Intraday Movement and Price Pressure

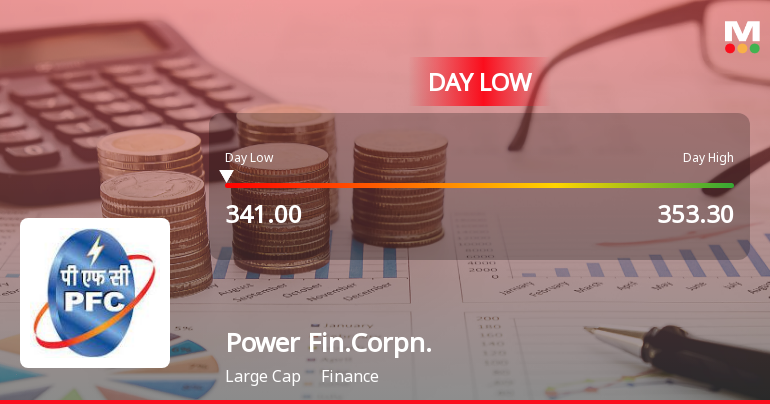

On 8 December 2025, Power Finance Corporation’s share price reached a low of Rs 341.7, reflecting a drop of 3.12% from the previous close. This intraday low marks a fresh 52-week low for the stock, signalling a continuation of recent downward momentum. The stock’s performance today lagged behind its sector peers, underperforming the finance sector by approximately 1.4%.

The decline follows two consecutive days of gains, indicating a reversal in short-term trend. The stock is currently trading below all key moving averages, including the 5-day, 20-day, 50-day, 100-day, and 200-day averages, which suggests sustained selling pressure and a cautious market stance towards the stock.

Market Context and Sector Comparison

The broader market, represented by the Sensex, opened flat but moved into negative territory as the session progressed. The Sensex fell by 651.23 points, or 0.86%, closing at 84,973.61. Despite this decline, the Sensex remains close to its 52-week high of 86,159.02, trading just 1.4% below that peak. The index continues to hold above its 50-day moving average, which itself is positioned above the 200-day moving average, reflecting an overall bullish trend in the broader market.

In contrast, Power Finance Corporation’s share price movement today was more pronounced, with a 3.10% decline compared to the Sensex’s 0.90% fall. This divergence highlights the stock’s relative weakness amid a market that, while retreating, remains in a generally positive technical position.

Performance Trends Over Various Timeframes

Examining Power Finance Corporation’s price trajectory over recent periods reveals a pattern of underperformance relative to the Sensex. Over the past week, the stock has declined by 5.31%, while the Sensex has fallen by 0.81%. The one-month view shows a 10.17% reduction in the stock price, contrasting with a 2.08% gain in the Sensex.

Extending the horizon further, the stock’s three-month performance registers a 13.46% decline, whereas the Sensex has appreciated by 5.15%. The one-year comparison is more pronounced, with Power Finance Corporation’s shares down 33.48% against the Sensex’s 3.96% rise. Year-to-date figures also reflect this trend, with the stock down 23.76% while the Sensex has gained 8.71%.

Despite these recent setbacks, the stock’s longer-term performance remains robust, with gains of 195.53% over three years, 268.27% over five years, and 325.70% over ten years, all surpassing the Sensex’s respective returns of 35.76%, 86.25%, and 235.61%.

Dividend Yield and Valuation Considerations

At the current price level, Power Finance Corporation offers a dividend yield of 4.05%, which is relatively attractive within the finance sector. This yield reflects the company’s ongoing commitment to shareholder returns despite the recent price pressures.

However, the stock’s market capitalisation grade remains at the lower end of the scale, indicating a smaller market cap relative to larger peers in the sector. This factor may contribute to the stock’s sensitivity to market fluctuations and sector-specific developments.

Technical Indicators and Moving Averages

The stock’s position below all major moving averages suggests a prevailing bearish sentiment among traders and investors. The 5-day and 20-day moving averages, often used to gauge short-term momentum, are currently above the stock price, signalling resistance levels that may be challenging to overcome in the near term.

Similarly, the 50-day, 100-day, and 200-day moving averages, which provide insight into medium- and long-term trends, also lie above the current trading price. This alignment indicates that the stock has been under pressure for an extended period and has yet to establish a recovery pattern.

Market Sentiment and Immediate Pressures

Investor sentiment towards Power Finance Corporation appears cautious amid the broader market’s mixed signals. While the Sensex maintains a technically bullish posture, the stock’s sharper decline and failure to hold recent gains suggest that immediate pressures are weighing on its price action.

Factors contributing to this sentiment may include sector-specific developments and the stock’s relative underperformance compared to the benchmark index. The divergence between the stock’s trajectory and the Sensex’s overall trend highlights the challenges faced by Power Finance Corporation in regaining upward momentum.

In addition, the stock’s proximity to its 52-week low may be influencing trading behaviour, with some market participants possibly adopting a cautious stance until clearer signs of recovery emerge.

Summary

Power Finance Corporation’s share price touched an intraday low of Rs 341.7 on 8 December 2025, marking a 3.12% decline and a fresh 52-week low. The stock underperformed both its sector and the broader Sensex index, which itself closed lower but remains near its yearly peak. Trading below all key moving averages, the stock faces immediate technical resistance and a cautious market environment.

While the stock offers a dividend yield of 4.05%, its recent price trends reflect ongoing challenges in regaining positive momentum. The divergence from the Sensex’s overall bullish technical setup underscores the stock’s current vulnerability amid prevailing market conditions.

Get 1 year of Weekly Picks FREE when you subscribe to MojoOne. Offer ends soon. Start Saving Now →

Leave a Reply