Of all of the disaster conferences around the globe within the wake of the collapse of Lehman Brothers within the US and the onset of the Nice Monetary Disaster of 2008, the one in Athens was essentially the most important. And it was a gathering that will go on, in varied kinds, for a decade. The attendance in Athens in late 2009 comprised European banks that have been on the hook for billions in euro loans to Greece that have been on the verge of default, specialists from the European Central Financial institution and Worldwide Financial Fund, European politicians who feared the collapse of the euro, and members of an abject Greek authorities whose profligacy had landed the events on this precarious place.

There was one predominant burning subject on the desk: the survival of the euro, the 10-year-old foreign money that had, uniquely, been designed by committee as an alternative of rising organically like sterling or the greenback. However some even feared the disaster may result in the collapse of all the European experiment.

As the primary gamers received across the desk, the scenario was determined. Greece was getting ready to chapter and foreign money merchants have been mercilessly attacking its sovereign debt whereas additionally doing their degree greatest to undermine different extremely indebted nations, notably Eire and Portugal.

The stakes may hardly have been greater. Below the Stability and Development Pact agreed within the Nineteen Nineties, member international locations had formally agreed to pursue mutually accountable financial insurance policies – fiscal self-discipline, briefly. No nation was allowed to print cash regardless of Brussels, borrowing was to be tightly managed and inflation intently managed. Most EU members had kind of adopted the principles, however not Greece.

Greece had misrepresented its funds earlier than it even joined the eurozone

Because the Peterson Institute for Worldwide Economics explains: “Regardless of the pact, the Greek authorities racked up years of deficits and extreme borrowing after adopting the euro in 2001.” That’s, two years after its official launch. Nonetheless, Greece was flagrantly breaking the principles and concealing it, a deceit helped by prevailing and unusually low rates of interest on its sovereign bonds. This was opposite to the traditional behaviour of presidency debt when a rustic runs persistent and enormous deficits and it assisted Greece in pulling the wool over Brussels’ eyes.

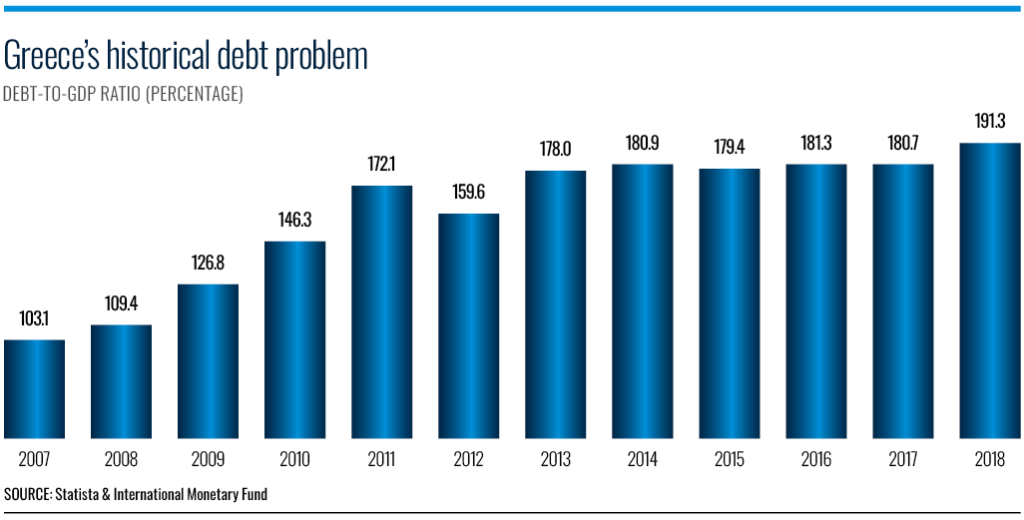

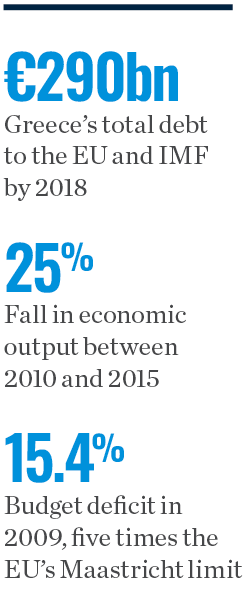

Because the Council on International Relations would clarify years later in a timeline of the drawn-out disaster, Greece had misrepresented its funds earlier than it even joined the eurozone. “Its price range deficit was effectively over three % and its debt degree about 100% of GDP,” the council identified, additionally citing Goldman Sachs’ position in serving to Greece conceal a part of the debt by way of complicated credit score swap transactions. Greece wasn’t the one EU nation to misbehave, economically talking, however it was definitely essentially the most irresponsible. Because the IMF would clarify in a paper years later: “Pensions and social transfers elevated by a whopping seven % of GDP from the time of euro adoption to the eve of the disaster, whereas the general public wage invoice rose by three % of GDP. This drove the general fiscal deficit from 4 % in 2000 to greater than 15 % of GDP in 2009 – a staggering 5 instances the Maastricht [official] restrict.

