It’s that point of the yr when you may evaluate your funds. The yr passed by was led by elements round a difficult international setting disrupted by commerce disputes and wars. Amidst that, India’s development is like an oasis. Whereas foreigners could not fancy Indian equities for now, they nonetheless maintain a sizeable chunk of India’s market capitalisation. Essentially the most distinguished supporters of the India story are actually Indian traders. They personal a fifth of Indian shares, immediately and not directly (via mutual funds). The story of Indian savers turning into traders is about to enter a brand new chapter over the subsequent 5 years.

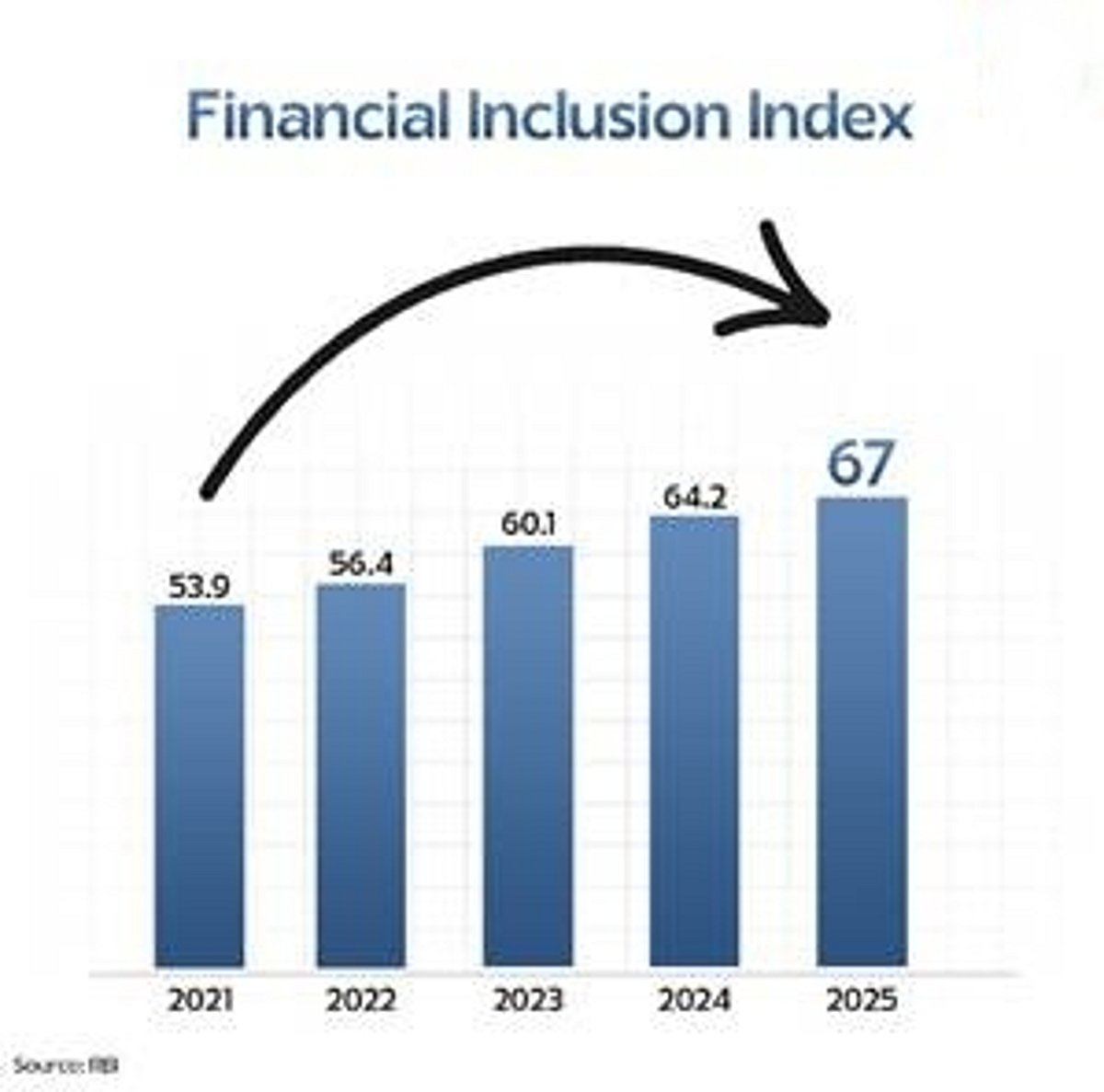

The Reserve Financial institution of India final week dropped a brand new monetary inclusion roadmap in a doc titled ‘Nationwide Technique for Monetary Inclusion 2025-30’. It isn’t only for bankers but additionally for the way forward for your cash, financial savings, borrowings and investments.

Banking requirements

The RBI examine reveals that India has moved the needle considerably on banking companies. From ‘everybody wants a checking account’ to ‘everybody deserves good service’. With the introduction of Jan Dhan accounts and the assist of Aadhaar and cell connectivity, it’s a end line. Nevertheless, the main focus is now on service high quality. The thought is to make sure that you employ your checking account successfully in your wants. The survey finds that the last-mile banking is reliably executed via better-trained enterprise correspondents. Onboarding is quicker than earlier than, because of the ‘know your buyer’ video course of. Digital cost experiences are getting higher, the survey finds. Sooner or later, your on a regular basis cash duties ought to get simpler and extra constant, regardless of the place you reside.

There may be additionally a robust push for the monetary inclusion of girls. The survey finds that solely 15% of enterprise correspondents are ladies. The RBI goals to double that quantity over the subsequent 5 years. It’s encouraging firms throughout mutual funds, insurance coverage, non-banking finance, and banking to create tailor-made merchandise for girls and susceptible households. If ladies have higher monetary entry, households have higher monetary safety. The survey calls it ‘inclusion with tooth.’

Digital Funds

The RBI examine places an formidable goal of 1 billion digital cost customers by 2029. To enhance your confidence within the digital funds system, the RBI is engaged on environment friendly grievance methods that may be filed with a single faucet in your cell system. It goals to speed up the blocking of fraudulent transactions via a nationwide fraud-intelligence system. RBI is insisting that app makers create a clear, scam-resistant consumer interface by avoiding darkish patterns. The central financial institution can be seeking to increase the scope of UPI Lite, UPI Lite X, and programmable central financial institution digital foreign money (e-rupee) over the subsequent 5 years.

Monetary literacy dives deeper.

Over the subsequent 5 years, RBI will create monetary literacy programmes based mostly on behaviour and private studying, the examine stated. There will likely be separate modules for cohorts reminiscent of college students, seniors, migrants, gig staff, and small and medium enterprises. The training will likely be largely scenario-based and sensible. There will likely be a decisive shift within the literacy programmes from explaining what monetary merchandise are to easy methods to use them. The examine highlights the significance of inculcating good cash habits with an emphasis on schooling on scams, digital hygiene and debt administration.

Security nets

One other important facet of the RBI’s subsequent five-year plan is strengthening security nets, together with insurance coverage, pensions, and emergency credit score. The RBI examine highlights that constructing your monetary resilience would be the focus. Your capacity to deal with shocks reminiscent of job loss, medical emergencies, or accidents could be thought-about. RBI plans make enrolment and declare processes simpler for insurance coverage schemes. It plans to push for reasonably priced pension plans, such because the Atal Pension Yojana. It is usually working in direction of a system to create an emergency overdraft facility for primary financial institution accounts.

Leave a Reply