Stock Performance and Market Context

On 8 December 2025, Goenka Business & Finance recorded a day change of -4.26%, underperforming its sector by 2.54%. The stock has declined by approximately 7.96% over the last two trading days, continuing its slide below all key moving averages, including the 5-day, 20-day, 50-day, 100-day, and 200-day averages. This sustained weakness contrasts with the broader market, where the Sensex opened flat but later fell by 557.05 points, or 0.75%, closing at 85,067.79. Notably, the Sensex remains close to its 52-week high of 86,159.02, trading above its 50-day and 200-day moving averages, signalling a generally bullish trend for the benchmark index.

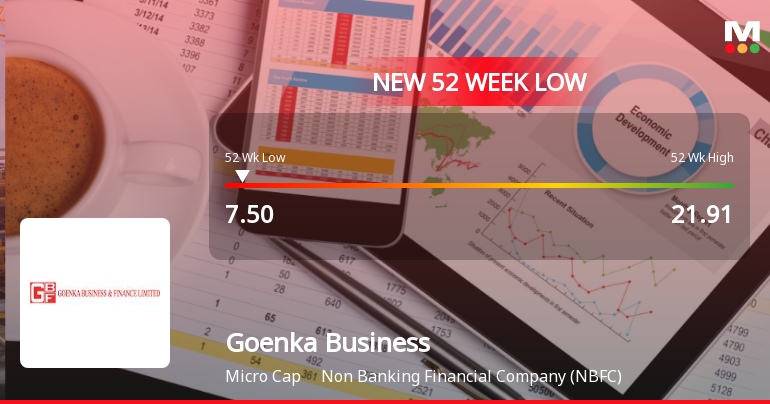

Long-Term Price Trends

Over the past year, Goenka Business & Finance’s stock price has declined by 40.00%, a stark contrast to the Sensex’s 4.11% gain during the same period. The stock’s 52-week high was Rs.21.91, indicating a substantial reduction in market value. This performance places the company among the weaker performers within the Non Banking Financial Company (NBFC) sector, where peers have generally maintained steadier valuations.

Financial Metrics Reflecting Challenges

Goenka Business & Finance’s financial indicators reveal pressures on both growth and profitability. The company’s net sales have contracted at an annual rate of 8.51%, with the latest six-month period showing a decline of 22.97% to Rs.39.26 crores. Profit before tax excluding other income for the most recent quarter stood at a loss of Rs.2.60 crores, representing a fall of 223.0% compared to the previous four-quarter average. Similarly, the net profit after tax for the quarter was a loss of Rs.1.97 crores, down by 2526.7% relative to the prior four-quarter average.

Return on Equity and Valuation

The company’s return on equity (ROE) has been subdued, averaging 3.61% over the long term and registering a negative 9.9% in the latest period. This has contributed to a valuation characterised by a price-to-book value of 0.4, which, while appearing low, is considered expensive when viewed in the context of the company’s earnings performance. Relative to its peers, Goenka Business & Finance’s valuation aligns with historical averages but does not reflect a premium justified by growth or profitability metrics.

Recent Quarterly Results and Trends

Goenka Business & Finance has reported negative results for four consecutive quarters, underscoring persistent difficulties in reversing its earnings trajectory. The decline in profits over the past year has been significant, with a reduction of 219.6% recorded. This downward trend has also been mirrored in the stock’s returns, which have underperformed the BSE500 index over one year, three years, and the last three months.

Shareholding Pattern and Market Position

The majority of the company’s shares are held by non-institutional investors, which may influence liquidity and trading dynamics. Operating within the NBFC sector, Goenka Business & Finance faces competitive pressures and sector-specific challenges that have contributed to its current market position.

Summary of Market and Stock Dynamics

While the broader market, as represented by the Sensex, remains near its yearly highs and maintains a generally positive technical stance, Goenka Business & Finance’s stock continues to face downward pressure. The stock’s position below all major moving averages indicates a lack of short- to medium-term momentum. The recent 52-week low of Rs.7.5 highlights the extent of the decline from its peak of Rs.21.91 within the last year.

Comparative Sector Performance

Within the NBFC sector, Goenka Business & Finance’s performance contrasts with peers that have maintained more stable sales growth and profitability. The company’s contraction in net sales and persistent losses over multiple quarters have contributed to its relative underperformance. This has been reflected in the stock’s returns, which have lagged behind broader market indices and sector benchmarks.

Technical Indicators and Trading Patterns

The stock’s trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages suggests a sustained bearish trend. This technical positioning often signals caution among market participants and may influence trading volumes and price volatility in the near term.

Conclusion

Goenka Business & Finance’s fall to a 52-week low of Rs.7.5 marks a significant milestone in its recent market journey. The combination of declining sales, consecutive quarterly losses, subdued return on equity, and valuation considerations have contributed to the stock’s current position. While the broader market environment remains relatively positive, the company’s financial and market indicators reflect ongoing challenges within its sector and business model.

Get 1 year of Weekly Picks FREE when you subscribe to MojoOne. Offer ends soon. Start Saving Now →

Leave a Reply