Tag: Bank

-

Unlock Your Dream: Select the Proper Examine Overseas Counselling Service With out Breaking the Financial institution

Finding out overseas is a dream for a lot of college students, providing a chance to realize world publicity, improve their training, and expertise new cultures. Nonetheless, navigating the complexities of worldwide training could be daunting. That is the place research overseas counselling companies are available. They supply steerage on every part from choosing the…

-

Affordable Dedicated Server Hosting: Unlocking Power Without Breaking the Bank

In today’s digital landscape, dedicated server hosting can be an essential asset for businesses of all sizes. However, many companies are often hesitant to make the leap, mainly due to cost concerns. The great news is that it’s entirely possible to secure affordable dedicated server hosting without sacrificing power or capability. In this article, we…

-

Inexpensive Devoted Servers in India: Excessive Efficiency with out Breaking the Financial institution

The digital panorama in India is evolving at an unprecedented tempo. With a rising variety of companies transitioning on-line, the necessity for dependable internet hosting options has by no means been higher. Amongst these choices, devoted servers stand out for his or her efficiency and adaptability. Nevertheless, many firms are involved in regards to the…

-

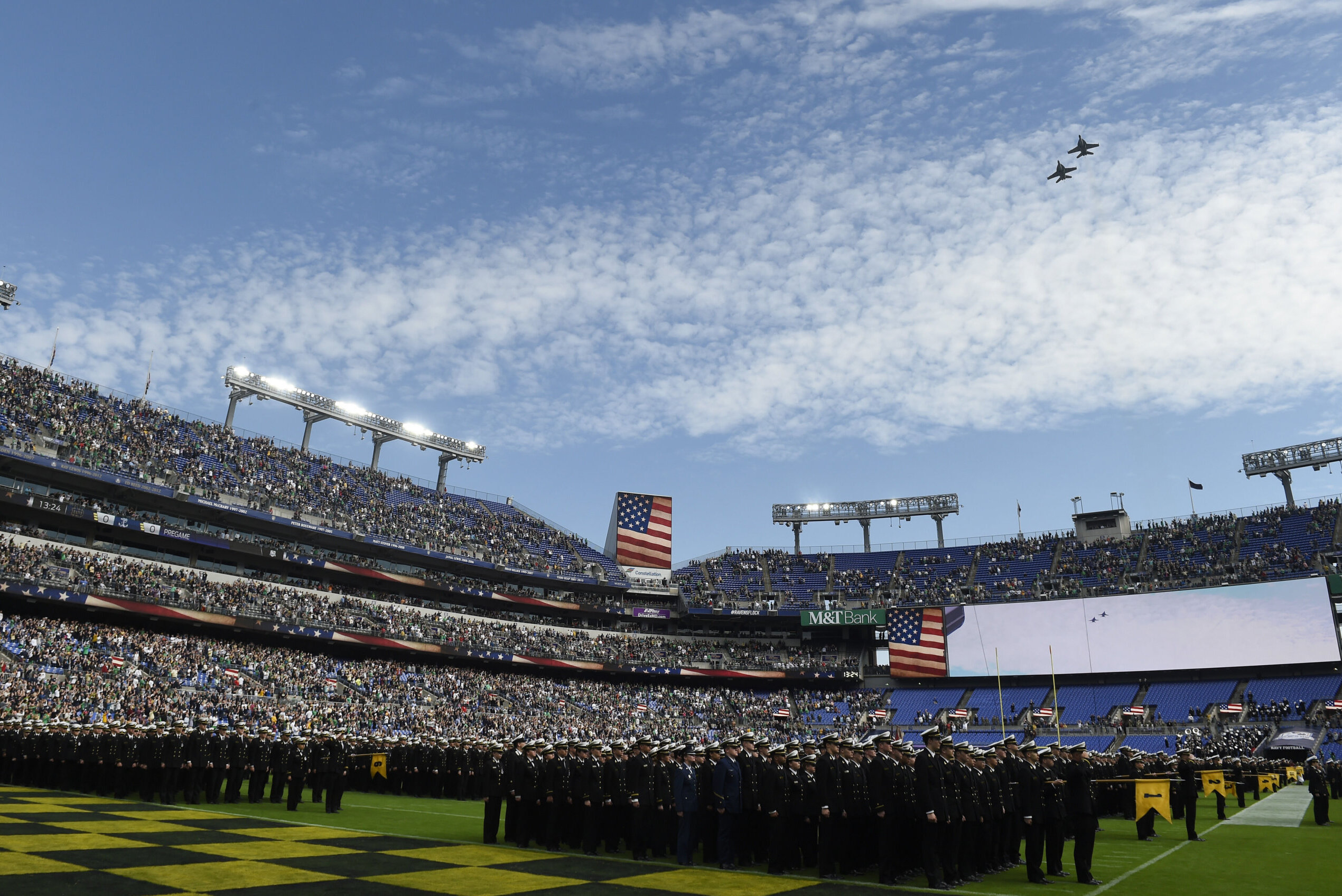

M&T Financial institution Stadium Designated No-Drone Zone for Military-Navy Sport

A Non permanent Flight Restriction shall be in place Saturday from 9 a.m. to 9 p.m., making a strict no-drone zone inside a 2-nautical-mile radius of M&T Financial institution Stadium and as much as 2,000 toes. Federal officers are tightening the skies over Baltimore, Maryland, forward of Saturday’s Military-Navy Sport. A Non permanent Flight Restriction…

-

Site visitors Advisory: Street Closures for Military-Navy Sport at M&T Financial institution Stadium

BALTIMORE (WBFF) — The Baltimore Metropolis Division of Transportation (BDCOT) is warning drivers of momentary street and lane closures going into impact for Saturday’s Military vs. Navy soccer recreation at M&T Financial institution Stadium. The sport will kick off at 3 p.m. on Dec. 13. ALSO READ | Former NFL QB, USAA shock veterans with…

-

