Meesho co-founder and CEO, Vidit Aatrey, formally joined the billionaire membership following the corporate’s extremely profitable inventory market itemizing. Meesho’s shares soared on their debut day, leaping almost 74% above the IPO worth, a transparent signal of robust investor confidence within the firm’s future.

This spectacular rally considerably boosted the worth of Aatrey’s appreciable 11.1% stake in Meesho, which accounts for roughly 47.25 crore shares. At its peak throughout the first day of buying and selling, the worth of his holding exceeded ₹9,000 crore, pushing his private internet price previous the $1-billion threshold.

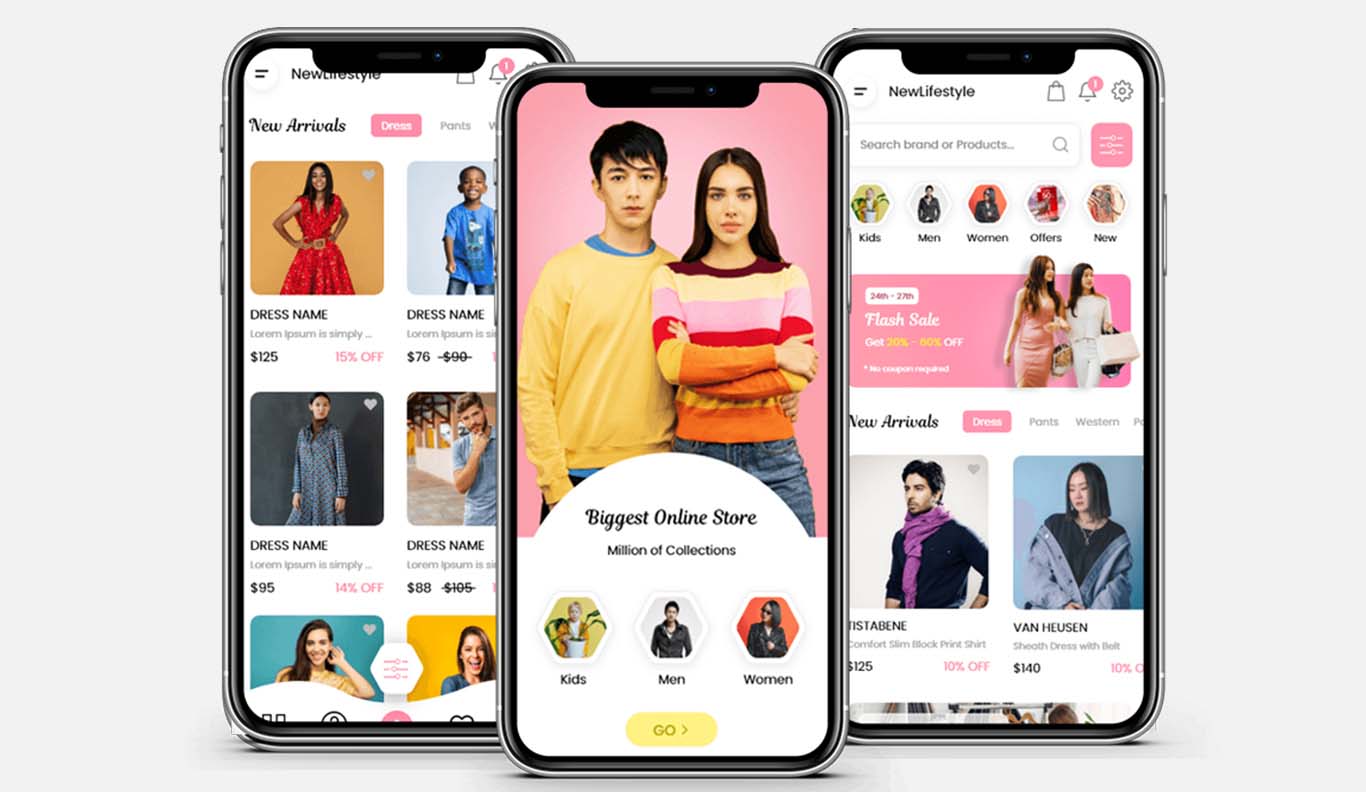

Based by Aatrey and Sanjeev Barnwal in 2015, Meesho initially centered on social commerce, empowering small sellers and particular person entrepreneurs to launch on-line companies affordably. It has since grown right into a dominant, value-driven e-commerce platform in India, notably profitable in Tier-2 and Tier-3 cities by prioritizing inexpensive merchandise and inclusive development. The platform is well-known for its sturdy community of resellers, which permits small companies to retail their merchandise successfully.

Meesho’s profitable IPO and powerful itemizing efficiency are a twin victory: it richly rewarded the founders and early traders whereas concurrently highlighting the rising maturity of India’s startup ecosystem. Aatrey’s achievement of billionaire standing symbolizes the large wealth creation potential pushed by innovation, robust execution, and reaching mass-market penetration. The corporate’s development has been fueled by a stellar group of marquee traders, together with Meta, SoftBank, Sequoia Capital, Y Combinator, Napers, and Elevation Capital, solidifying its influential place within the social commerce sector.

This text was authored by Akanksha Sudham, an intern at Deccan Chronicle.

Leave a Reply