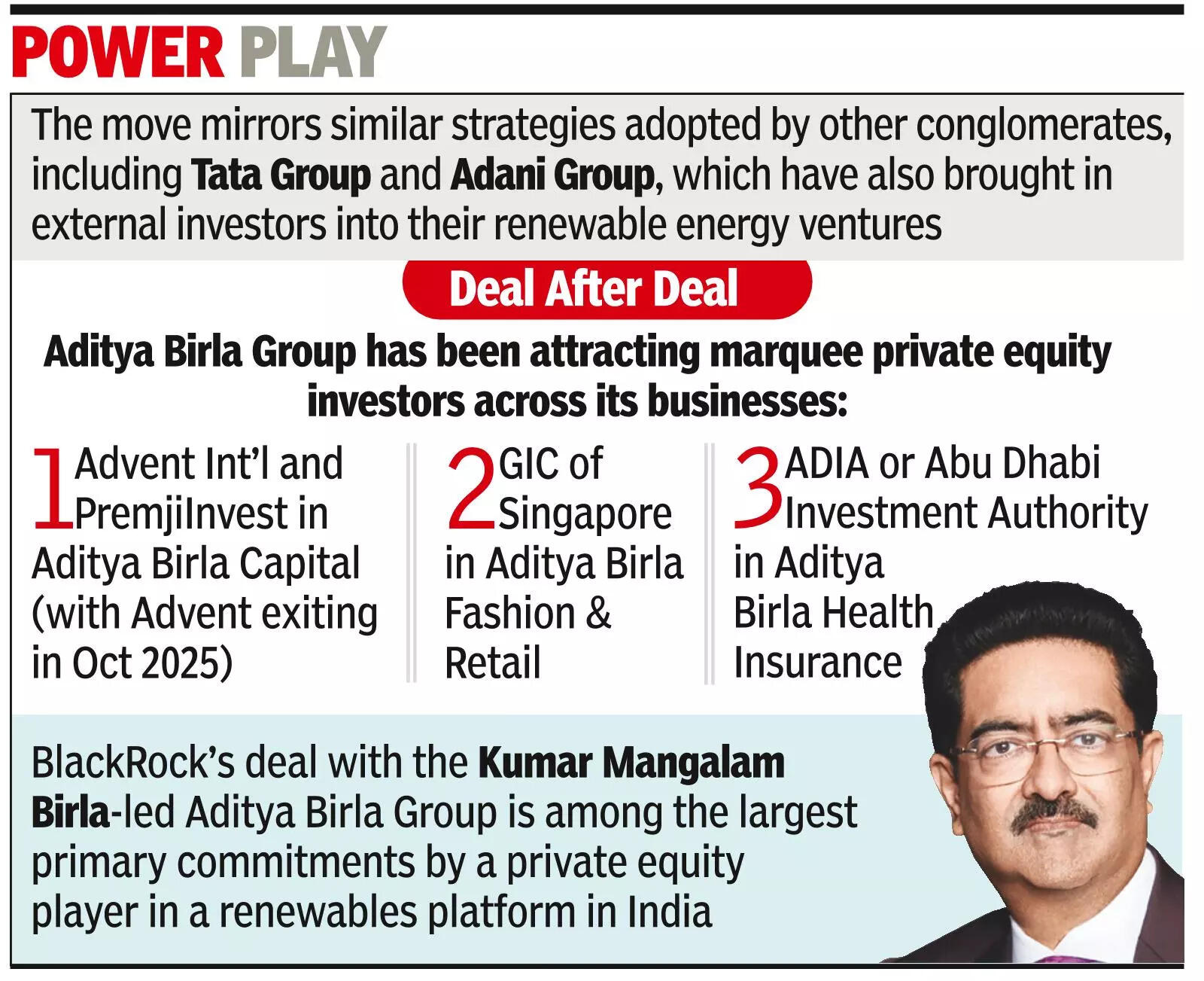

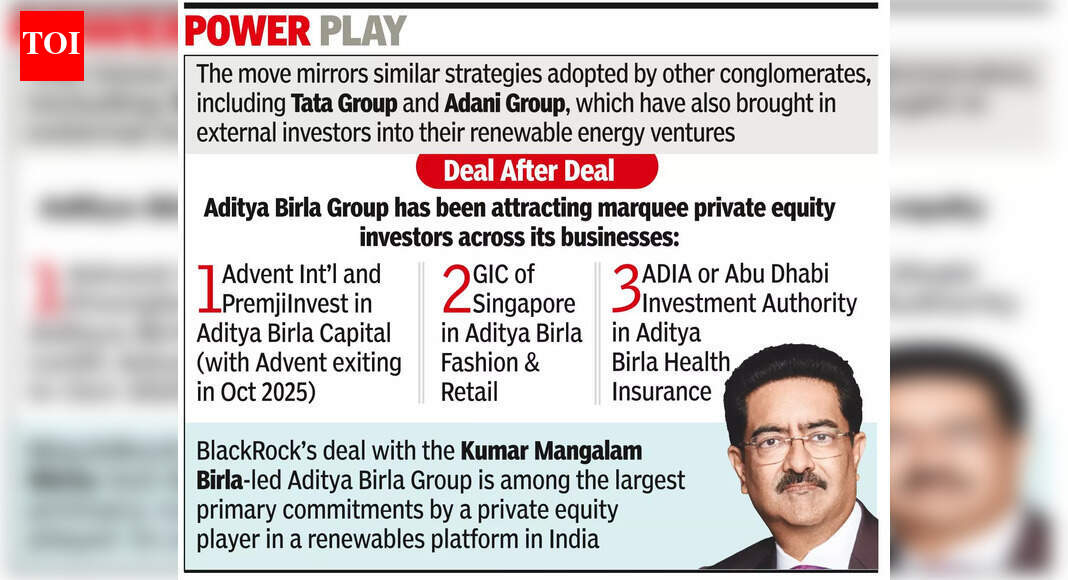

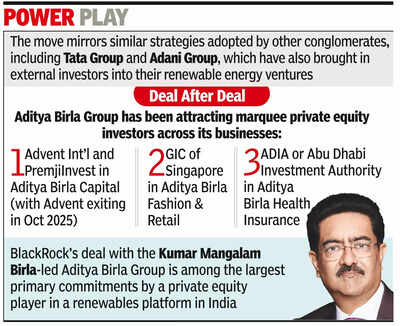

MUMBAI: BlackRock, one of many world’s largest asset managers, is about to take a position Rs 3,000 crore in Aditya Birla Group’s renewable vitality enterprise for a minority stake. The enterprise, housed below Grasim, has been valued at Rs 14,600 crore, highlighting the rising investor curiosity in India’s clear vitality sector. The transfer mirrors comparable methods adopted by different conglomerates, together with Tata Group and Adani Group, which have additionally introduced in exterior buyers into their renewable vitality ventures. Earlier, Qatar’s Nebras Energy had explored buying a 49% stake in Aditya Birla Renewables, however that deal didn’t materialise. On the time, different world buyers, together with Alberta Funding Administration Company and BlackRock International Infrastructure Companions (GIP), had expressed curiosity within the firm.

Housed Below Grasim, Clear Power Biz Valued At ₹14.6K Cr

Tuesday’s announcement confirms that discussions between Aditya Birla Group and GIP have progressed into a proper settlement, marking a major step within the group’s renewable vitality enterprise.Final 12 months, NYSE-listed BlackRock acquired International Infrastructure Companions, creating an infrastructure platform managing belongings price over $180 billion. Aditya Birla Renewables at the moment has a portfolio of 4.3 GW throughout 10 states, spanning photo voltaic, wind, hybrid, and floating photo voltaic initiatives, positioning it as certainly one of India’s distinguished renewable vitality gamers.Aditya Birla Group has been attracting marquee non-public fairness buyers throughout its companies. These embrace Creation Worldwide and PremjiInvest in Aditya Birla Capital (with Creation exiting in Oct 2025), GIC of Singapore in Aditya Birla Trend & Retail, and Abu Dhabi Funding Authority (ADIA) in Aditya Birla Well being Insurance coverage. These investments replicate the group’s technique of leveraging non-public capital to gas progress whereas sustaining operational and strategic management over its companies.Commenting on the deal, among the many largest major commitments by a personal fairness participant in a renewables platform in India, Aditya Birla Group chairman Kumar Mangalam Birla mentioned: “GIP’s funding marks a pivotal second in our progress journey, laying a powerful basis for an accelerated buildout of our renewables platform, as we goal a capability of 10GW+ within the coming years. Their world management in proudly owning and working a number of the most subtle vitality belongings worldwide brings each rigour and attain to our ambition. We see our renewables enterprise rising as a robust progress engine.”

Leave a Reply