Valuation Metrics Mirror Market Sentiment

Reliance House Finance’s price-to-earnings (P/E) ratio presently stands at roughly -42.2, a determine that contrasts sharply with typical constructive values seen within the housing finance business. This damaging P/E ratio signifies that the corporate is reporting losses relative to its earnings, an element that influences investor notion and valuation. As compared, friends resembling GIC Housing Finance and SRG Housing report P/E ratios of 5.83 and 15.34 respectively, suggesting extra standard earnings situations inside the sector.

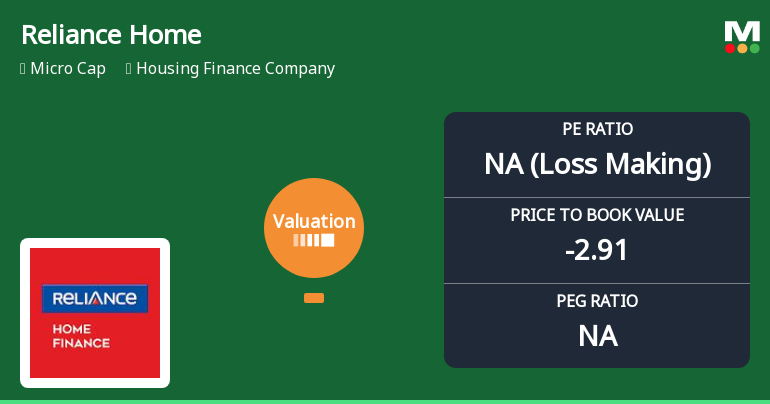

The value-to-book worth (P/BV) ratio for Reliance House Finance is round -2.91, which once more alerts a valuation under the corporate’s internet asset worth. This contrasts with different housing finance corporations the place P/BV ratios are usually constructive and sometimes above 1, reflecting investor willingness to pay a premium over ebook worth for development prospects or asset high quality. Adverse ebook worth metrics for Reliance House Finance additional complicate the valuation narrative, as they indicate that liabilities exceed belongings on the stability sheet.

Enterprise Worth Multiples and Capital Employed

Enterprise worth to EBITDA (EV/EBITDA) and enterprise worth to EBIT (EV/EBIT) ratios for Reliance House Finance are each roughly -57.0, figures which can be markedly completely different from business norms. These damaging multiples sometimes come up when earnings earlier than curiosity, taxes, depreciation and amortisation are damaging, reflecting operational challenges. Against this, opponents resembling GIC Housing Finance and Star Housing Finance report EV/EBITDA multiples within the vary of seven.8 to 11.2, indicating extra secure earnings profiles.

Moreover, the enterprise worth to capital employed ratio for Reliance House Finance is round -14.45, which once more factors to a valuation that doesn’t align with constructive capital utilisation. This metric is essential because it displays how successfully an organization is utilizing its capital to generate earnings, and damaging values recommend difficulties on this space.

Inventory Value Motion and Market Capitalisation

Reliance House Finance’s present inventory worth is ₹3.02, down from a earlier shut of ₹3.12. The 52-week worth vary spans from ₹2.84 to ₹7.84, indicating important volatility over the previous 12 months. The inventory’s current buying and selling vary at present has been between ₹2.97 and ₹3.19, reflecting continued market uncertainty.

Market capitalisation metrics grade the corporate at a decrease degree in comparison with friends, in keeping with the valuation shifts noticed. The day’s worth change of -3.21% additional emphasises the cautious stance buyers are adopting in direction of this inventory.

Comparative Efficiency In opposition to Sensex

When analysing returns, Reliance House Finance’s efficiency over numerous durations reveals a divergence from broader market developments. Over the previous week, the inventory declined by 3.21%, whereas the Sensex recorded a smaller fall of 0.84%. Over one month, the inventory’s return was -6.79%, contrasting with a 1.02% acquire within the Sensex. Yr-to-date figures present Reliance House Finance down by 25.43%, whereas the Sensex gained 8.00% throughout the identical interval.

Longer-term returns additionally spotlight this disparity. Over one 12 months, the inventory’s return was -8.48% in comparison with the Sensex’s 3.53%. Over three years, Reliance House Finance’s return was -17.71%, whereas the Sensex appreciated by 35.72%. Even over 5 years, the inventory’s 13.53% return falls in need of the Sensex’s 83.62% acquire. These figures illustrate the challenges Reliance House Finance faces in matching broader market efficiency.

Sector Comparability and Peer Evaluation

Inside the housing finance sector, Reliance House Finance’s valuation parameters stand out as markedly completely different from a lot of its friends. As an example, GIC Housing Finance is taken into account to have very engaging valuation metrics, with a P/E ratio close to 5.83 and an EV/EBITDA a number of round 11.17. Equally, Star Housing Finance’s P/E ratio of 17.71 and EV/EBITDA of seven.84 replicate a extra standard valuation profile.

Different corporations resembling India House Loans and Parshwanath Company exhibit very costly valuations, with P/E ratios of 263.43 and 67.8 respectively, indicating investor expectations of excessive development or premium pricing. Nonetheless, Reliance House Finance’s damaging earnings and ebook worth metrics place it in a distinct class, typically described as dangerous inside the sector context.

Some friends, together with Ruparel Meals and Ind Financial institution Housing, additionally present dangerous valuations with loss-making standing, highlighting that Reliance House Finance will not be alone in dealing with operational and valuation challenges. This sector-wide variability underscores the significance of cautious evaluation when contemplating investments in housing finance corporations.

Operational Efficiency Indicators

Return on capital employed (ROCE) and return on fairness (ROE) are key indicators of operational effectivity and profitability. Reliance House Finance presently reviews damaging capital employed and damaging ebook worth, which correspond with damaging ROCE and ROE figures. These metrics recommend that the corporate will not be producing returns above its price of capital, an element that weighs on valuation and investor confidence.

Dividend yield knowledge will not be obtainable for Reliance House Finance, which can replicate the corporate’s present monetary place and prioritisation of capital preservation over shareholder distributions.

Implications for Buyers and Market Outlook

The current evaluation adjustments in Reliance House Finance’s valuation parameters spotlight the complexities dealing with the corporate and the housing finance sector at massive. Adverse earnings and ebook worth metrics, coupled with valuation multiples that diverge considerably from sector averages, recommend that buyers ought to strategy this inventory with warning.

Whereas the corporate’s inventory worth has proven some resilience inside a unstable vary, the broader market context and peer comparisons point out that Reliance House Finance is navigating a difficult setting. Buyers could want to contemplate these components alongside broader financial circumstances, rate of interest developments, and regulatory developments impacting the housing finance business.

In abstract, Reliance House Finance’s valuation profile displays a shift in market evaluation that underscores operational and monetary hurdles. The divergence from peer valuation metrics and the inventory’s efficiency relative to the Sensex present essential context for evaluating the corporate’s prospects going ahead.

Solely ₹14,999 – Get MojoOne + Inventory of the Week for two Years PLUS 6 Months FREE Declare 83% OFF →

Leave a Reply