Metropolis skyline and Sempione Park in Milan, Italy

Writer: Luca Bonansea, Head of Personal Banking & Wealth Administration, BNL BNP Paribas

The Italian wealth administration market is present process a profound transformation, pushed by the speedy growth of the Excessive Web Price Particular person (HNWI) and Extremely Excessive Web Price Particular person (UHNWI) segments, and by the rising sophistication of entrepreneurial households’ monetary wants. On this evolving panorama, banks should reshape their advisory fashions in direction of providers which are built-in, revolutionary, and extremely personalised – constructed on specialised wealth administration platforms able to addressing complicated and world wants. On the similar time, the rise of synthetic intelligence is enabling a hybrid mannequin through which human experience is more and more enhanced by superior technological capabilities.

In recent times, the investable monetary wealth of Italian households has proven regular development, with a pointy acceleration amongst HNWIs and UHNWIs – a phase that continues to outperform the market common, demonstrating each a stronger capability to generate wealth and a better urge for food for stylish funding methods. The annual development fee of monetary wealth allotted to investments, round three p.c lately, is anticipated to stay steady by 2025–2026, supported by optimistic inflows and resilient market situations.

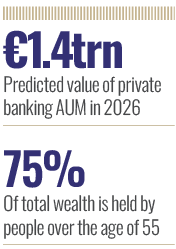

Personal banking stays a structural development engine inside the Italian monetary business, with property projected to rise by round six p.c by 2026 – nicely above the nationwide common. The sector’s property beneath administration (AuM) are anticipated to exceed €1.4trn in 2026, due to the power to supply an more and more diversified vary of options for stylish purchasers, particularly UHNWIs.

Italy is now approaching a basic turning level in what many name the ‘nice wealth switch’ – the inter-generational handover of a whole lot of billions of euros in property. Right now, almost 75 p.c of whole wealth is held by people over the age of 55. By 2033, it’s estimated that roughly €300bn can be handed on to youthful generations.

Personal banking stays a structural development engine inside the Italian monetary business

This demographic and monetary shift, mirrored throughout Europe, locations longevity and generational planning on the very centre of the wealth administration agenda. It marks a pivotal second for the way households handle each their private and their enterprise wealth. Right here, the worth of worldwide advisory turns into essential – the power to remodel the complexity of wealth transmission right into a strategic alternative for enterprise development and long-term worth creation.

Managing the wealth of Italian households will more and more require strategic companions able to creating worth all through each stage of the shopper’s life journey – growing collectively a structured plan of aims for the person, the household and the enterprise. Equally important can be a well-defined household governance construction to make sure the sleek transition of wealth and the continuity of the household enterprise when possession adjustments fingers. Within the coming years, the business’s key problem can be to supply goal-based, personalised, and versatile options by a really world wealth administration platform that may tackle the delicate and multidimensional wants of its clientele.

Investing in excellence

The transformation of wealth administration for HNWI and UHNWI purchasers requires an built-in and specialised method that goes far past conventional monetary administration. It calls for a holistic and goal-based imaginative and prescient of wealth. At BNL BNP Paribas Personal Banking & Wealth Administration, the power of our strategic advisory mannequin lies in our capability to supply HNWIs and UHNWIs with extremely expert professionals who ship tailor-made, well timed help. Inside our advisory mannequin, relationship managers work alongside a crew of specialists overlaying key areas resembling world markets, wealth planning, belief providers and company finance.

Our bankers, along with wealth planners and consultants from our fiduciary firm Servizio Italia, work intently with entrepreneurs to design succession plans that actively contain the following technology. Together with youthful members of the family within the design and implementation of succession methods has been instrumental in making certain enterprise continuity and in strengthening the long-term imaginative and prescient of many family-owned enterprises.

We make investments closely and repeatedly within the superior coaching of our professionals

Advisory throughout this delicate section is a cornerstone of our manner of doing personal banking.By way of our ‘One Financial institution’ mannequin, we leverage on the experience of all BNP Paribas Group enterprise traces – combining the specialised data of wealth administration with the vertical capabilities of company and funding banking. This permits us to supply actually 360-degree advisory providers, supporting entrepreneurs and their household companies in each extraordinary transactions (resembling M&A and possession transitions) and the every day administration of property – together with actual property and world markets advisory.

To constantly preserve the very best requirements, we make investments closely and repeatedly within the superior coaching of our professionals. A key initiative, on this regard, is the Excellence Academy of BNL BNP Paribas Personal Banking & Wealth Administration developed in partnership with the Bocconi College Faculty of Administration in Milan. The programme gives specialised, licensed coaching paths for bankers and advisors, making certain that our professionals stay on the forefront of business greatest practices and HNWI and UHNWI shopper expectations.

An AI-driven future

Trying forward, our imaginative and prescient is to construct an built-in, worldwide and innovation-driven service mannequin – positioning ourselves because the strategic advisor of reference for purchasers managing wealth over the medium and long run. Innovation and the power to anticipate shifts in world markets have gotten important property for anybody working in personal banking. Collaboration throughout enterprise traces inside the BNP Paribas Group, mixed with our agility in growing bespoke options, allows us to reply successfully to the challenges posed by market volatility and evolving regulation.

Integration with worldwide platforms is a defining function of our mannequin, permitting us to serve HNWIs and UHNWIs who’re more and more uncovered to cross-border dynamics and world funding alternatives. Our firm offers multi-asset, multi-currency options and superior reporting providers, making certain a seamless shopper expertise throughout all touchpoints.

Our cross-country structure and specialised service verticals enrich a price proposition that’s each complete and personalised. The rising demand for diversification and capital safety is driving curiosity in refined merchandise resembling various investments, personal property, and tailored financing options. Superior analytics are additional enhancing personalisation – permitting us to profile purchasers in better depth and anticipate their wants by predictive information fashions.

Synthetic intelligence is quickly rising as a transformative pressure throughout the business. By leveraging AI, we will deepen shopper perception, automate processes, and ship personalised, omnichannel experiences. Predictive analytics and insight-driven advisory instruments will allow a shift from standard to really proactive and customised advisory. The problem for the following decade can be to successfully combine the human and the technological – making a hybrid service mannequin powered by Human+AI sources that preserves the relational worth of human interplay whereas absolutely harnessing the potential of superior know-how.

Right now, the business faces an unprecedented alternative: to mix the legacy of relationship excellence and native experience with the brand new frontiers of internationalisation and innovation. Investing in world platforms, empowering our groups, and embedding AI inside advisory processes will permit us to ship a really distinctive service – one which meets the expectations of a classy, demanding, and world clientele.

This evolution requires a brand new sort of management – one able to orchestrating human and technological capabilities, combining the irreplaceable worth of individuals with the extraordinary potential of AI. It’s an intellectually stimulating problem for the following technology of execs in our business – and one through which we intend to play a number one position.

Leave a Reply