And so Greece’s non-public lenders, most of them French and German, blithely continued to throw cash on the nation. The usual rationalization for his or her failure to identify the hazard was a common misunderstanding of the principles of the eurozone. Because the Peterson Institute surmises: “Financing establishments might have assumed that any nation with a borrowing disaster can be bailed out. They have been complacent within the face of Greek deficits. The federal government’s borrowing spree helped to pay for public companies, public wage will increase and different social spending. Its borrowing was hidden by price range subterfuge. Warnings about its situation went largely unheeded.”

Summer time Olympics

Some started to fret although when Greece hosted the 2004 summer time Olympics at a value of €9bn and when extra public borrowing despatched the deficit to over six % and the ratio of debt to GDP to 110 %. “Greece’s unsustainable funds prompted the European Fee to position the nation underneath fiscal monitoring in 2005,” recollects the council.

It was the overall election of 2009 that opened the Pandora’s Field of Greece’s profligacy and triggered a descent into financial chaos. A brand new socialist authorities underneath George Papandreou revealed that the price range deficit was heading for over 12 % of GDP, practically double the unique estimates. However even that was too low – quickly it might be revised to fifteen.4 %. At that time credit standing companies abruptly downgraded Greece’s sovereign debt to junk standing.

By 2011 the cash markets have been completely rattled. “Bond markets began to lose confidence in Greece’s financial system,” explains the Peterson Institute, in one thing of an understatement. This lack of confidence become despair when non-public lenders in France and Germany belatedly realised that the EU had no formal system for bailing out a sick member, as Greece had manifestly grow to be. That meant that Greece may now not roll over its money owed as a result of the banks refused additional loans for worry of excellent cash following unhealthy. Therefore the EU’s most economically recalcitrant member couldn’t plug the gaps in its price range shortfalls. The alarm bells ringing throughout Europe, the IMF and ECB needed to hurriedly step in together with the EU’s financial trouble-shooters in what grew to become often called ‘the troika.’ None of those establishments had confronted a disaster of this magnitude.

Contagion

The rapid and looming menace was the danger of contagion in a European banking system already in bother within the wake of the 2008 financial institution collapses that precipitated the Nice Monetary Disaster. Many establishments bore heavy losses and so they had no urge for food for shovelling additional debt to Greece. Having mistakenly assumed all debt to member international locations was risk-free, that they had compounded their error by additionally assuming that Greece’s central financial institution had enough capital to soak up a Greek default.

Financing establishments assumed that any nation with a borrowing disaster can be bailed out

All of the sudden the banks, the troika and all people else on the sidelines of those more and more fraught negotiations have been deeply conscious of a long-held precept amongst central bankers. Particularly, ethical hazard. In easy phrases this meant that, if profligate nations have been bailed out, different economically delinquent governments would anticipate the identical favours. “All banks in Europe feared that Greek debt aid would set a precedent,” notes the Peterson Institute. “Bonds issued by different European governments instantly grew to become dangerous.”

In consequence the price of debt started to rise for different EU members. The Peterson Institute: “Virtually in a single day this made it dearer for these governments to borrow. Lack of investor confidence was infecting all the European monetary system.” Contagion actually was setting in.

The financial traces have been drawn. On one facet specialists feared that the Greek financial system can be strangled if the politicians imposed excessively punitive measures. On the opposite most EU politicians and, it appears, the troika have been decided to ship a message: “Germans and others in Europe felt that Greece needed to undergo the implications of its alleged misbehaviour.” Caught within the center have been hapless Greek residents. Because the financial system foundered and punitive measures have been certainly enforced, they rightly blamed their authorities for deceptive them. All too quickly Greece’s financial woes spilled into the streets as rioters in Athens rallied in opposition to hefty price range cuts and tax will increase that have been triggering excessive unemployment, shrunken dwelling requirements and slashed social companies. Concurrently, populist politicians over a lot of the EU have been attacking the EU, which, they argued, was suppressing their nationwide identities.

Athens deal

The rapid supply of Greek residents’ anger was the Athens deal, a three-year bailout scheme agreed in mid-2010. On this the IMF and EU threw Greece a €110bn lifeline repayable over three years. The worth was austerity measures together with €30bn in spending cuts and tax will increase. This was an all-out assault on the deficit put collectively by the IMF and different, principally reluctant, EU nations that already had fairly sufficient monetary troubles of their very own. Spain as an illustration was nearly overwhelmed by a real-estate disaster whereas Portugal was affected by its personal financial mismanagement. The ECB additionally stepped in by shopping for up closely discounted Greek bonds on the secondary market in what it known as the Securities Market Programme. This was an unprecedented transfer, however ECB president Mario Draghi promised the financial institution “would do no matter it takes.”

