- In latest days, analysts have lifted their consensus earnings estimate for Silicon Movement Know-how’s present quarter by over 11%, now projecting earnings progress of round 44% yr over yr alongside income progress of greater than 36%, reflecting stronger-than-expected demand.

- This shift builds on the corporate’s document of topping earnings estimates in every of the final 4 quarters, underscoring bettering operational execution and rising confidence in its long-term earnings energy.

- We’ll discover how this upward shift in earnings expectations might reinforce Silicon Movement’s funding narrative round subsequent‑technology storage demand and margins.

Uncover the following massive factor with financially sound penny shares that stability danger and reward.

Silicon Movement Know-how Funding Narrative Recap

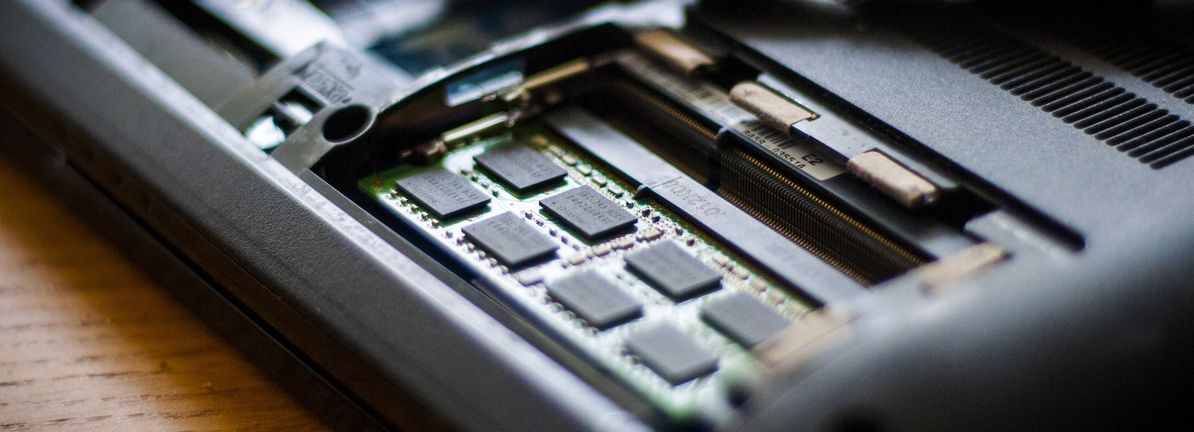

To personal Silicon Movement, you’ll want to consider that demand for subsequent technology storage controllers in PCs, information facilities and autos will preserve increasing and that the corporate can shield margins in very aggressive markets. The latest 11% uplift in consensus earnings for the present quarter helps the important thing close to time period catalyst of stronger finish demand, however does little to cut back the most important present danger round value competitors and potential gross margin stress.

Amongst latest bulletins, the launch of the SM8388 PCIe Gen5 enterprise SSD controller in November stands out within the context of rising earnings expectations, because it targets excessive efficiency, AI oriented information heart workloads the place controller connect alternatives may be significant. If the newer enterprise and AI associated merchandise acquire traction alongside the sooner COMPUTEX and embedded storage launches, they could assist offset long term issues round buyer focus and heavy R&D spending.

But, whereas latest earnings momentum appears encouraging, traders ought to nonetheless concentrate on how brutal pricing in sure controller segments can…

Learn the total narrative on Silicon Movement Know-how (it is free!)

Silicon Movement Know-how’s narrative initiatives $1.2 billion income and $196.6 million earnings by 2028. This requires 14.8% yearly income progress and a couple of $118.4 million earnings improve from $78.2 million right now.

Uncover how Silicon Movement Know-how’s forecasts yield a $114.00 honest worth, a 25% upside to its present value.

Exploring Different Views

Eight members of the Merely Wall St Group at the moment see honest worth for Silicon Movement unfold extensively between US$36.85 and US$114 per share. In opposition to this vary, the latest soar in earnings expectations highlights how delicate sentiment might be to any renewed pricing stress or gross margin pressure, so it’s value weighing a number of viewpoints earlier than deciding how this inventory would possibly match into your portfolio.

Discover 8 different honest worth estimates on Silicon Movement Know-how – why the inventory may be value lower than half the present value!

Construct Your Personal Silicon Movement Know-how Narrative

Disagree with present narratives? Create your personal in underneath 3 minutes – extraordinary funding returns not often come from following the herd.

In search of Different Investments?

Early movers are already taking discover. See the shares they’re focusing on earlier than they’ve flown the coop:

This text by Merely Wall St is common in nature. We offer commentary based mostly on historic information

and analyst forecasts solely utilizing an unbiased methodology and our articles aren’t supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your targets, or your

monetary scenario. We intention to convey you long-term centered evaluation pushed by elementary information.

Be aware that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials.

Merely Wall St has no place in any shares talked about.

New: Handle All Your Inventory Portfolios in One Place

We have created the final portfolio companion for inventory traders, and it is free.

• Join a limiteless variety of Portfolios and see your complete in a single foreign money

• Be alerted to new Warning Indicators or Dangers through electronic mail or cellular

• Observe the Truthful Worth of your shares

Have suggestions on this text? Involved concerning the content material? Get in contact with us straight. Alternatively, electronic mail editorial-team@simplywallst.com

Leave a Reply