Stock Price Movement and Market Context

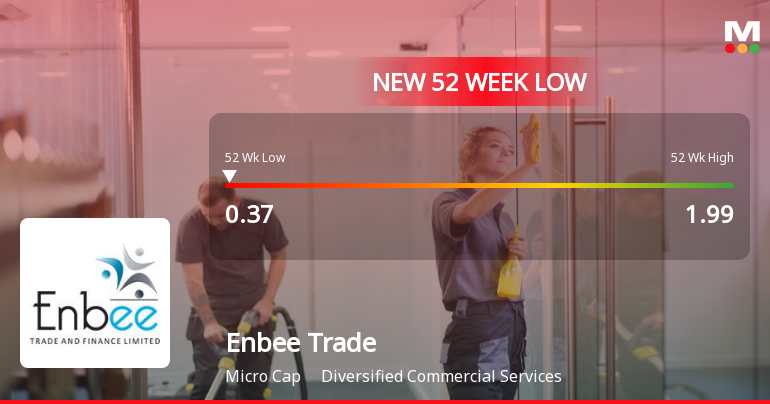

On 8 December 2025, Enbee Trade & Finance’s share price touched Rs.0.37, representing its lowest level in the past year and an all-time low. This price point is notably below the stock’s 52-week high of Rs.1.99, indicating a substantial reduction in market value over the period. The stock underperformed its sector by 3.31% on the day, with a daily decline of 2.50%. Furthermore, the share price is trading below all key moving averages, including the 5-day, 20-day, 50-day, 100-day, and 200-day averages, signalling sustained downward momentum.

The broader market environment also reflected some pressure, with the Sensex opening flat but eventually declining by 602.88 points, or 0.81%, to close at 85,021.96. Despite this, the Sensex remains relatively close to its 52-week high of 86,159.02, trading 1.34% below that peak and maintaining a position above its 50-day moving average, which itself is above the 200-day moving average, indicating a generally bullish trend for the benchmark index.

Comparative Performance Over One Year

Over the last twelve months, Enbee Trade & Finance’s stock price has shown a decline of 71.47%, contrasting with the Sensex’s positive return of 4.05% over the same period. This divergence highlights the stock’s relative weakness compared to the broader market. The stock’s 52-week high of Rs.1.99 stands in stark contrast to the current price, underscoring the extent of the price contraction.

Financial Metrics and Valuation

Enbee Trade & Finance’s financial data presents a mixed picture. The company reported net sales of Rs.14.82 crores over the latest six-month period, reflecting a growth rate of 78.13%. Net profit also showed a rise of 78.57%, with the company declaring positive results for six consecutive quarters. The profit before tax excluding other income (PBT less OI) for the quarter stood at Rs.3.58 crores, growing by 52.34%, while profit before depreciation, interest, and tax (PBDIT) reached a quarterly high of Rs.4.99 crores.

Despite these positive earnings trends, the stock’s valuation remains modest. The price-to-book value ratio is approximately 0.3, indicating that the stock is trading at a discount relative to its book value. The return on equity (ROE) averaged 9.16%, which is considered moderate within the sector. This valuation level is lower than the historical averages of its peers, suggesting a cautious market stance towards the stock.

Promoter Shareholding Trends

Promoter confidence appears to have shifted, with a reduction in their stake by 1.73% over the previous quarter. Currently, promoters hold 8.6% of the company’s shares. Such a decrease in promoter holding may be interpreted as a signal of changing perspectives on the company’s near-term prospects.

Sectoral and Market Positioning

Operating within the diversified commercial services industry, Enbee Trade & Finance faces competition from peers that have generally maintained steadier valuations. The sector itself has experienced varied performance, with some companies benefiting from broader economic trends while others have encountered headwinds. Enbee Trade & Finance’s current market capitalisation grade is relatively low, reflecting its micro-cap status and the challenges associated with liquidity and investor attention.

Summary of Recent Performance and Market Standing

While Enbee Trade & Finance has demonstrated growth in net sales and profits over recent quarters, its share price trajectory has not mirrored these operational results. The stock’s decline to Rs.0.37, its lowest in a year, reflects a complex interplay of market sentiment, valuation considerations, and promoter shareholding adjustments. The stock’s position below all major moving averages further indicates prevailing downward pressure in the short to medium term.

In contrast, the Sensex’s relative strength and proximity to its 52-week high highlight a divergence between the broader market and this particular stock. Investors and market participants may note the company’s ongoing earnings growth alongside the subdued market valuation, which remains discounted compared to sector peers.

Conclusion

Enbee Trade & Finance’s fall to a 52-week low of Rs.0.37 marks a significant milestone in its recent market journey. The stock’s performance over the past year, combined with promoter stake reduction and valuation metrics, paints a nuanced picture of the company’s current standing within the diversified commercial services sector. While financial results have shown positive trends, the market’s response has been cautious, as reflected in the stock’s price and trading patterns.

Market participants observing Enbee Trade & Finance will note the contrast between operational earnings growth and share price performance, underscoring the multifaceted factors influencing stock valuations in the current environment.

Get 1 year of Weekly Picks FREE when you subscribe to MojoOne. Offer ends soon. Start Saving Now →

Leave a Reply