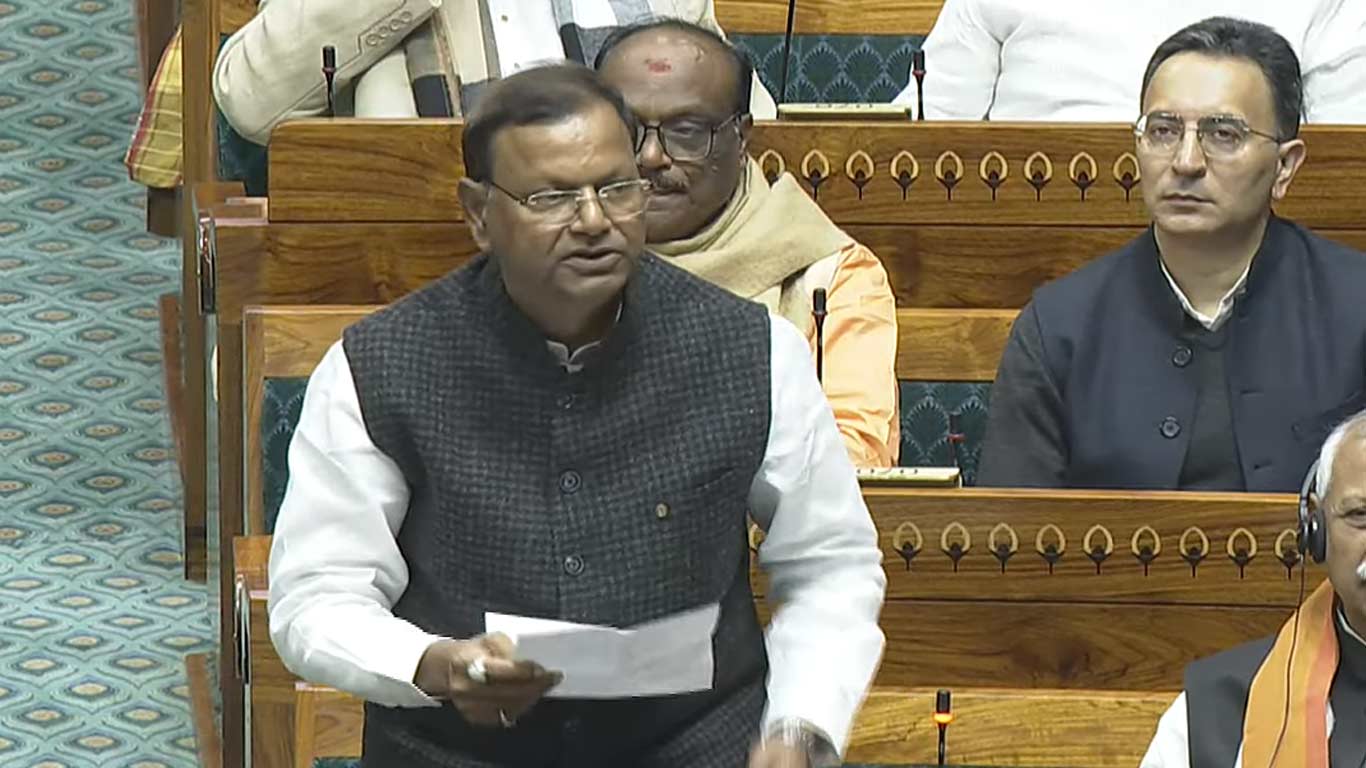

New Delhi, Dec 8 (KNN) Minister of State for Finance Pankaj Chaudhary on Monday detailed export credit availability and initiatives to ease trade finance constraints for MSME exporters.

Regulatory Measures

In a written reply to a question in Lok Sabha, the Minister said that the Reserve Bank of India (RBI) has introduced several measures, including collateral-free lending for loans up to Rs 10 lakh, relaxed capital requirements, and mandatory external benchmark–linked interest rates to enhance transparency.

In November 2025, RBI issued the Trade Relief Measures, 2025, providing exporters with deferred repayments, extended timelines for realisation of export proceeds, and greater flexibility in liquidating packing credit.

Export Credit Disbursement

The MoS Finance noted that banks and financial institutions remain the primary providers of export finance. Public sector banks, SIDBI, and EXIM Bank collectively disbursed Rs 21.71 lakh crore in export credit between FY 2020–21 and FY 2024–25.

Export Promotion Mission & Risk Mitigation

The Minister said that while no sovereign-backed export guarantee facility is currently proposed, the Export Promotion Mission (EPM) 2025–31 incorporates targeted risk-mitigation under the NIRYAT PROTSAHAN sub-scheme.

Measures in the scheme include partial credit-risk coverage for exporters lacking collateral and credit-enhancement support for MSMEs accessing emerging or underserved global markets.

Alongside NIRYAT DISHA, these initiatives are aimed at strengthening overall export competitiveness, particularly for high-risk MSME exporters.

(KNN Bureau)

Leave a Reply