The primary arrives on the fifth of the month: “Pricey Buyer, Rs 15,000 has been debited on your SIP in Nifty 50 Index Fund.” You’re feeling a surge of pleasure. You’re prudent, forward-looking, a participant within the India development story.The second arrives on the tenth: “Pricey Buyer, your bank card invoice of Rs 62,000 is due. Your Dwelling Mortgage EMI of Rs 45,000 shall be deducted shortly.” You’re feeling a knot in your abdomen.

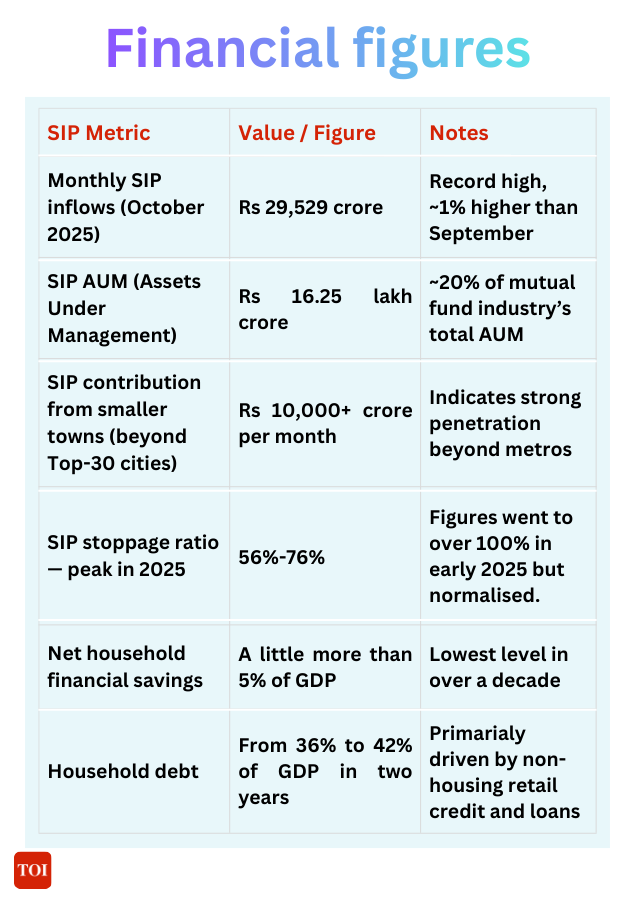

That is the dichotomy defining private finance in India in late 2025. On the floor, the information suggests a golden age of financialization.India’s mutual fund SIP story appears to be like like a dream run on paper. In October 2025, month-to-month SIP contributions hit a document Rs 29,529 crore, with SIP belongings now over Rs 16.25 lakh crore, a couple of fifth of all the mutual fund trade’s AUM.However scratch the floor and a extra sophisticated image emerges. SIP stoppage ratios have hovered round a excessive of roughly 75% (it was 76 in Sept) in current months, that means a big chunk of registered SIPs are being discontinued or allowed to lapse, whilst recent cash pours in.On the identical time, RBI-based analyses recommend family monetary liabilities have grown greater than twice as quick as belongings in recent times, with liabilities’ share of GDP rising whilst recent monetary financial savings as a share of GDP have dipped.So is the center class actually getting richer, or simply extra leveraged with a veneer of economic sophistication?

1. The headline numbers: document SIPs, stressed buyers

The laborious information tells two simultaneous tales.

- All-time excessive SIP flows: October’s SIP inflows of Rs 29,529 crore marked yet one more peak, up about 1% over September and persevering with a post-pandemic surge in systematic investing.

- SIP AUM is now mainstream: SIP-linked belongings are over Rs 16.25 lakh crore, round 20% of the MF trade’s whole AUM, a giant bounce from a decade in the past when SIPs had been nonetheless a distinct segment retail product.

- Past metros: Flows from smaller cities (past top-30 cities) now contribute over Rs 10,000 crore of month-to-month SIP inflows, greater than 40% of lively fairness SIP flows, indicating that the SIP tradition has firmly penetrated Bharat, not simply India.

But the SIP stoppage ratio, SIPs discontinued in a month divided by SIPs registered within the final 12 months, has been uncomfortably excessive. After spiking above 100% earlier in 2025, it has “normalised” solely to the 56–76% band, and up to date readings are nonetheless round 75%.A excessive stoppage ratio doesn’t robotically imply panic, it additionally captures SIPs maturing, folio clean-ups, and portfolio rebalancing. However persistently elevated stoppages recommend churn, and presumably stress, even because the headline SIP quantity makes for a feel-good headline.

