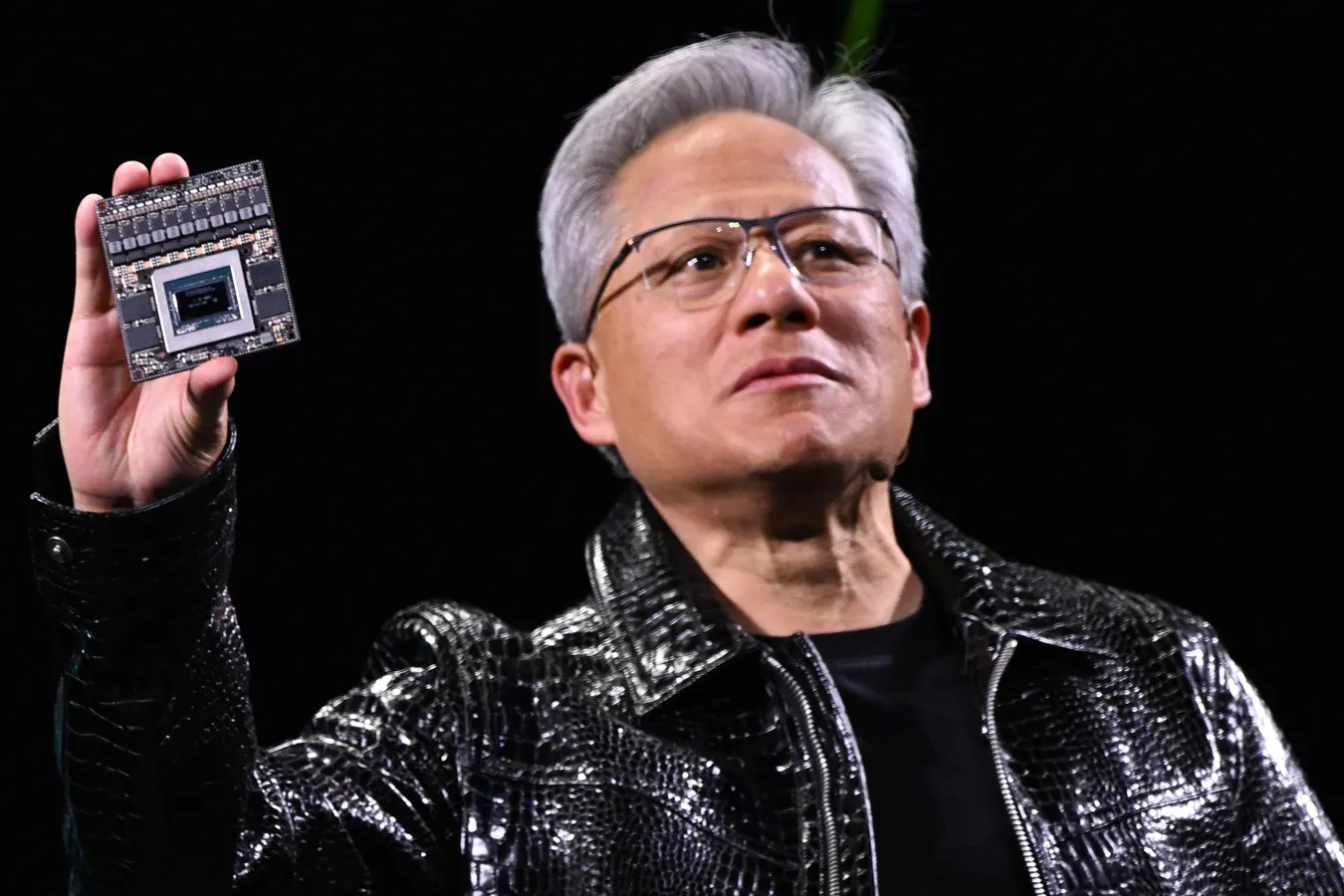

Nvidia CEO Jensen Huang (Photograph by Artur Widak/NurPhoto by way of Getty Pictures)

NurPhoto by way of Getty Pictures

“What in regards to the AI bubble?” is the commonest query being requested of economists and funding professionals right now. Skepticism is acceptable about two points: the assertion of a bubble, and the valuation of firms in new fields. Bubbles are laborious to determine in actual time, although underlying demand could also be simpler to see.

