Shift toward advanced memory chips

The rationale for Micron’s pivot is rooted in industry-wide changes in demand. High-performance memory used in AI and data centers differs fundamentally from traditional consumer memory in terms of pricing stability, contract structure, and long-term visibility. Compared with the highly competitive and cyclical consumer segment, enterprise-focused memory typically carries stronger margins and more predictable demand profiles. Micron has recently revised its revenue and profit outlook higher, linking the adjustment to stronger orders for memory used in AI infrastructure. However, despite this positive momentum, the semiconductor and memory industries remain cyclical. Demand continues to be influenced by global macroeconomic conditions, capital-spending cycles, supply-chain constraints, and competitive capacity expansions across the sector.

Market perception and sentiment

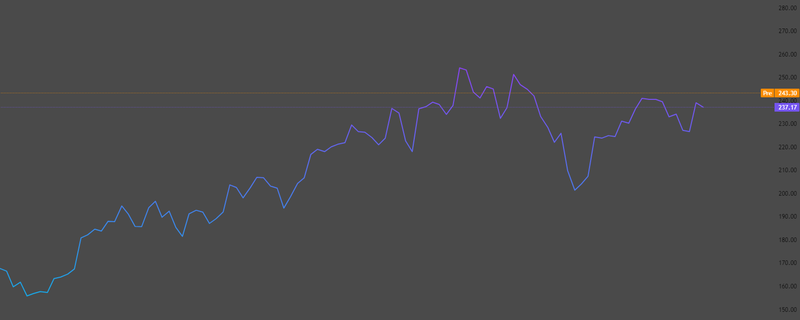

The global memory market remains highly concentrated, with only a small group of large manufacturers capable of operating at advanced process nodes. Competition is primarily driven by technological execution, manufacturing efficiency, yield optimization, and long-term supply relationships with major customers. The capital-intensive nature of advanced fabrication creates substantial barriers to entry, which structurally limits new participants and constrains global supply growth. Following Micron’s strategic announcement, the stock recorded a 3.21% decline last week. Pre-market indications today show a recovery of approximately 2.5% from the recent low. Market forecasts expectations for continued pricing strength in advanced memory over the coming quarters, supported by sustained demand from AI-related applications more than 30%.

Source: Trading View

Ongoing uncertainties

Despite improving demand conditions for advanced memory, Micron continues to operate in a sector characterized by pronounced volatility. A slowdown in AI infrastructure investment, delays in major data-center projects, or a broader softening in enterprise technology spending could weigh on near-term demand. In addition, memory pricing remains highly sensitive to changes in global supply dynamics, where production adjustments by large manufacturers can shift market balance quickly. Geopolitical risks and export restrictions on advanced semiconductors add another layer of uncertainty to the operating environment. These factors underscore the inherent cyclicality and risk exposure that remain present in the global memory-chip industry, even amid strong structural growth drivers.

Leave a Reply