Sturdy Momentum Drives Stock to New Heights

The stock of Saptak Chem & Enterprise has demonstrated sustained upward movement, registering good factors for 21 consecutive shopping for and promoting lessons. Over this period, the stock has delivered a return of fifty.77%, reflecting robust momentum that has propelled it to its current peak price. This rally stands out notably when compared with the broader market, with the Sensex shopping for and promoting lower by 0.51% instantly at 84,665.25 elements, down 359.82 elements from the open.

Together with outperforming the Sensex, Saptak Chem & Enterprise has moreover outpaced its sector mates, registering a day-on-day effectivity that is 1.62% stronger than the Shopping for and promoting & Distributors sector frequent. This relative vitality highlights the stock’s resilience amid a market ambiance the place small caps are most important, with the BSE Small Cap index gaining 0.83% instantly.

Technical Indicators Help Uptrend

Technical analysis reveals that Saptak Chem & Enterprise is shopping for and promoting above all key shifting averages, along with the 5-day, 20-day, 50-day, 100-day, and 200-day averages. This alignment of shifting averages is often interpreted as a bullish signal, indicating that the stock’s price growth is supported by fixed purchasing for curiosity over quite a few time frames.

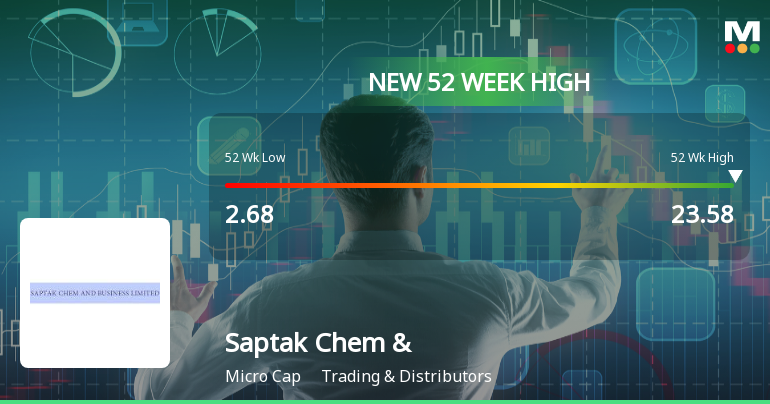

The stock’s 52-week low stands at Rs.2.68, underscoring the dimensions of the rally it has expert over the earlier 12 months. The current market capitalisation grade of 4 shows its standing contained in the market, whereas the stock’s effectivity over the previous 12 months has been excellent, with a obtain of 394.34% compared with the Sensex’s 3.87% over the similar interval.

Market Context and Sector Effectivity

Whereas Saptak Chem & Enterprise has been advancing steadily, the broader market has confirmed blended indicators. The Sensex stays close to its private 52-week extreme of 86,159.02, in the intervening time about 1.76% beneath that peak. The index is shopping for and promoting above its 50-day shifting frequent, which itself is positioned above the 200-day shifting frequent, suggesting a sometimes optimistic medium-term growth for the market.

Inside this ambiance, small-cap shares have taken the lead, with the BSE Small Cap index posting good factors instantly. Saptak Chem & Enterprise, categorized contained in the Shopping for and promoting & Distributors sector, has capitalised on this growth, outperforming every its sector and the broader small-cap part.

Worth Effectivity and Historic Perspective

The stock’s journey from a 52-week low of Rs.2.68 to the current extreme of Rs.23.58 represents a substantial appreciation in price. This effectivity over the previous 12 months places Saptak Chem & Enterprise among the many many excessive performers in its class, with a return that dwarfs the Sensex’s modest 3.87% obtain over the similar timeframe.

Such a trajectory signifies sturdy underlying components supporting the stock’s price movement, along with sustained purchasing for curiosity and optimistic market sentiment inside its sector. The stock’s capability to maintain up its place above all most important shifting averages further reinforces the vitality of this uptrend.

Summary of Key Metrics

Saptak Chem & Enterprise’s current market capitalisation grade of 4 places it inside an affordable range relative to its mates. The stock’s day change of 1.99% instantly offers to the optimistic momentum that has been establishing over the earlier three weeks. Its fixed good factors over 21 lessons and the substantial 50.77% return all through this period highlight the stock’s sturdy effectivity trajectory.

Shopping for and promoting properly above all most important shifting averages, the stock’s technical indicators align with its newest price movement, suggesting that the current growth is properly supported by market dynamics.

Conclusion

Saptak Chem & Enterprise’s achievement of a model new 52-week extreme at Rs.23.58 marks a giant milestone in its market journey. The stock’s sustained good factors over the earlier 21 lessons, blended with its outperformance relative to every the sector and broader market indices, underscore a interval of notable vitality. Supported by optimistic technical indicators and a strong year-on-year return, the stock’s current place shows a bit of robust momentum contained in the Shopping for and promoting & Distributors sector.

Restricted Time Solely! Enhance now and get 1 12 months of Stock of the week worth Rs. 14,999 for FREE. Don’t miss out on this distinctive present. Declare Your Free 12 months →

Leave a Reply