Tag: Market

-

Indian Railway Finance Corporation Hits Intraday Low Amid Broader Market Decline

Intraday Price Movement and Market Context The stock’s intraday low of ₹111 marks a significant point as it trades approximately 2.75% above its 52-week low of ₹108.05. The day’s decline of 3.05% places Indian Railway Finance Corporation below its key moving averages, including the 5-day, 20-day, 50-day, 100-day, and 200-day averages, signalling a persistent downward…

-

KJMC Financial Services Hits 52-Week Low of Rs.56.1 Amidst Market Turbulence

Intraday Price Movements and Volatility On 8 December 2025, KJMC Financial Services opened the trading day with a gap up, registering an initial gain of 9.1%. The stock reached an intraday high of Rs.64.95, reflecting early optimism among traders. However, this momentum was not sustained, and the share price declined sharply to touch an intraday…

-

Market Insights: Shares, Economy, IPOs, and Global Trends

Why This Tenant Says Bandra Is Better Than California | The Tenant In this episode of The Tenant, meet Abhi, a former California resident who now believes Bandra is better than the Golden State. He lives in a 550 sq ft 1BHK for ₹50,000/month and explains why Bandra won his heart — from all-day sunlight…

-

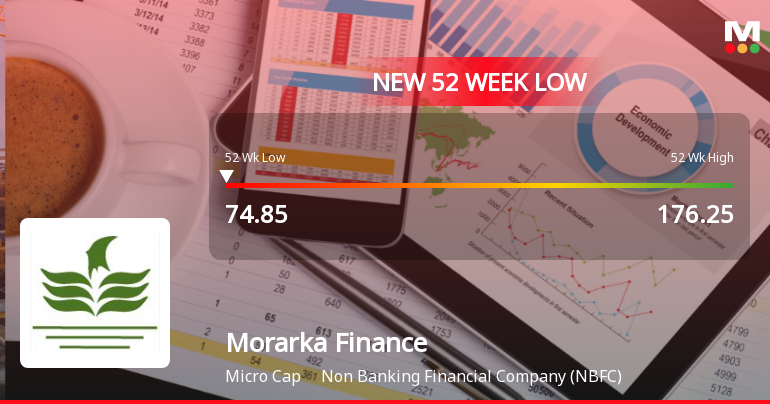

Morarka Finance Shares Plunge to 52-Week Low of Rs. 77.05 Amid Market Turbulence

Intraday Price Movement and Volatility On 8 December 2025, Morarka Finance opened with a gap down of 4.01%, setting a bearish tone for the trading session. The stock exhibited significant volatility, with an intraday price range spanning from a high of Rs.90.00 to the low of Rs.77.05, representing an intraday volatility of 7.75% based on…

-

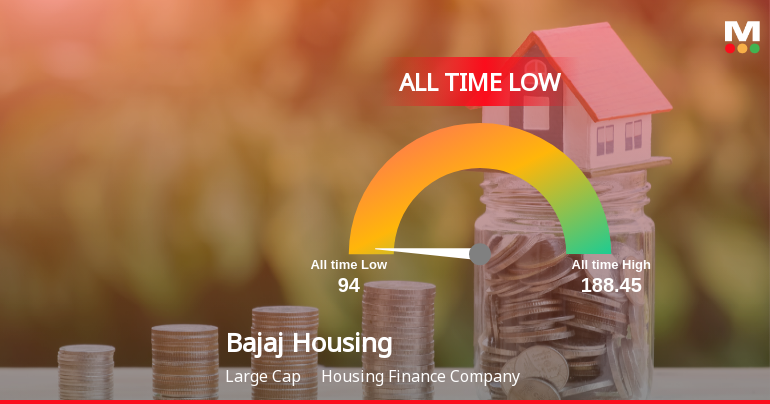

Bajaj Housing Finance Faces Record Lows in Ongoing Market Decline

Recent Market Performance and Price Trends The stock has experienced a continuous decline over the past three trading sessions, with cumulative returns falling by 1.91% during this period. On the latest trading day, Bajaj Housing Finance recorded a drop of 0.94%, underperforming the Sensex, which declined by 0.37%. Over the past week, the stock’s performance…

-

Qgo Finance Adjusts Market Assessment Amid Conflicting Financial Indicators

Understanding the Recent Evaluation Shift The recent adjustment in Qgo Finance’s market assessment stems from a combination of factors across four key analytical dimensions: quality, valuation, financial trend, and technical outlook. Each of these parameters offers insight into the company’s current standing and future prospects within the NBFC sector. Quality Assessment Reflects Challenges Qgo Finance’s…

-

Comprehensive Market Insights: Stocks, Economy, and Global Finance Updates

Why This Tenant Says Bandra Is Better Than California | The Tenant In this episode of The Tenant, meet Abhi, a former California resident who now believes Bandra is better than the Golden State. He lives in a 550 sq ft 1BHK for ₹50,000/month and explains why Bandra won his heart — from all-day sunlight…

-

Ruparel Food’s Market Assessment: Navigating Financial Challenges

Overview of the Evaluation Revision The stock’s score was downgraded following a comprehensive review of its fundamental and market indicators. This adjustment reflects a reassessment of Ruparel Food’s quality, valuation, financial trend, and technical outlook. Such changes in analytical perspective are crucial for investors seeking to gauge the company’s potential within the housing finance sector,…

-

AD Manum Finance Adjusts Market Outlook in Response to Financial Challenges

Understanding the Shift in Market Assessment The recent revision in AD Manum Finance’s evaluation metrics stems from a combination of factors across four key analytical parameters: quality, valuation, financial trend, and technical outlook. Each of these dimensions offers insight into the company’s current standing and the challenges it faces in a competitive and volatile market…

-

Vani Commercials Adjusts Market Strategy in Response to Diverging Financial and Technical Indicators

Technical Trends Signal Caution The technical landscape for Vani Commercials has undergone a subtle but notable shift. Weekly and monthly Moving Average Convergence Divergence (MACD) indicators suggest a bearish to mildly bearish momentum, signalling a cautious outlook among traders. Bollinger Bands on both weekly and monthly charts reinforce this sentiment, indicating price volatility skewed towards…