Stock Performance and Market Context

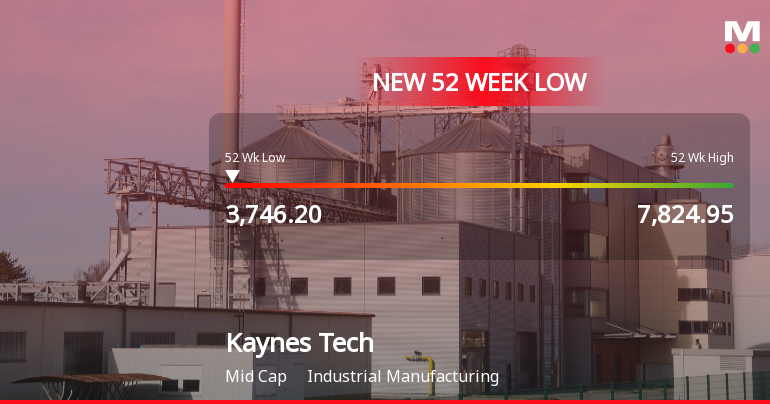

On 8 December 2025, Kaynes Technology India recorded an intraday low of Rs.3746.2, representing a fall of 14.05% from its previous levels. The stock also touched an intraday high of Rs.4531.15, showing a 3.96% rise during the day, but ultimately closed near its lowest point. This trading day was characterised by high volatility, with an intraday volatility of 10.91% calculated from the weighted average price.

The stock has been on a downward trajectory for four consecutive sessions, resulting in a cumulative return of -28.97% over this period. This underperformance is more pronounced when compared to the Electronics – Components sector, which declined by 2.56% on the same day. Furthermore, Kaynes Technology India underperformed its sector by 9.25% during the trading session.

In terms of moving averages, the stock is trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a sustained downward trend across multiple time frames.

Comparative Market and Sector Analysis

The broader market context reveals that the Sensex opened flat with a minor change of -87.53 points but later declined by 522.15 points, closing at 85,102.69, down 0.71%. Despite this, the Sensex remains close to its 52-week high of 86,159.02, just 1.24% away. The index is trading above its 50-day moving average, which itself is positioned above the 200-day moving average, suggesting a generally bullish trend for the market.

In contrast, Kaynes Technology India’s one-year performance shows a return of -38.22%, significantly lagging behind the Sensex’s 4.15% gain over the same period. The stock’s 52-week high was Rs.7824.95, highlighting the extent of the recent decline.

Financial Metrics and Valuation Insights

Kaynes Technology India’s financial indicators present a mixed picture. The company’s return on equity (ROE) stands at 8.1%, while its price-to-book value ratio is 6.2, indicating a valuation that some may consider expensive relative to book value. Despite this, the stock is trading at a discount compared to the average historical valuations of its peers within the sector.

Over the past year, the company’s profits have shown a rise of 59.5%, while the price-to-earnings-to-growth (PEG) ratio is 1.5. This suggests that earnings growth has been notable, even as the stock price has not reflected this trend.

In the last year, while the BSE500 index generated returns of 0.62%, Kaynes Technology India’s stock has produced negative returns of -38.22%, indicating a significant underperformance relative to the broader market.

Operational and Growth Data

The company’s debt-to-equity ratio remains low, averaging at zero, which points to a conservative capital structure with minimal reliance on debt financing. Net sales have grown at an annual rate of 53.35%, and operating profit has expanded by 59.98%, reflecting healthy long-term growth trends.

Net profit growth has been recorded at 62.73%, with the company declaring positive results for three consecutive quarters. The operating profit to interest ratio for the most recent quarter is 6.50 times, indicating strong coverage of interest expenses by operating earnings.

Profit before tax excluding other income for the quarter stood at Rs.108.61 crores, growing at 45.8% compared to the previous four-quarter average. Net sales for the quarter were Rs.906.22 crores, up 25.4% against the previous four-quarter average.

Shareholding and Market Position

Institutional investors hold a significant stake in Kaynes Technology India, accounting for 34.37% of the shareholding. This group increased their holdings by 1.26% over the previous quarter, reflecting a steady interest from entities with substantial analytical resources.

With a market capitalisation of Rs.29,218 crores, Kaynes Technology India is the second-largest company in the Industrial Manufacturing sector, trailing only Honeywell Auto. The company constitutes 25.00% of the sector’s market capitalisation and accounts for 13.29% of the industry’s annual sales, which total Rs.3,225.35 crores.

Summary of Recent Developments

Kaynes Technology India’s recent decline to a 52-week low of Rs.3746.2 comes amid a backdrop of high volatility and a series of consecutive daily losses. Despite the stock’s underperformance relative to the broader market and its sector, the company’s financial results over recent quarters have shown growth in sales, profits, and operational metrics.

The stock’s valuation metrics indicate a premium relative to book value, yet it trades at a discount compared to peer historical averages. Institutional investors maintain a sizeable stake, and the company holds a prominent position within its sector by market capitalisation and sales contribution.

While the broader market, represented by the Sensex, remains near its 52-week high and trades above key moving averages, Kaynes Technology India’s stock continues to face downward pressure, reflected in its current trading below all major moving averages.

Conclusion

The fall to the 52-week low marks a significant moment for Kaynes Technology India, highlighting the divergence between the company’s operational growth and its stock market performance. The stock’s recent volatility and extended decline contrast with the broader market’s relative strength, underscoring the challenges faced within the Industrial Manufacturing sector on this occasion.

Limited Time Only! Upgrade now and get 1 Year of Stock of the week worth Rs. 14,999 for FREE. Don’t miss out on this exclusive offer. Claim Your Free Year →

Leave a Reply