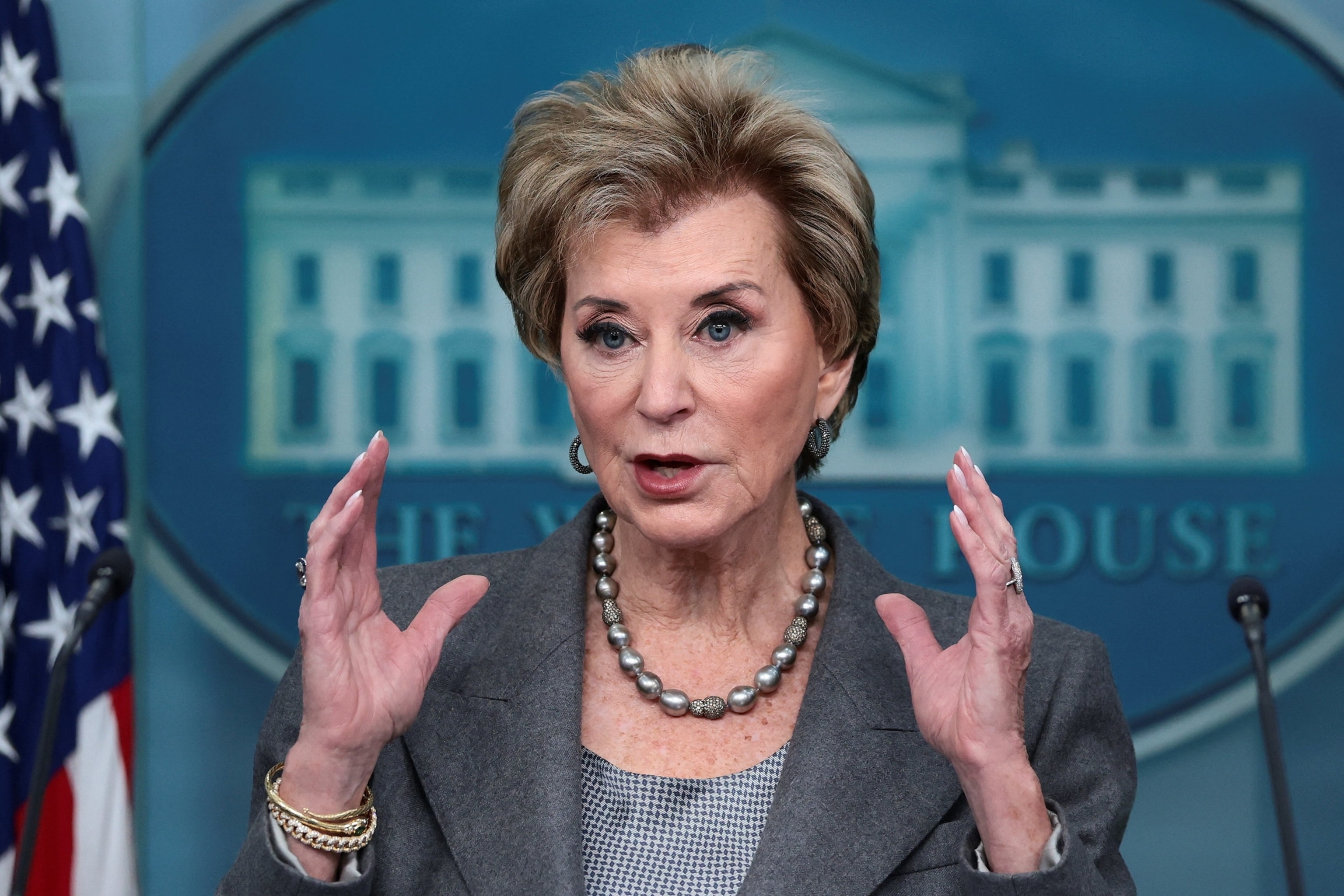

Schooling Secretary Linda McMahon speaks throughout a press briefing on the White Home, Nov. 20, 2025, in Washington.

Evelyn Hockstein/Reuters

The Biden administration launched the SAVE Plan, which it dubbed probably the most inexpensive cost plan ever, after the Supreme Courtroom struck down Biden’s earlier signature debt aid program in 2023.

SAVE was considered one of a number of earnings pushed compensation (IDR) plans, which calculate cost measurement based mostly on earnings and household measurement, geared toward easing the compensation course of as a pandemic-era pause ended.

A number of Republican-led states, together with Missouri, sued the Biden administration over the plan, and a federal appeals courtroom blocked this system in 2024.

The announcement on Tuesday would mark an finish to these lawsuits.

McMahon, a vocal critic of pupil mortgage forgiveness, has mentioned the administration will now not enable American taxpayers to tackle money owed that aren’t their very own.

“The Biden Administration’s unlawful SAVE Plan would have price taxpayers, a lot of whom didn’t attend faculty or already repaid their pupil loans, greater than $342 billion over ten years,” McMahon wrote in a publish on X. “We can’t tolerate it.”

Her company’s already saddled Federal Pupil Assist (FSA) Workplace will present assist to debtors at present enrolled in deciding on a brand new, “authorized compensation plan,” the division mentioned.

The division mentioned debtors could have a restricted time to discover a new cost plan. Nonetheless, FSA’s Mortgage Simulator software will estimate month-to-month funds, decide compensation eligibility and choose a brand new plan that most closely fits these debtors’ wants and objectives, the division mentioned.

