Opening Value Surge and Intraday Efficiency

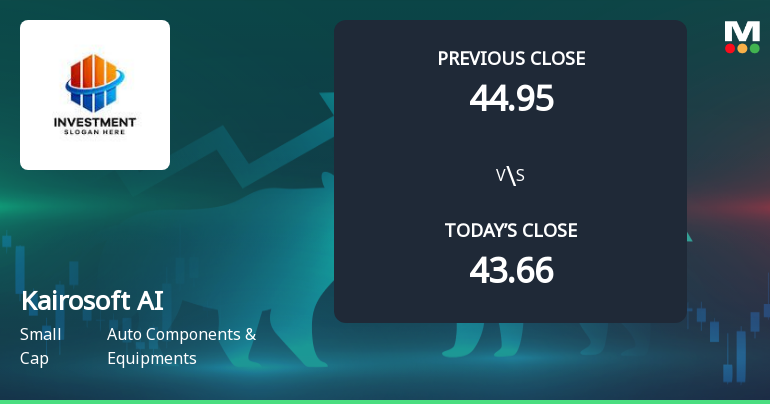

The inventory opened at a value reflecting a 6.96% improve in comparison with its earlier shut, touching an intraday excessive of Rs 46.7. This hole up opening is critical inside the context of the inventory’s current value behaviour, because it outperformed the broader Sensex index, which confirmed a marginal change of 0.03% on the identical day. The day’s efficiency for Kairosoft AI Options recorded a acquire of three.07%, indicating sustained momentum past the preliminary surge.

Technical Indicators and Shifting Averages

From a technical standpoint, the inventory’s value presently trades above its 5-day and 20-day transferring averages, suggesting short-term energy. Nevertheless, it stays beneath the 50-day, 100-day, and 200-day transferring averages, which can point out that longer-term developments have but to align with the current upward motion. The every day transferring averages collectively current a bearish stance, whereas weekly indicators akin to MACD and KST present mildly bullish indicators. Conversely, month-to-month technicals replicate a extra cautious outlook with bearish tendencies.

Volatility and Beta Concerns

Kairosoft AI Options is classed as a excessive beta inventory, with an adjusted beta of 1.35 relative to the Small Cap Market (SMLCAP). This elevated beta means that the inventory is susceptible to bigger value fluctuations in comparison with the general market, which aligns with the noticed hole up and intraday volatility. Traders monitoring the inventory ought to notice this attribute as it might contribute to amplified value swings in each instructions.

Current Efficiency Context

Over the previous month, Kairosoft AI Options has recorded a value change of -1.62%, contrasting with the Sensex’s 0.65% acquire throughout the identical interval. This current decline locations the present hole up in a context of short-term restoration or correction. The inventory’s efficiency right this moment, nonetheless, exhibits a reversal of this pattern with a constructive day change of three.07%, indicating a shift in buying and selling dynamics.

Sector Comparability and Market Capitalisation

Throughout the Auto Parts & Equipments sector, Kairosoft AI Options’ outperformance right this moment by 5.31% relative to its friends highlights a definite divergence from sector developments. The corporate holds a market capitalisation grade of three, situating it inside a selected vary of market worth amongst its sector counterparts. This positioning could affect liquidity and buying and selling volumes, components that may contribute to the noticed value actions.

Technical Abstract and Market Sentiment

Weekly technical indicators current a blended image: the MACD and KST oscillators are mildly bullish, whereas Bollinger Bands counsel a mildly bearish stance. Month-to-month indicators lean in direction of bearishness, with the Dow Concept signalling a mildly bearish pattern. The Relative Energy Index (RSI) on a weekly foundation exhibits bullish momentum, whereas month-to-month RSI doesn’t present a transparent sign. These blended indicators replicate a market setting the place short-term optimism coexists with longer-term warning.

Hole Fill Potential and Buying and selling Outlook

The numerous hole up opening of Kairosoft AI Options could invite consideration to the potential of a spot fill, a standard phenomenon the place costs retrace to earlier ranges after an preliminary soar. Nevertheless, the sustained intraday momentum, as evidenced by the inventory sustaining features above short-term transferring averages, means that the hole fill will not be speedy. The interaction between short-term bullish technicals and longer-term bearish indicators will doubtless affect value motion within the coming periods.

Abstract of Market Dynamics

Kairosoft AI Options’ efficiency right this moment displays a powerful begin with a spot up opening and intraday features that outpace each sector and benchmark indices. The inventory’s excessive beta attribute contributes to its volatility, whereas technical indicators present a nuanced view of market sentiment. The divergence between short-term energy and longer-term warning underscores the complexity of the present buying and selling setting for this auto parts participant.

Investor Concerns

Market members observing Kairosoft AI Options ought to notice the inventory’s place relative to key transferring averages and the blended indicators from technical indicators. The hole up opening highlights a constructive shift in buying and selling exercise, but the broader context of current month-to-month developments advises a measured strategy to deciphering this motion. The inventory’s excessive beta standing additional emphasises the potential for amplified value swings in response to market developments.

Conclusion

In abstract, Kairosoft AI Options’ hole up opening and subsequent intraday efficiency mark a notable occasion inside the Auto Parts & Equipments sector. The inventory’s capability to maintain features above short-term averages, mixed with its excessive beta nature, suggests energetic buying and selling curiosity and volatility. Whereas technical indicators current a blended outlook, the present value motion displays a constructive market response at first of the session.

Solely ₹14,999 – Get MojoOne + Inventory of the Week for two Years PLUS 6 Months FREE Declare 83% OFF →

Leave a Reply