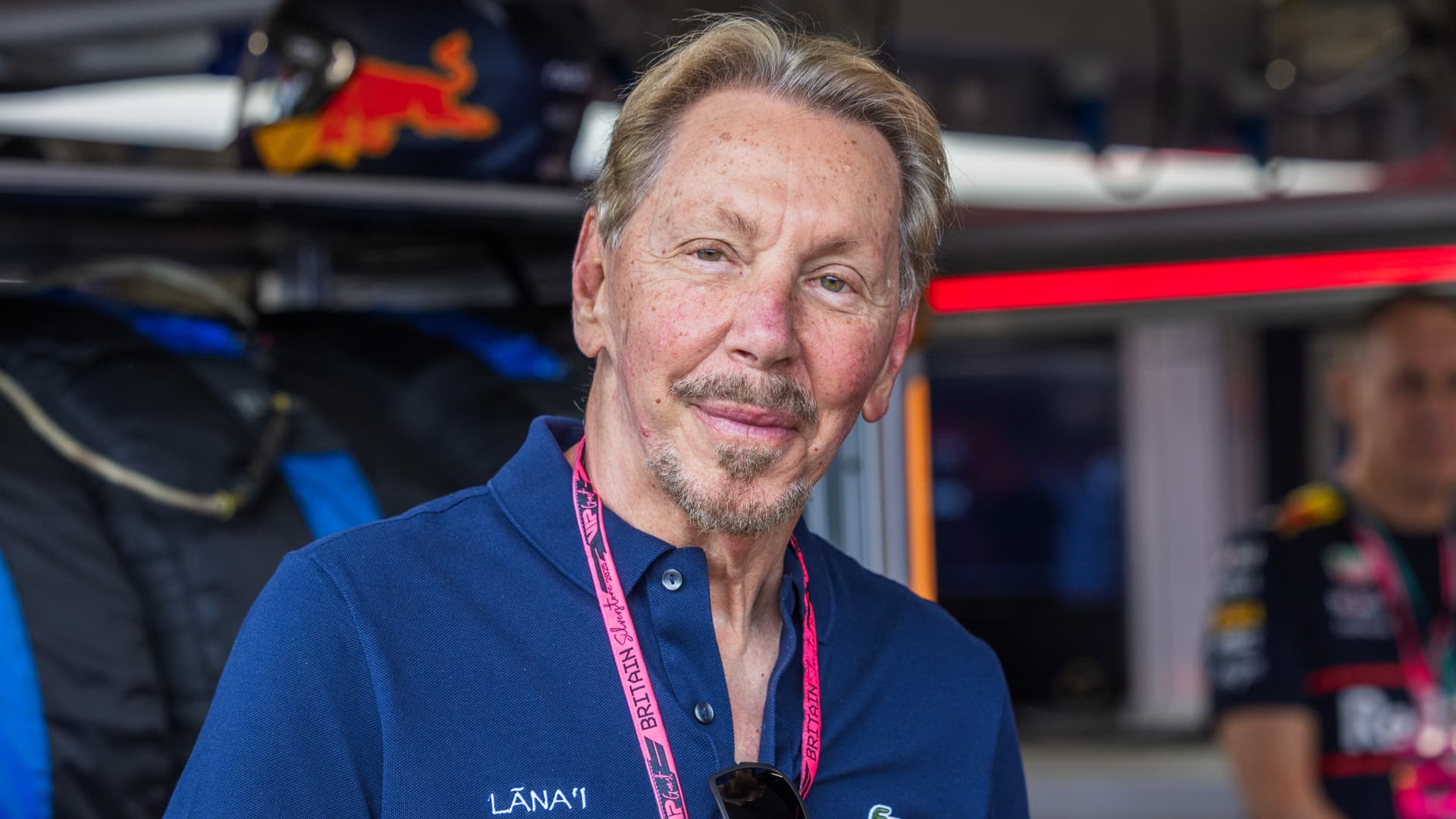

Larry Ellison, Oracle’s co-founder and chief expertise officer, seems on the Formulation One British Grand Prix in Towcester, U.Okay., on July 6, 2025.

Jay Hirano | Sopa Photographs | Lightrocket | Getty Photographs

Oracle is scheduled to report fiscal second-quarter outcomes after market shut on Wednesday.

Here is what analysts expect, based on LSEG:

- Earnings per share: $1.64 adjusted

- Income: $16.21 billion

Wall Avenue expects income to extend 15% within the quarter that ended Nov. 30, from $14.1 billion a yr earlier. Analysts polled by StreetAccount are on the lookout for $7.92 billion in cloud income and $6.06 billion from software program.

The report lands at a important second for Oracle, which has tried to place itself on the middle of the factitious intelligence growth by committing to large build-outs. Whereas the transfer has been a boon for Oracle’s income and its backlog, traders have grown involved concerning the quantity of debt the corporate is elevating and the dangers it faces ought to the AI market gradual.

The inventory plummeted 23% in November, its worst month-to-month efficiency since 2001 and, as of Tuesday’s shut, is 33% under its document reached in September. Nonetheless, the shares are up 33% for the yr, outperforming the Nasdaq, which has gained 22% over that stretch.

Over the previous decade, Oracle has diversified its enterprise past databases and enterprise software program and into cloud infrastructure, the place it competes with Amazon, Microsoft and Google. These corporations are all vying for giant AI contracts and are investing closely in information facilities and {hardware} essential to fulfill anticipated demand.

OpenAI, which sparked the generative AI rush with the launch of ChatGPT three years in the past, has dedicated to spending greater than $300 billion on Oracle’s infrastructure companies over 5 years.

“Oracle’s job is not to think about gigawatt-scale information facilities. Oracle’s job is to construct them,” Larry Ellison, the corporate’s co-founder and chairman, instructed traders in September.

Oracle raised $18 billion throughout the interval, one of many greatest issuances on document for a tech firm. Skeptical traders have been shopping for five-year credit score default swaps, driving them to multiyear highs. Credit score default swaps are like insurance coverage for traders, with patrons paying for defense in case the borrower cannot repay its debt.

“Buyer focus is a significant challenge right here, however I believe the larger factor is, How are they going to pay for this?” stated RBC analyst Rishi Jaluria, who has the equal of a maintain score on Oracle’s inventory.

In the course of the quarter, Oracle named executives Clay Magouyrk and Mike Sicilia as the corporate’s new CEOs, succeeding Safra Catz. Oracle additionally launched AI brokers for automating numerous sides of finance, human assets and gross sales.

Executives will talk about the outcomes and challenge steering on a convention name beginning at 5 p.m. ET.

WATCH: Oracle’s debt issues loom massive forward of quarterly earnings

Leave a Reply