Harness the Energy of Reasonably priced Devoted Server Internet hosting: Maximize Efficiency With out Breaking the Financial institution

Printed by DJ-Applied sciences | 2025 Within the fast-paced digital age, companies are more and more counting on sturdy infrastructure to fulfill the calls for of their prospects. At DJ-Applied sciences, we perceive the important function that internet hosting options play in your organization’s success. As we step into 2025, the demand for devoted server…

-

Financial institution of Canada Maintains Key Curiosity Fee at 2.25%, No Future Improve Timeline Supplied

The Financial institution of Canada lower rates of interest at its final two consecutive fee selections. REUTERS/Blair Gable · REUTERS / Reuters The Financial institution of Canada (BoC) held its benchmark rate of interest at 2.25 per cent on Wednesday, a transfer broadly anticipated by economists. The market had 93.5 per cent odds that the…

-

RBI Approves Fino Funds Financial institution’s Transition to Small Finance Financial institution

Notably, Fino Funds Financial institution is concentrating on a revenue after tax of Rs 100 crore within the present monetary 12 months, based on Chief Government Officer Rishi Gupta. He had said that the conversion right into a SFB will allow higher management over its product choices and drive additional progress. “We’re engaged on some…

-

RBI Approves Fino Funds Financial institution’s Transition to Small Finance Financial institution

Mumbai: The Reserve Financial institution on Friday granted ‘in-principle’ approval to Fino Funds Financial institution Ltd (FPBL) for conversion right into a Small Finance Financial institution (SFB).Fino Funds Financial institution, which began operations in 2017, had utilized for a small finance financial institution license in October-December 2023. RBI has issued the Tips for ‘on faucet’…

-

Financial institution of England Lowers Capital Necessities for UK Banks

The Financial institution of England’s Monetary Coverage Committee (FPC) diminished its benchmark capital requirement for UK banks from %14 to %13 of risk-weighted property (RWAs). Following a decline in common danger weights since 2016, a rising variety of main UK banks are actually extra constrained by leverage ratio necessities than by risk-weighted measures. The FPC plans…