Intraday Price Movement and Volatility

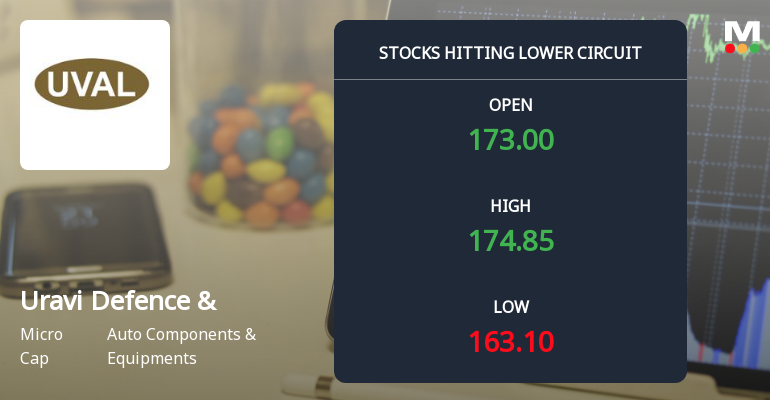

On the trading day, Uravi Defence & Technology opened with a gap up, initially rising by 2.46% to touch an intraday high of ₹172. However, this early optimism was short-lived as the stock succumbed to heavy selling pressure, ultimately hitting the lower circuit price band of ₹159.47, a 5.0% decline from the previous close. The stock’s intraday volatility was notably high at 6.41%, underscoring the unsettled market sentiment surrounding the company’s shares.

The weighted average price for the day was closer to the low price, indicating that the bulk of trading volume occurred near the lower end of the price range. Total traded volume was recorded at 42,790 shares, with a turnover of approximately ₹0.07 crore, reflecting relatively modest liquidity given the stock’s micro-cap status and market capitalisation of ₹189 crore.

Extended Downtrend and Market Context

Uravi Defence & Technology’s share price has been on a consistent downward trajectory, registering losses for eleven consecutive sessions. Over this period, the stock has declined by 19.57%, underperforming its sector peers and broader market indices. On the day in question, the stock’s 1-day return of -5.00% contrasted with the Auto Components & Equipments sector’s decline of -1.68% and the Sensex’s fall of -1.05%, highlighting the stock’s relative weakness.

Technical indicators also point to a bearish trend, with the stock trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages. This persistent weakness suggests that investor confidence remains subdued, and the stock is struggling to find support amid broader market pressures.

Investor Participation and Liquidity Concerns

Investor participation has shown signs of waning interest, as evidenced by a sharp decline in delivery volume. On 5 December, the delivery volume was recorded at 2,560 shares, representing a 73.01% drop compared to the five-day average delivery volume. This reduction in long-term investor engagement may be contributing to the stock’s heightened volatility and susceptibility to sharp price movements.

Despite the micro-cap nature of Uravi Defence & Technology, the stock maintains sufficient liquidity for trading sizes up to ₹0 crore based on 2% of the five-day average traded value. However, the relatively low turnover and volume figures suggest that large trades could face challenges in execution without impacting the price significantly.

Sector and Industry Performance Comparison

The Auto Components & Equipments sector, to which Uravi Defence & Technology belongs, has experienced a modest decline on the day, with a sector return of -1.68%. This contrasts with the stock’s sharper fall, indicating company-specific factors may be influencing investor sentiment more than broader sector trends. The Sensex’s 1.05% decline further contextualises the market environment, which has been generally cautious but not as severe as the stock’s performance.

Uravi Defence & Technology’s market capitalisation of ₹189 crore places it firmly in the micro-cap category, which often entails higher volatility and sensitivity to market news or internal developments. The stock’s price band of ₹5 and the maximum daily loss of 5.0% reflect regulatory mechanisms designed to curb excessive volatility, which were triggered due to the intense selling pressure.

Supply-Demand Imbalance and Panic Selling

The stock’s fall to the lower circuit limit is indicative of an unfilled supply of shares, where selling interest outstrips buying demand to such an extent that the price cannot fall further within the day’s permissible range. This scenario often points to panic selling or a rush to exit positions, which can be triggered by negative news, disappointing financial results, or broader market fears.

In Uravi Defence & Technology’s case, the persistent decline over multiple sessions and the sharp intraday reversal from a positive open to a lower circuit close suggest that sellers dominated trading throughout the day. The lack of sufficient buyers to absorb the selling pressure resulted in the stock hitting the maximum permissible loss limit, effectively halting further price declines for the session.

Outlook and Investor Considerations

Given the current trading pattern and technical indicators, Uravi Defence & Technology faces significant headwinds in the near term. The stock’s inability to sustain gains, coupled with falling investor participation and persistent selling pressure, suggests that caution is warranted. Investors should closely monitor volume trends and price action for signs of stabilisation or reversal before considering new positions.

Furthermore, the stock’s micro-cap status and relatively low liquidity imply that price movements can be amplified by comparatively small trades, increasing risk for investors. Market participants may also wish to compare Uravi Defence & Technology’s fundamentals and valuation metrics with other companies in the Auto Components & Equipments sector to identify potentially more stable or promising opportunities.

In summary, Uravi Defence & Technology’s recent trading activity highlights the challenges faced by smaller companies in volatile market conditions, where heavy selling pressure can quickly push prices to regulatory limits. The stock’s new 52-week low and extended downtrend underscore the need for careful analysis and risk management in this segment of the market.

Get 1 year of Weekly Picks FREE when you subscribe to MojoOne. Offer ends soon. Start Saving Now →

Leave a Reply