The veteran tech large continues to strengthen its place within the AI house.

Tech large Worldwide Enterprise Machines (IBM 0.48%) has been investing in synthetic intelligence (AI) for many years, and now, these efforts are paying off. Its inventory has soared over 40% 12 months up to now.

To additional develop its AI know-how, IBM has turned to acquisitions — and certainly one of its subsequent ones will likely be Cognitus. On the floor, this deal won’t appear to be associated to AI, since Cognitus makes a speciality of enterprise useful resource planning programs, particularly throughout the SAP ecosystem.

However while you dig into the small print, it turns into clear that Cognitus actually may help IBM with its AI efforts.

Picture supply: Getty Pictures.

How Cognitus may help IBM

To know how the Cognitus acquisition bolsters IBM’s AI choices, a little bit of background is required. Throughout Large Blue’s storied historical past, it has served shopper, company, and authorities prospects. With the advents of synthetic intelligence and cloud computing, the conglomerate shifted its focus to the final two buyer segments and realigned its choices accordingly.

For instance, IBM now makes a speciality of hybrid cloud companies. This mannequin blends the associated fee effectivity of public clouds, which share infrastructure amongst numerous organizations, with the improved safety and privateness of a personal cloud devoted to a single enterprise. The hybrid setup fits many IBM purchasers, permitting them to make use of public clouds for normal features like web site internet hosting, whereas sustaining a personal cloud for confidential property comparable to monetary and buyer knowledge.

That is the place Cognitus is available in. Its specialization in enterprise useful resource planning led the corporate to assemble AI instruments that may meet the strict safety, privateness, and regulatory necessities of consumers comparable to governments, monetary establishments, and healthcare suppliers.

Cognitus’ AI instruments provide capabilities — together with compliance monitoring in actual time — that ought to show compelling to lots of IBM’s prospects. These options are along with Cognitus’ core experience in SAP implementations, which is able to complement and strengthen IBM’s present SAP choices.

In line with IBM’s press launch saying the deal, “This helps organizations in complicated and controlled industries simplify operations and obtain better consistency with a single supplier.”

Worldwide Enterprise Machines

Right now’s Change

(-0.48%) $-1.50

Present Worth

$309.24

Key Knowledge Factors

Market Cap

$289B

Day’s Vary

$303.33 – $311.05

52wk Vary

$214.50 – $324.90

Quantity

3M

Avg Vol

5.2M

Gross Margin

57.22%

Dividend Yield

2.17%

Different elements bolstering IBM’s enterprise

With organizations all over the world adopting AI, facilitating the mixing of synthetic intelligence into their enterprise useful resource planning platforms via Cognitus may bolster IBM’s success. Within the third quarter, gross sales from IBM’s software program division, which encompasses its AI choices, grew 10% 12 months over 12 months to $7.2 billion.

Furthermore, Cognitus will contribute to a different key element of Large Blue’s enterprise: its consulting arm. The corporate generated $5.3 billion of its $16.3 billion in Q3 income from consulting. Consulting companies can come into play when a corporation implements enterprise useful resource planning.

The addition of Cognitus alone will not be a sport changer for Large Blue’s AI enterprise. It’s going to, nevertheless, complement IBM’s pending acquisition of Confluent, introduced on Dec. 8, which bolsters its real-time knowledge capabilities. Wedbush analysts praised that deal, calling it a “sturdy transfer.”

With the introduction of Confluent into the combo, IBM’s tech stack will turn into markedly stronger. Synthetic intelligence requires mountains of information to carry out duties with accuracy. Because the knowledge feeding AI comes from many sources, it may be a large number to work with. Confluent turns that mess into usable knowledge, feeding into Cognitus and the opposite platforms that comprise Large Blue’s tech stack.

The tech large additionally lately initiated a partnership with AI start-up Anthropic. IBM will incorporate Anthropic’s AI fashions into its software program.

To purchase or to not purchase IBM inventory

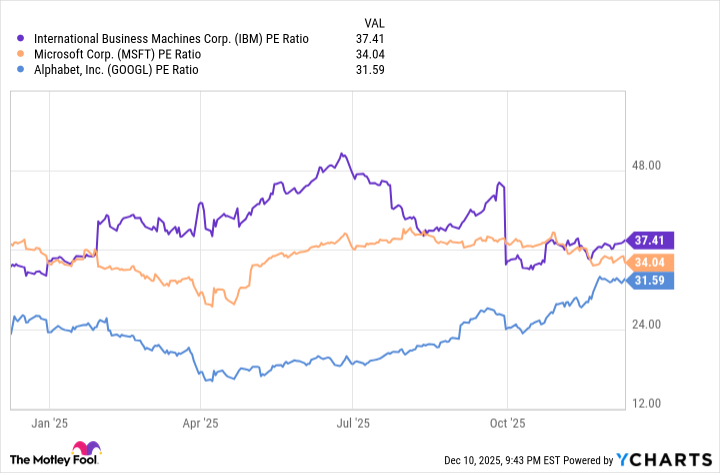

So IBM is continuous to construct up its AI arsenal — however is now an opportune time to spend money on its shares? Answering that query requires assessing its inventory valuation. This may be performed by looking at IBM’s price-to-earnings ratio (P/E), which measures how a lot traders are prepared to pay for every greenback of the corporate’s earnings over the previous 12 months, and evaluating it to main rivals within the AI and cloud sectors, Microsoft and Alphabet.

Knowledge by YCharts.

IBM’s P/E a number of has been elevated for many of 2025, though it dropped in latest months. Even so, it stays increased than for Microsoft and Alphabet. This implies IBM shares aren’t low-cost.

General, Large Blue has some strong elements, and it is bringing collectively many compelling capabilities via acquisitions comparable to Cognitus and Confluent. And its dividend yield of greater than 2% on the present share worth is hefty for an AI-focused tech firm.

However given its elevated valuation, the prudent method can be to attend for the inventory worth to drop earlier than shopping for IBM shares.

Leave a Reply