2. Behind the growth: debt rising sooner than financial savings

Zoom out from mutual funds to the family steadiness sheet, and the distinction sharpens.

- Analyses of RBI information present family monetary liabilities grew about 102% between 2019–20 and 2024–25, whereas monetary belongings rose solely 48% in the identical interval.

- Annual creation of recent monetary belongings has fallen from about 12% of GDP to 10.8%, whereas the tempo of including new debt has climbed from 3.9% of GDP to 4.7%, after peaking at 6.2% within the fast post-pandemic years.

- General family financial savings (monetary+bodily) have slipped to about 18.1% of GDP in FY24, marking a 3rd straight yr of decline, as extra Indians lean on credit score to fund consumption

- Web family monetary financial savings, monetary belongings minus monetary liabilities, have fallen to only over 5% of GDP, the bottom stage in additional than a decade.

In the meantime, RBI’s Monetary Stability Report notes that family debt has risen from about 36% to roughly 42% of GDP over two years, pushed largely by non-housing retail credit score, private loans, bank cards, and small-ticket consumption loans.So, whilst extra middle-class households proudly showcase their SIP screenshots, their legal responsibility aspect is swelling sooner than the asset aspect. Mutual funds have grown from lower than 1% to about 6% of households’ gross monetary financial savings between FY12 and FY23,however that doesn’t imply they’re saving extra general, they’re simply saving in another way, even whereas borrowing extra.

3. 4 middle-class cash tales

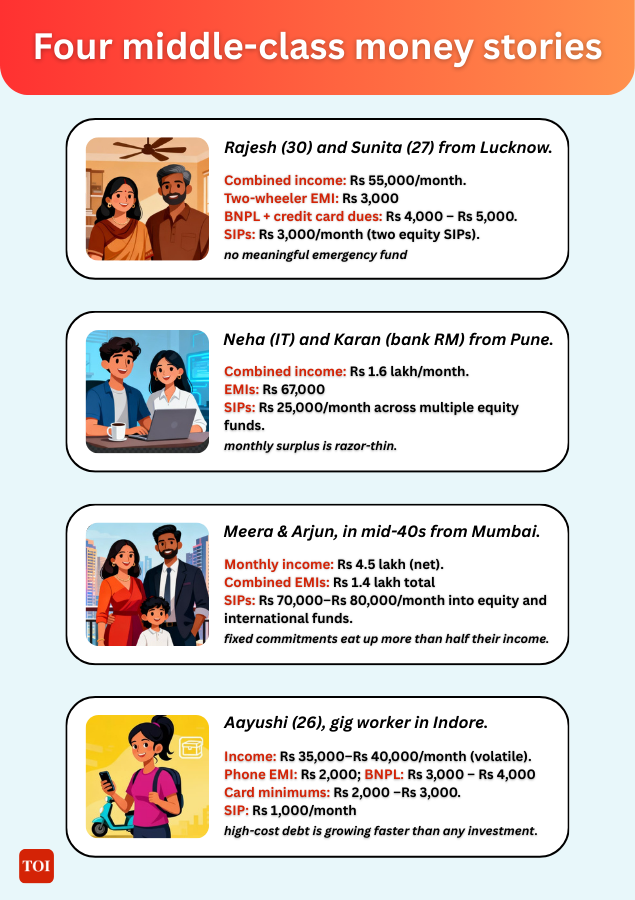

To know how this performs out on the bottom, think about 4 composite households — every operating SIPs and EMIs aspect by aspect.(a) The lower-middle couple: SIP as a badge of arrival

- Profile: Rajesh and Sunita, 30 and 27, work in a BPO and a retail chain in Lucknow. Mixed month-to-month revenue: ~Rs 55,000.

- Liabilities:

- Two-wheeler mortgage EMI: Rs 3,000

- BNPL + bank card repayments: Rs 4,000 – Rs 5,000 (put up on-line festivals, this typically spikes)

- SIPs:

- Two fairness SIPs of Rs 1,500 every (Rs 3,000 whole), began after a colleague’s “markets solely go up” sermon on social media.

On paper, they’re doing all the pieces proper: investing early, utilizing SIPs, collaborating in capital markets. However they don’t have any significant emergency fund, and most months they roll over a part of their BNPL and credit-card dues.One medical emergency or job loss, and the very first thing to go shall be SIPs, not EMIs. Their SIP journey is much less about surplus money and extra about aspirational stress — the worry of being left behind.(b) The rising center IT household: SIPs vs way of life EMIs

- Profile: Neha (IT engineer) and Karan (personal financial institution RM) in Pune. Mixed month-to-month revenue: ~Rs 1.6 lakh.