The programme allowed Europe’s prime central financial institution to soak up the federal government bonds of different struggling sovereigns. “This was to spice up market confidence and forestall additional sovereign debt contagion all through the eurozone,” explains the Council. Actually the contagion was spreading so quick that EU finance ministers additionally agreed rescue measures price practically $1trn to hard-hit eurozone international locations.

However austerity didn’t work for Greece. After a short rally when the deficit sank to 5 % of GDP, an encouraging enchancment, the inevitable occurred. The Greek financial system was stripped so naked that it fell into decline and there weren’t the funds to satisfy the loans that also hung over the nation like a sword of Damocles.

Deauville deal

Two years after the Athens deal, the scenario was as soon as once more so dire that the danger of a Greek default was again on the desk. German chancellor Angela Merkel and French president Nicolas Sarkozy led a brand new programme that grew to become often called the Deauville Deal. “If the euro fails, Europe will fail,” declared Merkel.

This time the banks – ‘irresponsible lenders,’ in line with the events concerned within the deal – have been instructed to just accept their share of the punishment within the type of discounting the worth of their loans. In brief, they needed to take a haircut. However because the Peterson Institute acknowledges: “The Deauville announcement rattled bond markets additional. Banks feared having to take haircuts on the worth of their loans. Bond yields spiked, making the prospect of a well timed return of Greece to market borrowing much more distant.” The banks have been strong-armed into submission. Going through full write-offs or haircuts, many of the non-public lenders opted for the latter somewhat than be celebration to an entire default.

This second bailout handed Greece €130bn, however the nation’s non-public lenders took a beating – a 53.5 % write-down. Greece’s facet of the discount was to slash its debt to GDP ratio from 160 % to only over 120 % by 2020. It was the biggest restructuring of its kind in historical past. Concurrently, all however two EU members – Britain and the Czech Republic – signed the Fiscal Compact Treaty designed to maintain their financial behaviour in line. The disaster had now dragged on for 4 years – after which it received worse.

Though, in 2013, Greece lastly posted a surplus, it was a technical one described as a “small major fiscal surplus, the fiscal steadiness excluding curiosity funds.” Simply when the authorities have been able to applaud, the financial system plummeted to a good decrease degree, with financial output down by 25 % in contrast with 2010, which had been unhealthy sufficient. Unemployment hit 27 %. And debt to GDP ratio shot up from the 130 % of 2009 to 180 % by the top of 2015.

The affected person was even sicker. About 25,000 public servants from an admittedly bloated paperwork have been laid off and the labour unions, whose members had taken a beating, known as a common strike. As extra rational economists had argued years earlier than, if the aim of the rescue measures was to assist Greece repay its money owed, because it absolutely was, it had demonstrably failed. Clearly, solely a wholesome financial system may produce the revenues that enabled it to climb out of bother.

The composition of Greece’s debt was now unrecognisable from earlier than the rescue makes an attempt. Practically all of it lay within the arms of a wide range of European and worldwide establishments such because the European Monetary Stability Facility and the ECB, which was on the hook for long-term debt of as much as 30 years.

Behind the scenes the ECB was deeply concerned. It had issued greater than $1.2trn in quantitative easing – successfully the printing of credit score – to spice up a moribund European financial system.

Subsequent disaster

Then in 2015, to the horror of Brussels, indignant and disillusioned Greek voters put in a left-wing authorities underneath the Syriza celebration and one other disaster promptly ensued. Of all of the disaster years, this may be essentially the most fraught and lift the likelihood of ‘Grexit,’ Greece’s departure from the eurozone. As many now stated, it ought to by no means have been allowed to hitch within the first place.

New prime minister Alexis Tsipras had the backing of unions and he promptly attacked the troika over austerity measures, demanded aid from the mountain of debt and an finish to austerity. An aghast Brussels flatly refused, insisting that Greece work by way of the unique preparations earlier than coming again to the desk. When the Tsipras authorities missed a €1.6bn reimbursement to the IMF, negotiations between Greece and its official collectors deteriorated quickly. To stem the flight of capital from the nation, Tsipras had already restricted financial institution withdrawals to only €60. Finally although, the prime minister needed to bow to Greece’s obligations to collectors and, regardless of a referendum that overwhelmingly rejected austerity measures, he signed a 3rd bailout cope with as much as €86bn after a tense weekend of negotiations in August 2015 through which Greece was practically kicked out of the eurozone.

