Talking to CNBC-TV18, Managing Director Himanshu Baid stated, “We see the traction coming again within the worldwide market, whereas the home enterprise continues to develop at a gradual tempo.”

The corporate is assured of attaining a 15-16% income progress for the fiscal yr 2026 (FY26), regardless of going through important headwinds in its export markets. The corporate had beforehand revised its steerage down from 20% on account of a drag in worldwide enterprise.

The primary half (H1) of the yr noticed the home enterprise develop by a strong 18-19%, whereas exports remained flat. Baid defined that the export challenges, notably in Europe, have been resulting from aggressive product dumping by Chinese language opponents and overstocking by purchasers, points he believes have now largely levelled out.

Trying forward, Poly Medicure anticipates a return to normalcy for the export enterprise in FY27, supported by a restoration within the essential European market and the potential finalisation of an India-US commerce deal, which might unlock additional alternatives within the American market.

He additionally famous that the current weak point within the rupee has been a “blessing in disguise” for the corporate’s export-oriented enterprise.

Poly Medicure just lately accomplished two acquisitions, each timed favourably forward of rupee depreciation. The offers increase the corporate’s presence in trauma, ortho, and cardiology merchandise.

- FY26 contribution: Just a few months of income resulting from September/November closing—about ₹100 crore.

- FY27 contribution: Revenues anticipated to scale to ~₹300 crore from these companies.

Regardless of the inorganic enlargement, Poly Medicure maintains a robust money place of ₹750+ crore, giving the corporate room for extra small, adjacency-based acquisitions in FY27.

A weaker rupee is helpful for the corporate’s export-heavy income combine. Nonetheless, Baid highlighted that the home business continues to face challenges resulting from an inverted responsibility construction and decrease GST on imported medical gadgets. This makes native manufacturing much less aggressive versus imports.

For the calendar yr 2026, Poly Medicure‘s high priorities embrace increasing its new orthopaedics and cardiology companies in India by bringing in merchandise from its acquired firms and beginning native manufacturing.

The third precedence is to reinforce its oncology portfolio, notably on the biopsy aspect, aligning with its strategic give attention to high-prevalence non-communicable ailments.

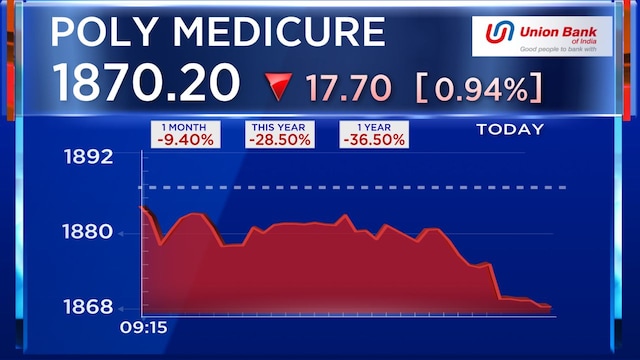

Poly Medicure’s present market capitalisation is ₹18,975.00 crore. The inventory is presently buying and selling at ₹1,870.20 as of 10:00 am on the NSE and has gained 36% over the past yr.

For your entire dialogue, watch the accompanying video

Leave a Reply