- Liabilities:

- Dwelling mortgage EMI: Rs 45,000

- Automotive mortgage EMI: Rs 14,000

- Schooling mortgage for Karan’s MBA: Rs 8,000

- SIPs:

- Round Rs 25,000 monthly throughout large-cap, mid-cap and hybrid funds.

They proudly speak about “changing into financially free by 45”. However after housing, EMIs, faculty charges, insurance coverage premiums and way of life spending, their month-to-month surplus is razor-thin. Any rise in rates of interest, faculty charges or a second automotive improve can tip them into revolving credit-card balances.For them, the query isn’t “SIP vs EMI” however whether or not the whole mounted outgo (EMIs + SIPs) is consuming an excessive amount of of their revenue.(c) The upper-middle dual-income metro family: asset-rich, cash-flow tight

- Profile: Meera and Arjun, mid-40s professionals in Mumbai, incomes ~Rs 4.5 lakh a month internet.

- Liabilities:

- Two residence loans (self-occupied flat + under-construction funding property) with mixed EMIs of Rs 1.4 lakh

- Automotive mortgage EMI: Rs 25,000

- SIPs:

- Rs 70,000–Rs 80,000 a month into diversified fairness and worldwide funds.

Their internet price appears to be like spectacular: property, fairness MFs, EPF. However they really feel continuously “broke” as a result of their mounted commitments eat up greater than half their revenue. Holidays, faculty journeys and big-ticket bills go on bank cards, typically repaid over 2–3 months.They’re, in some ways, the face of India’s leveraged wealth — belongings rising on the again of debt and markets, however with restricted shock absorption capability.(d) The aspirational solo earner: micro SIPs, macro credit score

- Profile: Aayushi, 26, gig employee and content material creator in Indore. Common month-to-month revenue: Rs 35,000–Rs 40,000, unstable.

- Liabilities:

- Cellphone EMI: Rs 2,000

- BNPL for devices and style: Rs 3,000–Rs 4,000

- Bank card minimums: Rs 2,000–Rs 3,000 some months

- SIPs:

- One micro-SIP of Rs 1,000 marketed as “simply Rs 33 a day on your future”.

For Aayushi, the SIP is nearly an ethical sign, proof that she isn’t “irresponsible with cash”. However in unhealthy months, she pays card minimums and retains the SIP going as a result of pausing seems like failure.Her threat isn’t dimension of SIP; it’s the truth that high-cost debt is rising sooner than any funding.

4. Is the SIP “cult” masking monetary stress?

None of those households is making a “mistake” by investing. In truth, the financialisation of financial savings — transferring from gold and FDs to market-linked merchandise — is a long-term optimistic.The issue is sequence and proportions:The elevated SIP stoppage ratio is an early warning signal. When money flows tighten — due to layoffs, medical payments, faculty payment hikes or EMI resets — buyers quietly cease SIPs lengthy earlier than they default on EMIs. The market sees strong gross SIP inflows, however particular person portfolios typically inform a stop-start story.In different phrases, the SIP growth can coexist with rising monetary fragility.