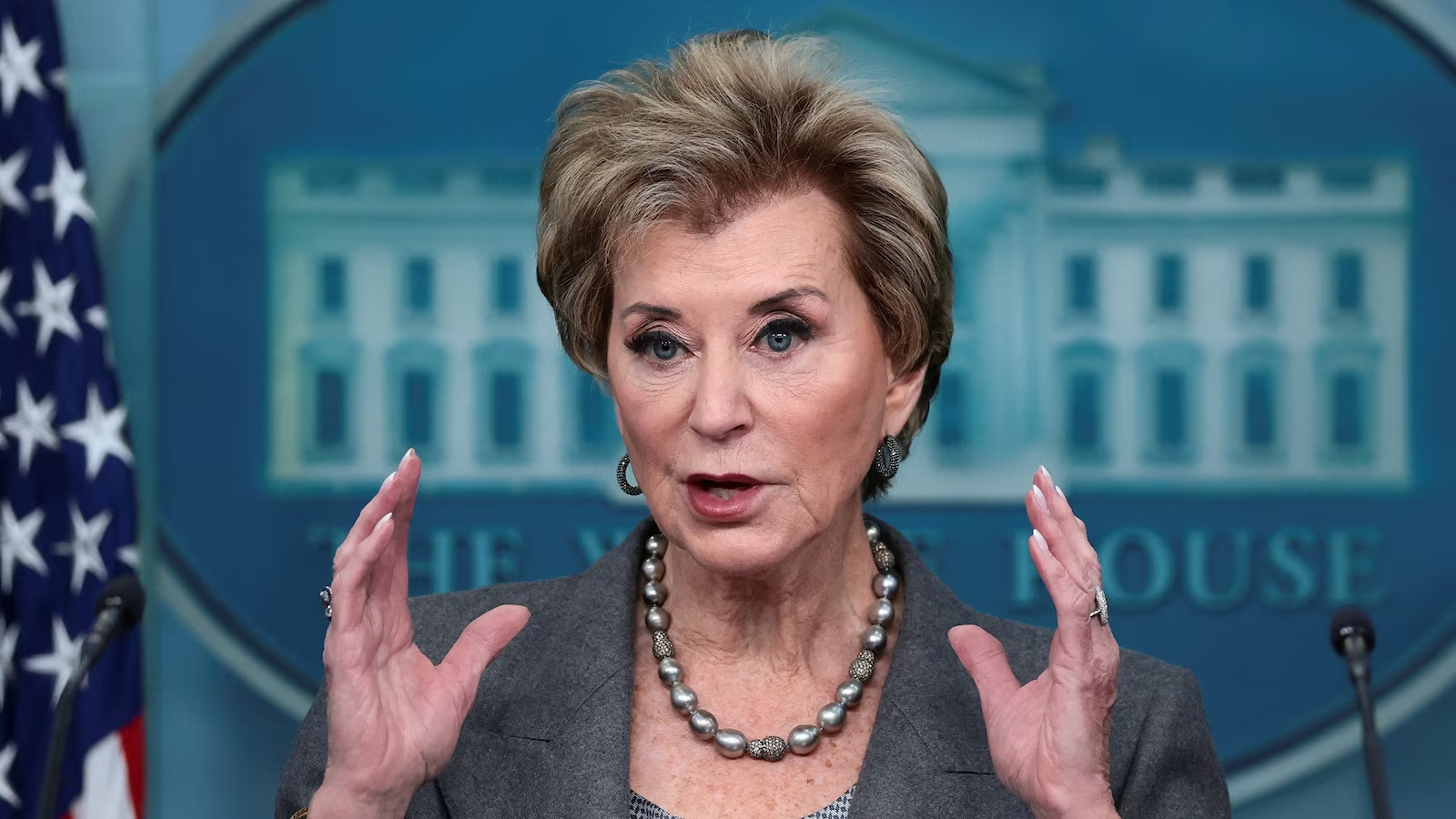

Schooling Secretary Linda McMahon speaks to reporters outdoors the White Home in Washington, November 19, 2025.

Jim Lo Scalzo/EPA/Shutterstock

Some pupil mortgage advocates fear the proposed settlement unleashes chaos on debtors.

“The 7+ million debtors enrolled in SAVE will face larger month-to-month mortgage funds — and should lose out on months of progress towards mortgage forgiveness,” Michele Zampini, affiliate vice chairman of federal coverage & advocacy at The Institute for Faculty Entry & Success (TICAS) wrote in an announcement.

Shield Debtors Deputy Govt Director and Managing Counsel Persis Yu mentioned the transfer strips debtors of probably the most inexpensive compensation plan that might assist tens of millions to remain on observe with their loans whereas protecting a roof over their head.

“This settlement is pure capitulation–it goes a lot additional than the swimsuit or the eighth Circuit order requires,” Yu wrote in an announcement to ABC Information. “The actual story right here is the unrelenting, right-wing push to jack up prices on working folks with pupil debt.”

The information of the settlement comes as Trump’s signature home coverage agenda, the One Large Stunning Invoice Act, included a provision to terminate all present pupil mortgage compensation plans — akin to SAVE and different income-driven compensation plans — for loans disbursed on or after July 1, 2026.

Beneath that invoice, the plans might be changed with two separate compensation plans: a regular compensation plan and the Reimbursement Help Plan (RAP), a brand new income-based compensation plan coming July 1, 2026.

Leave a Reply