The worth this time was wholesale financial reform whereby the federal government agreed to introduce tax reforms, minimize public spending even additional, privatise state property and decontrol the labour market. Simply to maintain an more and more divided authorities on observe, the €86bn was to be unfold over three years.

Curiously, the ECB sat in on the negotiations however refused additional loans. Clearly, the central financial institution thought it had finished sufficient.

Flip of the tide

Two issues now started to show the tide – the much less draconian phrases of the most recent rescue bundle and lengthy overdue financial reforms. In 2016, Greece supplied a nice shock by posting a big price range surplus of just about 4 %. Virtually miraculously, unemployment started to say no, albeit slowly. Then in 2017, the financial system began to develop for the primary time in eight years.

But the restoration was too gradual for Greeks, who voted the socialists out. Though the tide was turning, the buildup of rescue debt had reached proportions that horrified most economists. By 2018, Greece owed the EU and IMF alone about €290bn. Like a darkish cloud over the nation’s future, successive governments have been anticipated to run price range surpluses for the following 42 years! The dimensions of the Greek financial system had crashed by practically 1 / 4 and confronted a protracted uphill restoration.

This was a lot worse than had been thought on the outset of the disaster precisely a decade earlier. The IMF’s Poul Thomsen, director of the European division, painted a darkish image to an viewers on the London Faculty of Economics in 2019: “We had assumed that it might take Greece eight years to return to pre-crisis degree. This was as unhealthy as in america Nice Melancholy within the Nineteen Thirties, and significantly worse than the 4 years that it took international locations affected by the Asian disaster.

“The result was a lot worse. Right now, virtually 10 years later, GDP per capita remains to be 22 % under the pre-crisis degree. We forecast that it’s going to take one other 15 years, till 2034, to return to pre-crisis ranges. Below the Fee’s forecast it’s going to take till 2031.” So the place had the rescue missions gone fallacious?

on worldwide bailout phrases

Within the rationally argued view of Poul Thomsen, the enforced measures had diminished the financial system so severely that it couldn’t pay its method out of bother. Fundamental public companies couldn’t be supplied and capital spending was so low that any prospect of progress was rendered nearly unimaginable. As tax will increase have been piled on already excessive charges, tax collections had slumped from 65 % in 2010 to about 41 % in 2017 whereas – the other of what was wanted – effectively over half of all wage-earners and pensioners have been exempt from paying any private revenue tax in any respect. And in some way much-needed reforms of one of many EU’s most beneficiant pension schemes had been deserted alongside the way in which.

For many Greeks, the troika and the IMF specifically had grow to be the whipping boy. But opposite to the populist rhetoric, the IMF had not insisted on extra austerity. As a substitute the organisation had argued that Greece shouldn’t be requested to ship unreasonably excessive surpluses however must be required to repair its issues with pensions and taxes in order that the financial system may recuperate extra rapidly. In brief, go for progress.

The IMF’s total rationalization for Greece’s painfully drawn-out disaster was political. “Opposite to different crisis-hit international locations, there was no broad political help for the programme from the outset,” concludes Thomsen, citing varied events’ failure to unite behind the measures. In Portugal, which confronted comparable issues, there was broad political help for the rescue on either side of the aisle.

However the IMF doesn’t absolve itself of blame. The architects of the varied rescue missions merely anticipated an excessive amount of too quickly from an financial system with a lot self-inflicted injury. However classes had been realized and salvation was at hand.

The nice restoration

To the aid of Greece’s 10.4 million folks, by early 2025 GDP was rising sooner than the eurozone common and had been for 4 straight years. Furthermore, it was anticipated to take action till not less than 2027. The amount of public debt was down. Unemployment had fallen to traditionally low ranges of slightly below 10 %, albeit excessive by European requirements, however half 1,000,000 new jobs had been created in six years. The all-important major surplus had hit 4.8 %, greater than twice as excessive as predicted. And the times of junk standing for bonds have been over – in 2023, Greece’s sovereign debt was restored to funding grade in a red-letter day for the nation’s beleaguered central financial institution.

There’s work nonetheless to be finished, in line with a late 2024 survey by the OECD that cited low productiveness and reluctant enterprise funding nonetheless scarred by the Nice Monetary Disaster. However the worst is certainly over. In an occasion that no person would have predicted at the hours of darkness days of 2009, in Might 2025 Prime Minister Kyriakos Mitsotakis accepted an award at an financial convention in Berlin for what most economists have been calling a outstanding restoration.

Now not Europe’s downside youngster getting ready to “crashing out of the eurozone,” as he put it, “Greece is being recognised for its dedication, its self-discipline, its resilience and its capability to implement troublesome reforms.” Nonetheless, it was a close-run factor.

Leave a Reply