Synopsis: As it grows offline and pushes premiumization, Wakefit’s IPO questions whether its tech-led, multi-category, full-stack strategy can scale more quickly than established competitors like Sleepwell.

There is a lot of interest in Wakefit’s IPO. Although the company began with mattresses, it currently offers a wide range of home goods. The key question is whether Wakefit’s innovative strategy will enable it to expand more quickly than more traditional, well-known businesses.

About the IPO

Wakefit Innovations’ Rs 1,288.89-crore book-built IPO blends growth funding with shareholder exits. The fresh issue of Rs 377.18 crore will aid expansion, while the Rs 911.71-crore OFS allows early investors to partially monetise stakes. The issue reflects confidence in demand for branded, value-focused home and sleep solutions.

The IPO objectives clearly show Wakefit’s aggressive offline expansion push. A major chunk is being spent on opening 117 new COCO stores and supporting rentals of existing outlets, signalling a retail-led growth strategy. Strong allocation to marketing strengthens brand visibility, while machinery investment and general corporate use support long-term scalability and operational stability.

Wakefit Innovations has built a strong D2C brand in India by offering affordable, high-quality sleep and home solutions. Its early success with memory foam mattresses disrupted traditional pricing by cutting out intermediaries and focusing on online-first distribution.

Over the years, the company has smartly expanded beyond mattresses into furniture and furnishings, covering products like sofas, beds, wardrobes, and study tables. This wider portfolio allows it to address the complete home requirements of modern, value-conscious Indian consumers.

Wakefit’s digital-led model is now supported by a growing offline presence. With sales across 700 districts and 125 stores in 62 cities, the brand blends online reach with physical experience, strengthening trust, visibility, and last-mile customer engagement.

Beyond the IPO figures, however, what really counts is whether Wakefit’s model can scale differently from its traditional competitors. This is where the company’s full-stack structure becomes its greatest advantage.

Overview of the Indian mattress industry

The mattress market in India is currently valued at Rs 145–Rs 160 billion and is expanding by 10-12 percent annually. It might hit Rs 270–Rs 300 billion by 2030. The majority of mattresses are still made of cotton, but as consumers choose foam, latex, and orthopedic choices, their market share is declining. The fastest-growing type of mattress is foam.

Urban lifestyles, increased health consciousness, and consumers’ need for improved sleep products, particularly in Tier-2 cities, are the main drivers of this expansion. New orthopedic and hybrid designs are being introduced by major brands and D2C players. Online sales are rapidly increasing due to increased awareness and convenient financing alternatives, even if the majority of consumers still prefer to purchase mattresses offline so they may try them in person.

What makes Wakefit different than its competitors?

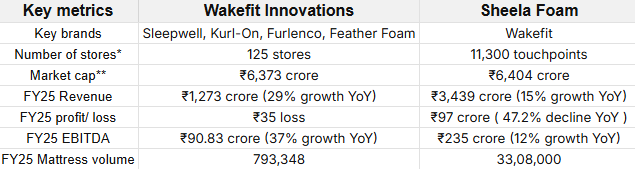

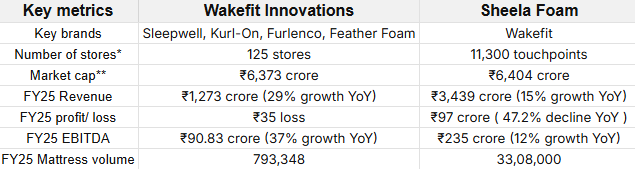

Wakefit today stands out in the home and sleep solutions market because it operates very differently from traditional mattress manufacturers. In a recent discussion, the management highlighted how this integrated structure differentiates Wakefit from peers: while mattresses still contribute around 60 percent of revenue, the furnishing category already accounts for 30 percent and is accelerating quickly.

This shift is supported by strong premiumisation; 30 percent of Wakefit’s total portfolio is now in the premium segment, improving margins and strengthening the brand’s position in urban, higher-income households.

Wakefit plans to open 35–40 stores every year, all company-owned, allowing full control over experience, pricing and brand messaging. These stores act as both conversion hubs and discovery centres, reinforcing the digital-first brand with physical touchpoints.

What makes Wakefit fundamentally different is that its growth is powered by consumer insights and technology, not merely by increasing production capacity. The company captures feedback, browsing behaviour, and repeat purchase patterns across millions of orders, and uses this data to refine product design, pricing and marketing. Its offline strategy also reflects a modern consumer approach rather than a legacy dealer-led network.

The model itself is what really distinguishes Wakefit from a traditional player like Sheela Foam. Due to its extensive distributor-dealer network, Sheela Foam is still mostly a single-category mattress producer, which limits the depth and speed of insights compared to a direct model like Wakefit’s.

Wakefit, on the other hand, has full-stack control over several home categories and owns the entire client relationship from beginning to end. It collects real-time data from each purchase, return, and browsing experience—something that a dealer-led system just cannot offer—and utilizes these insights to inform pricing, items, and store strategy.

Wakefit’s structure is built for speed, premiumization, and cross-selling throughout the whole home ecosystem, whereas Sheela Foam’s approach is optimized for stability. Wakefit has a fundamentally different and more scalable growth path than its traditional competition, thanks to its ability to combine manufacturing, technology, brand, and owned retail.

Sheela Foam’s strengths and blind spots are its exclusive brand stores and over 7,800 multi-brand dealers. Every transaction is mediated by intermediaries. They are aware of the quantity of mattresses sold, but they are unaware of the buyers, their needs, or the reasons for the returns. Instead of focusing on the client, they are optimizing for dealer margins.

Wakefit, on the other hand, sees everything. Wakefit is aware that a buyer may browse a mattress at two in the morning, add a bed frame to their cart, abandon checkout, and then purchase a pillow protector three days later. They doubled recommendation engine income in a quarter and increased mattress protector sales by 70 percent in 30 days using this precise behavioral data.

In conclusion, Wakefit’s IPO is more about whether a digital-first, multi-category, insight-driven company will overtake established competitors like Sleepwell than it is about mattresses. It has a radically different trajectory from legacy manufacturers because its approach is obviously designed for speed, premiumization, and cross-category expansion. Wakefit has the potential to become the next major consumer story in India’s home solutions industry if it can carry out its offline scale-up without compromising profitability or customer experience.

Written by Satyajeet Mukherjee

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.

Leave a Reply