Intraday Price Movement and Volatility

On 8 December 2025, Morarka Finance opened with a gap down of 4.01%, setting a bearish tone for the trading session. The stock exhibited high volatility throughout the day, with an intraday price range spanning from a low of Rs.77.05 to a high of Rs.90.00, representing a 7.75% weighted average price volatility. Despite touching an intraday high that was 3.45% above the opening price, the stock ultimately closed near its lowest point, marking an 11.44% drop from the previous close.

Comparison with Sector and Market Benchmarks

Morarka Finance underperformed its sector by 5.69% during the session, indicating relative weakness within the Non Banking Financial Company (NBFC) space. The broader market, represented by the Sensex, experienced a decline of 0.53%, closing at 85,255.43 points after falling 369.41 points from its flat opening. Notably, the Sensex remains close to its 52-week high of 86,159.02, trading 1.06% below that peak and maintaining a bullish stance above its 50-day and 200-day moving averages.

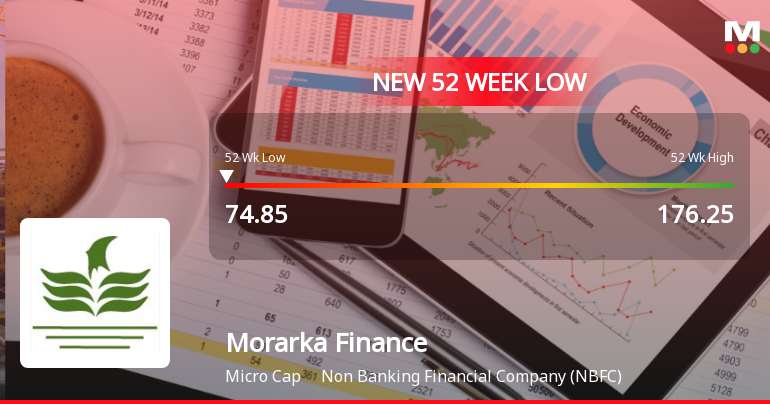

Technical Indicators and Moving Averages

Morarka Finance is currently trading below all key moving averages, including the 5-day, 20-day, 50-day, 100-day, and 200-day averages. This positioning suggests sustained downward momentum over multiple time frames. The stock’s 52-week high stands at Rs.176.25, highlighting the extent of the price contraction over the past year.

Long-Term Performance and Financial Metrics

Over the past year, Morarka Finance’s stock price has declined by 51.63%, contrasting with the Sensex’s positive return of 4.35% during the same period. This underperformance extends beyond the last year, with the stock consistently lagging behind the BSE500 benchmark across the previous three annual periods.

Financially, the company’s long-term growth indicators show subdued trends. Net sales have contracted at an annual rate of 6.52%, while operating profit has followed a similar trajectory with a decline of 6.90% annually. The average Return on Equity (ROE) stands at 2.01%, reflecting modest profitability relative to shareholder equity.

Quarterly Financial Highlights

Despite the broader challenges, Morarka Finance reported its highest quarterly figures in certain profit metrics during the September 2025 quarter. The Profit Before Depreciation, Interest, and Taxes (PBDIT) reached Rs.1.50 crore, while Profit Before Tax excluding other income (PBT less OI) was Rs.1.49 crore. The Profit After Tax (PAT) for the quarter stood at Rs.1.12 crore, marking the highest quarterly profit recorded by the company.

Valuation and Shareholding Structure

The company’s valuation metrics indicate a Price to Book Value ratio of 0.4, suggesting a fair valuation relative to its book value. However, the stock trades at a premium compared to the average historical valuations of its peers within the NBFC sector. Promoters remain the majority shareholders, maintaining significant control over the company’s equity.

Summary of Market Context

The broader market environment has shown mixed signals, with the Sensex maintaining a position near its 52-week high and trading above key moving averages. In contrast, Morarka Finance’s stock has demonstrated persistent weakness, reflected in its trading below all major moving averages and its recent 52-week low price point. The stock’s high intraday volatility and significant price gap at the open further underscore the unsettled trading conditions it faces.

Conclusion

Morarka Finance’s decline to Rs.77.05 marks a notable milestone in its recent price trajectory, underscoring the challenges faced by the company within the NBFC sector. The stock’s performance over the past year, combined with its current valuation and financial indicators, paints a picture of subdued momentum amid a market that continues to reward more robust performers. While the company has recorded some positive quarterly profit figures, the overall trend remains cautious as the stock navigates a complex market landscape.

Get 1 year of Weekly Picks FREE when you subscribe to MojoOne. Offer ends soon. Start Saving Now →

Leave a Reply