Understanding the Golden Cross and Its Significance

The Golden Cross is extensively regarded by market analysts and merchants as a dependable indicator of a pattern reversal from bearish to bullish. It happens when the short-term transferring common, on this case the 50-day transferring common (DMA), crosses above the long-term 200 DMA. This crossover means that latest value motion is gaining energy relative to the longer-term pattern, typically interpreted as an indication that purchasing curiosity is growing and that the inventory could expertise upward momentum.

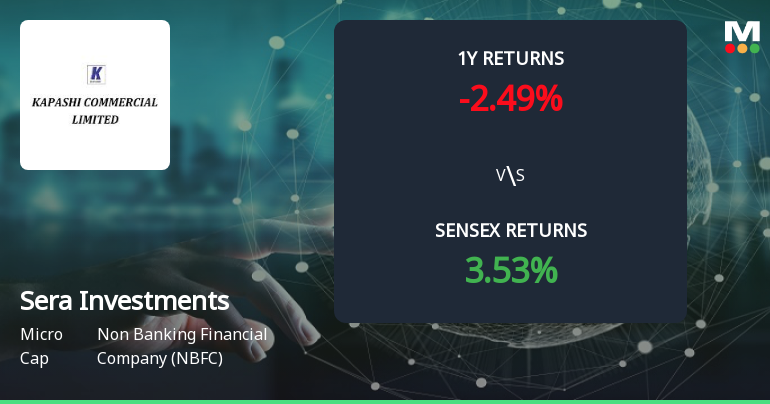

For Sera Investments & Finance India, this technical occasion is especially noteworthy given its historic value efficiency and present market context. Whereas the inventory’s one-year efficiency reveals a decline of two.49%, contrasting with the Sensex’s 3.53% acquire over the identical interval, the formation of the Golden Cross might point out a possible change in investor sentiment and value trajectory.

Latest Technical Indicators Supporting the Bullish Outlook

Extra technical indicators reinforce the importance of this crossover. The Shifting Common Convergence Divergence (MACD) indicator is bullish on each weekly and month-to-month charts, suggesting constructive momentum within the medium and long term. Bollinger Bands additionally present a mildly bullish stance on the weekly timeframe and a bullish indication month-to-month, implying that value volatility is aligning with an upward pattern.

Conversely, the Relative Energy Index (RSI) on the weekly chart stays bearish, indicating some short-term warning amongst merchants. Nonetheless, the absence of a month-to-month RSI sign means that longer-term momentum could also be stabilising. The KST (Know Certain Factor) indicator presents a combined image with weekly bullishness however gentle bearishness month-to-month, highlighting the nuanced nature of the inventory’s technical panorama.

Lengthy-Time period Momentum and Historic Efficiency Context

Inspecting Sera Investments & Finance India’s longer-term returns gives additional perception into the potential implications of the Golden Cross. Over the previous 5 years, the inventory has delivered a cumulative return of 243.85%, considerably outpacing the Sensex’s 83.62% over the identical interval. Extending the horizon to 10 years, the inventory’s return stands at 397.63%, in comparison with the Sensex’s 234.19%. These figures spotlight the corporate’s capability for substantial progress over prolonged intervals, which aligns with the bullish momentum urged by the latest technical crossover.

Nonetheless, the three-year efficiency of 21.42% trails the Sensex’s 35.72%, indicating some latest challenges or market headwinds. The Golden Cross could subsequently signify a technical sign of a possible restoration or acceleration in progress after this relative underperformance.

Market Capitalisation and Valuation Metrics

Sera Investments & Finance India is assessed as a micro-cap inventory with a market capitalisation of roughly ₹276 crores. The corporate’s price-to-earnings (P/E) ratio stands at -130.21, reflecting unfavorable earnings or losses in latest intervals, whereas the business common P/E is 28.68. This valuation context means that the inventory is presently buying and selling at a reduction relative to its sector friends, which can appeal to buyers in search of worth alternatives if the technical indicators translate into basic enhancements.

Quick-Time period Value Actions and Relative Energy

Within the rapid time period, the inventory’s one-day value change was -0.45%, barely underperforming the Sensex’s -0.32% on the identical day. Over the previous week, nevertheless, Sera Investments & Finance India recorded a acquire of 1.72%, contrasting with the Sensex’s decline of 0.84%. The one-month and three-month performances additional underscore this constructive pattern, with the inventory rising 2.39% and 19.52% respectively, in comparison with the Sensex’s 1.02% and three.64%. 12 months-to-date, the inventory’s return of 26.43% notably exceeds the Sensex’s 8.00%, reinforcing the notion of strengthening momentum.

Implications for Traders and Market Contributors

The formation of the Golden Cross in Sera Investments & Finance India’s value chart is a technical growth which will appeal to consideration from merchants and buyers searching for indicators of a sustained upward pattern. This crossover typically precedes intervals of elevated shopping for curiosity and might mark the start of a brand new bullish part, particularly when supported by different constructive technical indicators corresponding to MACD and Bollinger Bands.

However, buyers ought to contemplate the broader market context, together with the corporate’s valuation metrics and up to date earnings efficiency, earlier than drawing conclusions. The unfavorable P/E ratio and micro-cap standing counsel that the inventory carries sure dangers and could also be topic to volatility. The combined indicators from momentum indicators like RSI and KST additionally advise warning and the necessity for ongoing monitoring.

Conclusion: A Potential Turning Level for Sera Investments & Finance India

The Golden Cross formation in Sera Investments & Finance India’s inventory chart represents a noteworthy technical occasion which will sign a shift in market sentiment and a possible bullish breakout. Supported by constructive momentum indicators and a historical past of robust long-term returns, this growth might mark the start of a brand new upward pattern for the inventory.

Traders ought to weigh this technical sign alongside basic elements corresponding to valuation and earnings efficiency, in addition to broader market situations. Whereas the Golden Cross is commonly seen as a dependable indicator of pattern reversal, it’s not infallible and needs to be thought of as a part of a complete funding evaluation.

Because the inventory navigates this vital juncture, market members will likely be watching carefully to see if the bullish momentum sustains and interprets into significant value appreciation within the months forward.

Solely ₹14,999 – Get MojoOne + Inventory of the Week for two Years PLUS 6 Months FREE Declare 83% OFF →

Leave a Reply