Underlying fundamentals are extraordinarily constructive for synthetic intelligence firms, with two main financial actions nearly sure to show robust. Corporations producing massive language fashions (LLMs) might be a significant engine of productiveness throughout a really broad swath of enterprise, non-profits and authorities. As well as, a mess of firms are creating specialised functions that use LLMs to enhance productiveness in particular duties, reminiscent of billing or product design. Along with these two main approaches, small language fashions for specialised duties have been developed, although it’s much less sure that this strategy will beat specialised apps related to LLMs.

However robust fundamentals don’t at all times justify sky-high firm valuations. The trick is to determine how excessive the basics might be relative to present valuations. That’s extremely laborious to do, besides on reflection.

The AI trade is determining the perfect enterprise mannequin for making use of to know-how to real-world issues. That mixes with human tendency towards speculative frenzies to make valuation troublesome. The enterprise mannequin problem has been under-appreciated in latest discussions.

In 1908, the USA had over 250 firms manufacturing cars. Two main developments adopted: Automobiles gross sales soared to previously-unbelievable ranges, and most automotive firms went out of enterprise. That’s a surprising outcome.

Automobile firms had to determine how you can manufacture the product effectively, one thing that Ford was good at. They usually had to determine what clients most wished of their automobiles, which Common Motors was higher at. In an trade with massive economies of scale, the lower-performing firms misplaced market-share, inflicting their prices to exceed that of different firms. In order that they failed.

Comparable outcomes got here within the dot-com growth of the Nineties. Many firms had been fashioned in e-commerce, and most went out of enterprise. However on-line purchasing has hit ranges that few anticipated twenty years in the past. The enterprise idea was nice, however a lot of the particular makes an attempt failed.

Underlying this dichotomy is an idea I name “the trial and error financial system.” Companies have to experiment although many experiments will fail—or they succeed within the sense that the corporate learns what won’t work. Hardly ever does a significant innovation work completely in its first iteration.

Within the AI house, we’ll watch many errors. Some firms will fail. Different will stumble badly however survive. And some will discover the proper mannequin for serving to their clients obtain big good points in productiveness—and they’re going to find yourself being price their lofty valuations.

Market construction is a part of the puzzle as to final firm success. Typically one firm dominates a selected house. Who can identify the quantity two firm in small enterprise accounting software program? That’s as a result of each accountant can load a pc file created with QuickBooks. Small enterprise homeowners with an alternate accounting program have extra bother.

Some industries have a handful of massive gamers whereas others have many small gamers—consider eating places. I wrote some time again: “Whereas the big language mannequin will resemble the Airbus-Boeing oligopoly, the functions sector will appear to be sushi, burgers, pizza and on and on.” That’s, the companies offering very particular functions might be quite a few, utilizing very particular data of a sector. When {an electrical} contractor needs sooner turnaround occasions for bids, he’ll flip to an AI product developed with intimate data of that individual area of interest: estimating prices {of electrical} installations. That program won’t assist to the automotive supplier making an attempt to spice up the service division’s gross sales, however another app will. Nevertheless, these software suppliers might use the identical LLM because the engine behind the scene.

As for inventory valuation, contemplate that Amazon inventory reached a excessive in 1999. Two years later, the inventory had dropped 95%. It turned out, although, that purchasing on the 1999 excessive wasn’t so silly. The inventory is now price 52 occasions that outdated 1999 peak. A comparable funding within the Commonplace & Poor’s 500 index would, with dividends reinvested, be price about than eight occasions the quantity invested.

The Amazon story is effective not just for its eventual financial worth, however due to the wild trip alongside the best way. The inventory has had loads of setbacks alongside its journey. And traders ought to keep in mind that many dot-com investments grew to become nugatory.

Is the AI trade in a bubble? I actually don’t know. Each particular person inventory within the sector is fairly dangerous at present costs, however some will show to be price right now’s value and extra. Many investments might be whole losses. Nevertheless, the proof is powerful that AI might be an enormous drive within the enterprise world for years to return.

Leave a Reply