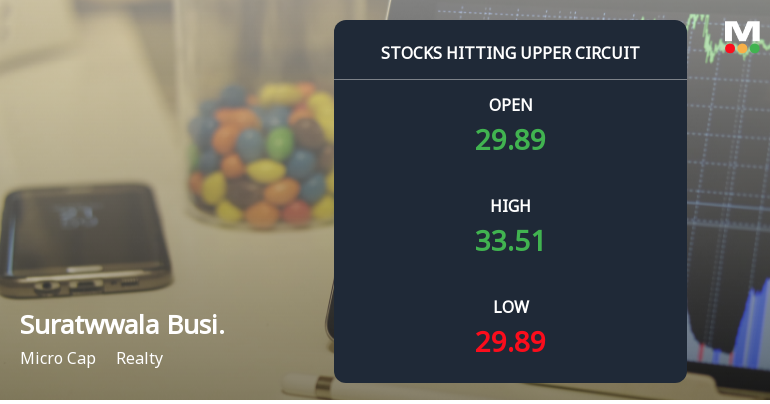

Intraday Value Motion and Volatility

On the buying and selling day, Suratwwala Enterprise Group’s fairness shares traded inside a large value band of ₹29.36 to ₹35.23, marking an intraday volatility of 11.77%. The inventory closed at ₹30.56, reflecting a day change of 6.13% and outperforming the Realty sector’s 0.16% achieve in addition to the Sensex’s decline of 0.27%. This efficiency underscores the inventory’s distinct momentum relative to its friends and the broader market.

The weighted common value for the day was nearer to the decrease finish of the vary, indicating that whereas the inventory touched its higher circuit, a major quantity of trades occurred close to the lower cost ranges. Whole traded quantity stood at roughly 1.115 lakh shares, with a turnover of ₹0.35 crore, signalling lively participation but additionally a level of value discovery all through the session.

Market Capitalisation and Liquidity Context

Suratwwala Enterprise Group is assessed as a micro-cap firm with a market capitalisation of ₹529 crore. Regardless of its comparatively modest dimension, the inventory demonstrated enough liquidity, with buying and selling volumes supporting sizeable commerce sizes with out extreme value influence. The liquidity evaluation, primarily based on 2% of the five-day common traded worth, confirms the inventory’s capability to soak up trades of significant dimension.

Technical Indicators and Shifting Averages

From a technical standpoint, the inventory’s final traded value was above its five-day shifting common, signalling short-term power. Nevertheless, it remained beneath its 20-day, 50-day, 100-day, and 200-day shifting averages, suggesting that the latest rally has but to translate right into a sustained medium- to long-term uptrend. This positioning might point out that the inventory is in an early part of restoration or consolidation inside a broader downtrend.

Investor Participation and Supply Volumes

Notably, supply volumes on 9 Dec 2025 had been recorded at 25,600 shares, representing a decline of 53.46% in comparison with the five-day common supply quantity. This drop in investor participation by supply trades might mirror cautious sentiment amongst long-term holders or profit-booking by some individuals. The distinction between sturdy intraday value positive factors and falling supply volumes highlights a dynamic the place short-term speculative curiosity is driving the value motion greater than sustained accumulation.

Higher Circuit Set off and Regulatory Freeze

The inventory’s value motion triggered the higher circuit restrict of ₹35.23, representing a 20% cap on the day’s value rise. This regulatory mechanism is designed to curb extreme volatility and speculative buying and selling. As soon as the higher circuit is hit, buying and selling within the inventory is topic to a freeze, stopping additional value advances for the rest of the session. This freeze displays the market’s recognition of sturdy demand that would not be totally matched by provide, leading to unfilled purchase orders.

The presence of unfilled demand on the higher circuit degree signifies that patrons had been keen to transact at costs past the regulatory cap however had been unable to search out sellers at these ranges. This imbalance typically alerts bullish sentiment and generally is a precursor to continued curiosity in subsequent periods, offered market circumstances stay beneficial.

Comparative Efficiency and Sector Context

Suratwwala Enterprise Group’s outperformance relative to the Realty sector and the Sensex is notable. Whereas the sector recorded a marginal achieve of 0.16%, the inventory’s intraday return of 5.18% and general day change of 6.13% spotlight its distinct momentum. This divergence could also be attributed to company-specific developments or shifts in investor notion concerning its valuation and prospects.

Nevertheless, the inventory’s micro-cap standing and comparatively low market capitalisation indicate that it could be extra inclined to volatility and liquidity constraints in comparison with bigger friends. Buyers ought to weigh these elements rigorously when contemplating publicity to such shares inside the realty sector.

Outlook and Market Evaluation

Latest buying and selling exercise in Suratwwala Enterprise Group displays a shift in market evaluation, with elevated shopping for curiosity driving the inventory to its higher circuit. Whereas the short-term value motion is encouraging, the inventory’s place beneath key shifting averages and declining supply volumes recommend that traders stay cautious concerning the sustainability of the rally.

Market individuals might search for affirmation by sustained quantity help and a break above longer-term shifting averages earlier than contemplating the inventory as coming into a extra steady uptrend. Moreover, monitoring sector tendencies and broader market circumstances will likely be important to contextualise the inventory’s efficiency inside the realty business panorama.

Investor Issues

Buyers analysing Suratwwala Enterprise Group ought to contemplate the inventory’s micro-cap nature, which frequently entails increased volatility and decrease liquidity in comparison with bigger corporations. The latest higher circuit occasion highlights sturdy speculative curiosity but additionally underscores the significance of regulatory mechanisms in moderating value swings.

Given the inventory’s present technical positioning and buying and selling patterns, a cautious strategy could also be warranted. Monitoring supply volumes, value motion relative to shifting averages, and sector developments will present useful insights into the inventory’s potential trajectory.

Abstract

Suratwwala Enterprise Group’s buying and selling session on 10 Dec 2025 was marked by vital shopping for strain that propelled the inventory to its higher circuit restrict, attaining a most intraday achieve of practically 20%. The inventory outperformed its sector and benchmark indices regardless of a decline in supply volumes, reflecting a posh interaction of speculative demand and cautious investor participation. Regulatory buying and selling freezes following the higher circuit hit prevented additional value escalation, leaving unfilled demand as a key function of the session.

Whereas the short-term momentum is obvious, the inventory’s place beneath key shifting averages and micro-cap standing recommend that traders ought to rigorously consider the sustainability of this rally inside the broader realty sector context.

Solely ₹14,999 – Get MojoOne + Inventory of the Week for two Years PLUS 6 Months FREE Declare 83% OFF →

Leave a Reply