It is that time of the year when you can review your finances. The year gone by was led by factors around a challenging global environment disrupted by trade disputes and wars. Amidst that, India’s growth is like an oasis. While foreigners may not fancy Indian equities for now, they still hold a sizeable chunk of India’s market capitalisation. The most prominent supporters of the India story are now Indian investors. They own a fifth of Indian shares, directly and indirectly (through mutual funds). The story of Indian savers becoming investors is set to enter a new chapter over the next five years.

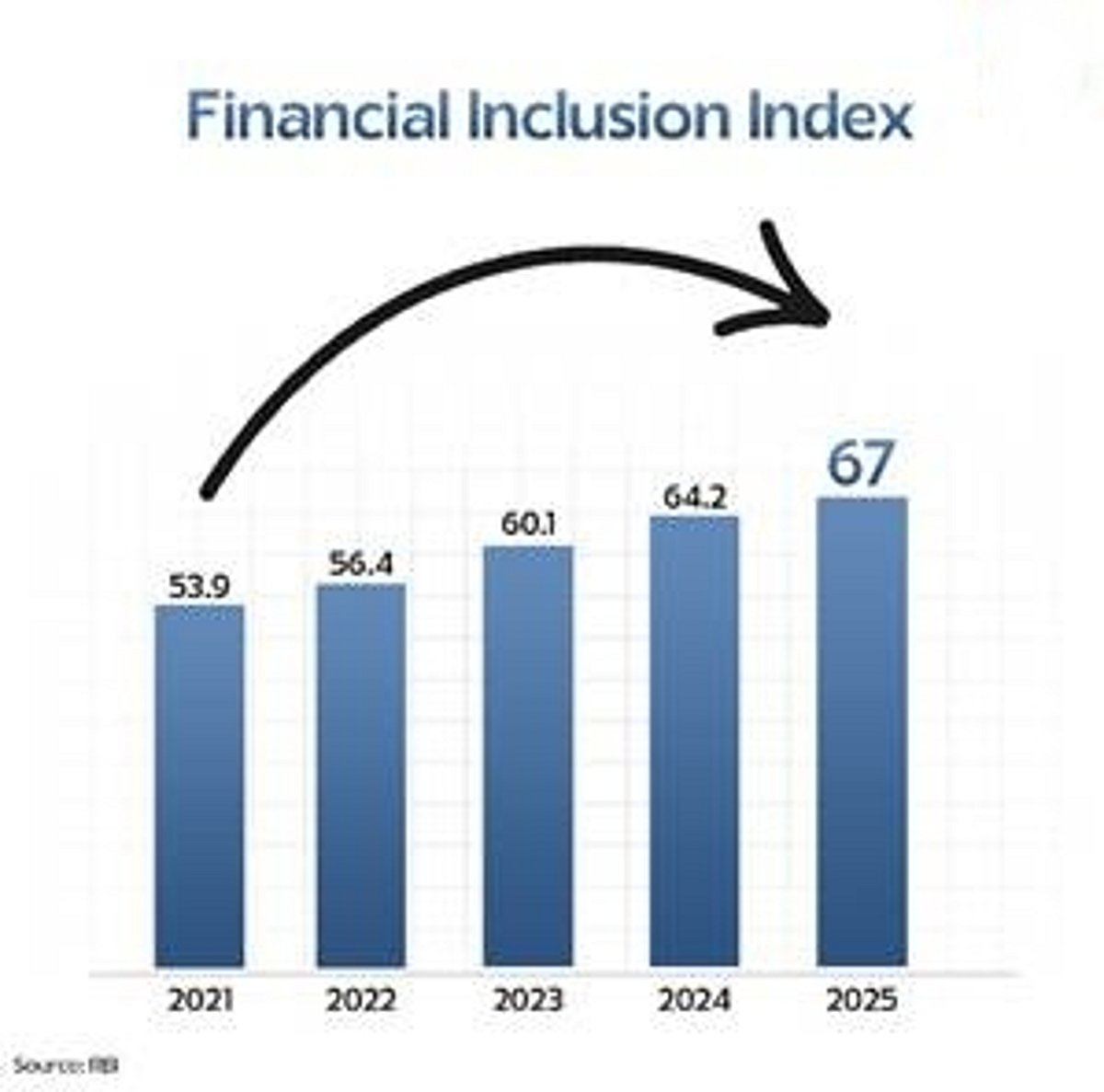

The Reserve Bank of India last week dropped a new financial inclusion roadmap in a document titled ‘National Strategy for Financial Inclusion 2025-30’. It is not just for bankers but also for the future of your money, savings, borrowings and investments.

Banking standards

The RBI study shows that India has moved the needle significantly on banking services. From ‘everyone needs a bank account’ to ‘everyone deserves good service’. With the introduction of Jan Dhan accounts and the support of Aadhaar and mobile connectivity, it is a finish line. However, the focus is now on service quality. The idea is to ensure that you use your bank account effectively for your needs. The survey finds that the last-mile banking is reliably done through better-trained business correspondents. Onboarding is faster than before, thanks to the ‘know your customer’ video process. Digital payment experiences are getting better, the survey finds. In the future, your everyday money tasks should get easier and more consistent, no matter where you live.

There is also a strong push for the financial inclusion of women. The survey finds that only 15% of business correspondents are women. The RBI aims to double that number over the next five years. It is encouraging companies across mutual funds, insurance, non-banking finance, and banking to create tailored products for women and vulnerable households. If women have better financial access, families have better financial security. The survey calls it ‘inclusion with teeth.’

Digital Payments

The RBI study puts an ambitious target of one billion digital payment users by 2029. To improve your confidence in the digital payments system, the RBI is working on efficient complaint systems that can be filed with a single tap on your mobile device. It aims to accelerate the blocking of fraudulent transactions through a national fraud-intelligence system. RBI is insisting that app makers create a clean, scam-resistant user interface by avoiding dark patterns. The central bank is also looking to expand the scope of UPI Lite, UPI Lite X, and programmable central bank digital currency (e-rupee) over the next five years.

Financial literacy dives deeper.

Over the next five years, RBI will create financial literacy programmes based on behaviour and personal learning, the study said. There will be separate modules for cohorts such as students, seniors, migrants, gig workers, and small and medium enterprises. The learning will be largely scenario-based and practical. There will be a decisive shift in the literacy programmes from explaining what financial products are to how to use them. The study highlights the importance of inculcating good money habits with an emphasis on education on scams, digital hygiene and debt management.

Safety nets

Another critical aspect of the RBI’s next five-year plan is strengthening safety nets, including insurance, pensions, and emergency credit. The RBI study highlights that building your financial resilience will be the focus. Your ability to handle shocks such as job loss, medical emergencies, or accidents would be considered. RBI plans make enrolment and claim processes easier for insurance schemes. It plans to push for affordable pension plans, such as the Atal Pension Yojana. It is also working towards a system to create an emergency overdraft facility for basic bank accounts.

Leave a Reply