Category: Finance

-

Sabka Bima Sabki Raksha Invoice: A New Initiative by the Finance Minister in Lok Sabha

On Tuesday, Union Finance Minister Nirmala Sitharaman will ask for go away to current the Sabka Bima Sabki Raksha (Modification of Insurance coverage Legal guidelines) Invoice, 2025 within the Lok Sabha, which is supposed to give you a brand new legislation that will additional modify the principle insurance-related legal guidelines in India in order to…

-

Ceejay Finance: Navigating Blended Monetary and Technical Indicators

High quality Evaluation: Monetary Efficiency and Returns The standard parameter for Ceejay Finance is influenced primarily by its monetary outcomes and return metrics. The corporate reported flat monetary efficiency within the second quarter of the fiscal yr 2025-26, indicating a interval of stagnation quite than development. This lack of momentum is additional underscored by the…

-

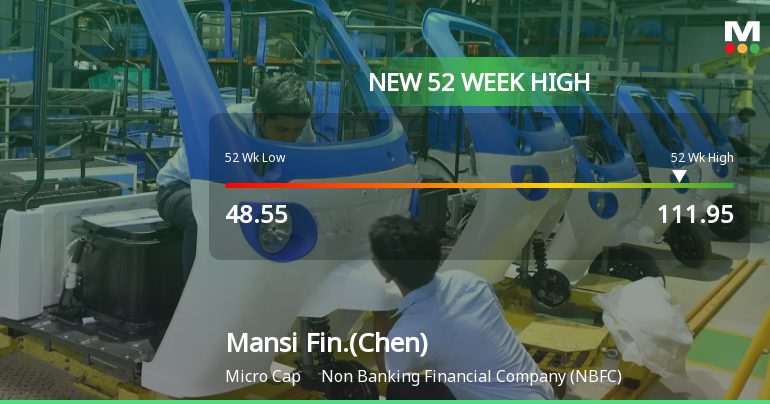

Mansi Finance Reaches New 52-Week Excessive of Rs. 111.95 in Chennai

Inventory Efficiency and Market Context The inventory of Mansi Finance (Chennai) recorded its highest worth within the final 52 weeks at Rs.111.95 at present, marking a notable peak in comparison with its 52-week low of Rs.48.55. This represents a considerable worth vary motion over the yr, underscoring the inventory’s upward momentum. Over the previous 12…

-

Market Dynamics: Navigating Conflicting Alerts

High quality Evaluation: Lengthy-Time period Development and Institutional Confidence Jio Monetary Providers continues to display sturdy elementary energy, notably evident in its long-term monetary trajectory. The corporate’s working income have exhibited a compound annual development price (CAGR) of 462.61%, underscoring a sustained growth in core earnings. Internet gross sales have additionally proven a exceptional annual…

-

Manba Finance Evaluation: Navigating Blended Monetary and Technical Indicators

High quality Evaluation: Monetary Efficiency and Market Place Manba Finance’s latest quarterly outcomes for Q2 FY25-26 point out a largely flat monetary efficiency, with working money circulation for the yr registering at a low of ₹-323.56 crores. This determine factors to ongoing challenges in producing optimistic money inflows from operations, a crucial issue for sustaining…

-

Navigating Monetary Uncertainty: Analyzing Conflicting Indicators

High quality Evaluation: Balancing Debt and Profitability Cholamandalam Monetary Holdings continues to function as a high-debt entity, with a median debt-to-equity ratio of 9.49 instances. This degree of leverage signifies a big reliance on borrowed capital, which may amplify monetary danger, particularly in unstable market situations. The corporate’s return on capital employed (ROCE) averages 9.89%,…

-

Manba Finance: Navigating Technical Momentum in a Difficult Market

Technical Development and Value Motion The inventory worth of Manba Finance closed at ₹137.30, down from the earlier shut of ₹139.10, marking a day change of -1.29%. The intraday vary noticed a low of ₹137.30 and a excessive of ₹149.00, indicating some volatility inside the session. Over the previous 52 weeks, the inventory has traded…

-

Navigating Uncertainty: Balancing Monetary and Technical Indicators

High quality Evaluation: Monetary Efficiency and Operational Metrics Ramsons Tasks has demonstrated optimistic monetary leads to the latest quarter, with the second quarter of FY25-26 reflecting encouraging figures. The corporate reported a revenue after tax (PAT) of ₹5.42 crores over the newest six-month interval, signalling operational profitability. Moreover, working money circulate for the yr reached…

-

PNB Housing Finance Experiences Technical Momentum Shift Amid Market Volatility

Technical Momentum and Value Motion PNB Housing Finance’s present market value stands at ₹922.30, down from the earlier shut of ₹937.45, marking a day change of -1.62%. The inventory’s intraday vary has fluctuated between ₹903.00 and ₹948.20, indicating some volatility inside the session. Over the previous 52 weeks, the inventory has traded between a low…

-

House First Finance Firm India: Navigating Combined Technical Alerts Amid Worth Momentum Shift

Worth Momentum and Market Efficiency The inventory of House First Finance Firm India closed at ₹1,184.55, marking a modest change from the earlier shut of ₹1,174.75. The intraday buying and selling vary spanned from ₹1,172.90 to ₹1,193.15, reflecting a comparatively slim band of value motion. Over the previous week, the inventory recorded a return of…