5. The way to know in case you’re over-leveraged (and what to do)

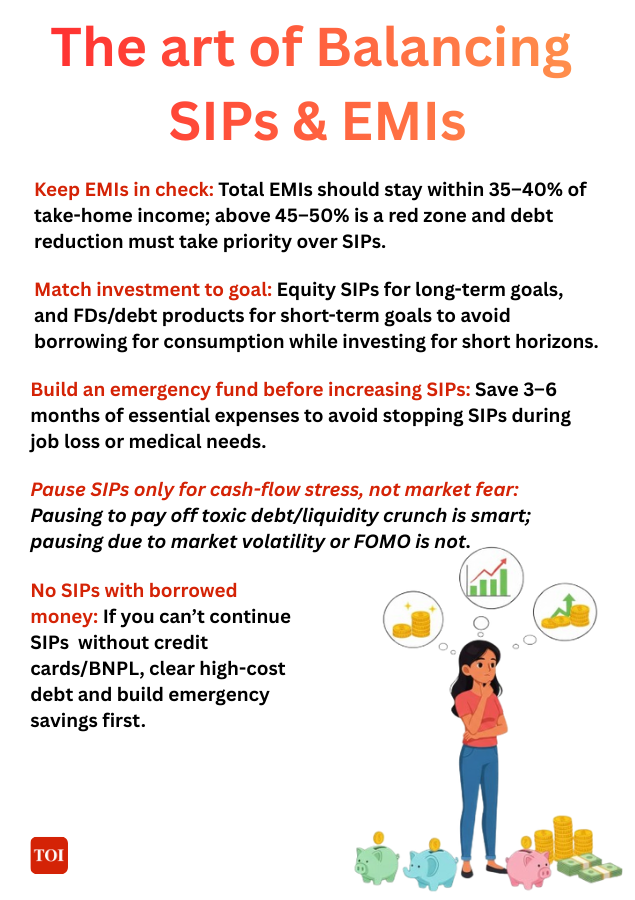

You don’t want a spreadsheet mannequin to diagnose your scenario. A number of easy guidelines may help.Rule 1: Test your debt-to-income (DTI)As a thumb rule:

- Attempt to maintain all EMIs (residence, automotive, training, private loans) inside 35–40% of your month-to-month take-home.

- If EMIs cross 45–50% of take-home, you might be within the pink zone — you might be one shock away from hassle.

If you happen to’re above 45%, your precedence must be decreasing debt, not growing SIPs.Rule 2: Don’t do SIPs from borrowed cashAsk your self bluntly: if my bank cards and BNPL vanished tomorrow, might I nonetheless:

- Pay all my EMIs on time, and

- Proceed my SIPs?

If the sincere reply is not any, you might be successfully funding investments with debt — hoping fairness returns will outrun double-digit rates of interest. Which will work in bull runs, nevertheless it’s a harmful technique.Hierarchy of motion ought to normally be:

- Clear or cut back high-cost debt (bank cards, BNPL, private loans).

- Construct a fundamental emergency fund.

- Then scale up fairness SIPs for long-term targets.

Rule 3: Construct an emergency fund earlier than “maxing” SIPsEarlier than you chase the proper SIP quantity:

- Goal an emergency fund of three–6 months of important bills (together with EMIs and college charges).

- Maintain it in a mix of financial institution deposits and really low-risk liquid funds.

This buffer is what permits you to trip out job loss or sickness with out stopping SIPs or defaulting on EMIs. With out it, each your funding plan and credit score rating are on the mercy of luck.Rule 4: When to pause SIPs — and when to notThink about pausing or decreasing SIPs if:

- Your whole EMI outgo has crossed 45–50% of take-home.

- You haven’t any emergency fund, and also you’re utilizing credit score to handle month-end.

- You’re sitting on revolving card debt at 30–40% annual curiosity.

In such instances, briefly pausing SIPs to pay down poisonous debt or construct fundamental liquidity is rational, not “undisciplined”.Don’t pause SIPs simply because:

- Markets have fallen or develop into unstable.

- “Everybody says a crash is coming.”

- You’re feeling FOMO about direct shares, crypto or choices and wish to redirect SIP cash there.

Market volatility is exactly when SIPs work finest; real cash-flow stress is when they are often paused strategically.Rule 5: Match product to purposeA ultimate, under-rated rule:

- Use fairness SIPs for long-term targets (5–7 years and past) like retirement, kids’s larger training, or upgrading a home.

- For near-term targets (1–3 years), focus extra on short-duration debt funds, RDs, or FDs, even when returns look boring.

Many over-leveraged households are successfully doing the alternative: borrowing at 12–18% for near-term way of life and concurrently investing in unstable belongings for brief horizons.

The underside line: richer, but in addition extra fragile

India’s center class is undeniably extra financially conscious and extra plugged into capital markets than a decade in the past. SIPs have democratised fairness possession, together with in smaller cities, and could possibly be a robust engine of wealth over the subsequent 10–20 years.However the identical steadiness sheets present:

- Debt rising sooner than belongings,

- Financial savings falling as a share of GDP, and

- Skinny emergency buffers in lots of households.

The actual query, then, isn’t “SIPs vs EMIs”. It’s whether or not households are utilizing SIPs from a place of surplus and planning — or from a spot of tension and FOMO, layered on prime of rising debt.If you happen to maintain your whole EMIs in test, construct a modest emergency fund, and keep away from utilizing credit score to fund your SIPs, the present SIP growth can genuinely make you richer over time. If not, you might uncover too late that what appeared like disciplined investing was truly only a subtle way of life past your means.

Leave a Reply