Buying and selling Quantity and Worth Turnover Spotlight Market Curiosity

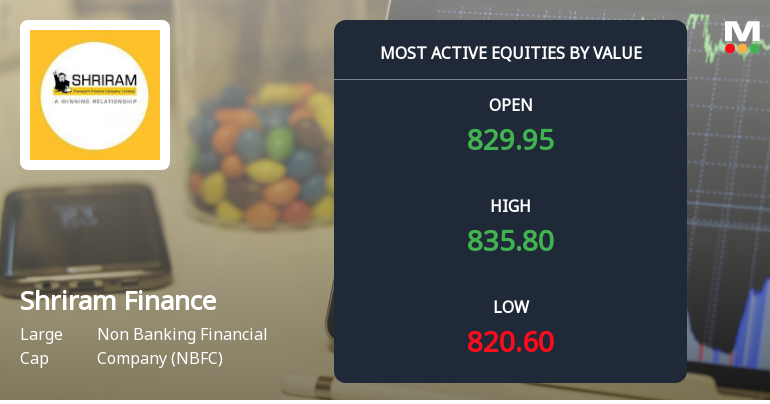

On the buying and selling day, Shriram Finance recorded a complete traded quantity of 31,96,318 shares, translating into a considerable traded worth of roughly ₹264.02 crore. This stage of exercise locations the inventory among the many highest by way of worth turnover, signalling sturdy participation from market contributors. The inventory opened at ₹830.45 and fluctuated inside a spread of ₹821.00 to ₹835.05 earlier than settling at a final traded value (LTP) of ₹832.05 as of 10:40 AM IST.

The earlier closing value stood at ₹828.10, indicating a modest day change of 0.18%. This value motion is in step with the broader sector’s efficiency, which recorded a 0.32% return for the day, whereas the Sensex benchmark index posted a 0.41% acquire. The inventory’s one-day return of 0.73% suggests a barely stronger efficiency relative to each the sector and the benchmark.

Value Developments and Transferring Averages Sign Market Dynamics

Evaluation of Shriram Finance’s value pattern reveals that the inventory has reversed its path after 4 consecutive days of decline. This shift might point out renewed investor confidence or a technical correction. The inventory’s value presently trades above its 20-day, 50-day, 100-day, and 200-day shifting averages, which frequently function key help ranges for traders. Nevertheless, it stays beneath the 5-day shifting common, suggesting some short-term consolidation or profit-taking exercise.

Such positioning relative to shifting averages will be interpreted because the inventory sustaining a typically constructive medium- to long-term pattern, whereas experiencing some short-term volatility. This dynamic is typical in shares with excessive liquidity and lively buying and selling, the place speedy shifts in investor sentiment can affect value motion.

Investor Participation and Supply Volumes Replicate Engagement

Investor participation in Shriram Finance has proven notable exercise, with supply volumes reaching 94.11 lakh shares on 3 December 2025. This determine represents a close to doubling—98.39% enhance—in comparison with the five-day common supply quantity, highlighting a surge in shares held by traders fairly than simply traded intraday. Such an increase in supply quantity usually factors to elevated conviction amongst consumers and sellers, as shares are transferred into investor demat accounts fairly than being flipped rapidly.

Liquidity metrics additional help the inventory’s capability to deal with sizeable trades with out important value disruption. Based mostly on 2% of the five-day common traded worth, Shriram Finance is liquid sufficient to accommodate commerce sizes of roughly ₹14.63 crore. This stage of liquidity is enticing for institutional traders and enormous merchants looking for to enter or exit positions effectively.

Market Capitalisation and Sector Context

Shriram Finance is assessed as a large-cap firm with a market capitalisation of roughly ₹1,55,234 crore. Working inside the NBFC sector, the corporate performs a major position in offering monetary companies outdoors the standard banking system. The sector itself has been beneath shut scrutiny on account of regulatory adjustments and evolving credit score circumstances, making liquidity and buying and selling exercise necessary indicators of investor sentiment.

The inventory’s efficiency at the moment, intently mirroring the sector’s 0.32% return, means that it’s shifting in tandem with broader sectoral developments. This alignment might mirror the corporate’s sensitivity to sector-specific developments comparable to credit score demand, rate of interest actions, and regulatory updates.

Institutional Curiosity and Order Stream Insights

The elevated traded worth and quantity, mixed with rising supply volumes, level in the direction of lively institutional participation in Shriram Finance. Giant order flows sometimes accompany such buying and selling patterns, as institutional traders search to construct or cut back positions in sizeable portions. The inventory’s liquidity profile helps these transactions, enabling smoother execution with out extreme value impression.

Furthermore, the inventory’s value motion after a multi-day decline and its place relative to key shifting averages might entice technical merchants on the lookout for potential entry factors. The interaction of basic curiosity and technical alerts usually drives the high-value buying and selling noticed in such shares.

Outlook and Investor Concerns

For traders monitoring Shriram Finance, the present buying and selling exercise provides a number of factors of curiosity. The inventory’s capacity to maintain buying and selling volumes exceeding 31 lakh shares and worth turnover above ₹260 crore signifies a wholesome market urge for food. Its value behaviour, together with a latest pattern reversal and positioning above a number of shifting averages, suggests a medium-term constructive technical backdrop.

Nevertheless, the inventory’s short-term motion beneath the 5-day shifting common highlights the significance of monitoring near-term value fluctuations. Traders must also take into account sectoral developments and macroeconomic elements influencing NBFCs, comparable to credit score progress, rate of interest insurance policies, and regulatory adjustments.

Given the corporate’s large-cap standing and liquidity profile, Shriram Finance stays a focus for each retail and institutional traders looking for publicity to the NBFC sector. The continued buying and selling patterns and supply volumes present helpful insights into market sentiment and potential future value trajectories.

Abstract

Shriram Finance’s elevated buying and selling volumes and worth turnover on 4 December 2025 underscore its significance inside the NBFC sector and the broader fairness market. The inventory’s value actions align intently with sector and benchmark indices, whereas technical indicators recommend a medium-term constructive pattern with short-term consolidation. Elevated supply volumes and liquidity metrics level to lively investor participation and institutional curiosity, making it a key inventory to look at for market contributors targeted on high-value buying and selling exercise.

Get 1 12 months of Weekly Picks FREE once you subscribe to MojoOne. Provide ends quickly. Begin Saving Now →

Leave a Reply