Gupta said, “Payments bank cannot do lending… so both from a liability point of view as well as from the lending point of view, it’s a big change for us.” Fino will continue operating as a payments bank until the licence becomes fully operational.

Fino expects lending operations to begin in 12–18 months after restructuring and compliance changes. Gupta said the business is expected to improve profitability as the bank earns lending margins and annuity income.

He said, “The bottom line growth will be exponential once we move to an SFB model.” Fino currently has a low cost of funds at around 2% and total deposits of ₹2,600 crore.

The company plans to strengthen technology and human resources as part of the shift, while focusing on an asset-light small finance bank model that uses its digital distribution network.

The bank will focus on growing deposits first, supported by its distribution and merchant network. Gupta said liabilities could grow four to five times over the next few years.

Also Read | PNB to keep deposit rates steady, sees stronger credit growth in December quarter

Fino plans a credit-deposit ratio of 70–75% as it begins lending. Over the first 3–4 years after full operationalisation, it targets:

- ₹8,000–10,000 crore lending book

- ₹14,000–15,000 crore deposit base

Gupta said the model will be more stable and predictable once the SFB journey takes shape.

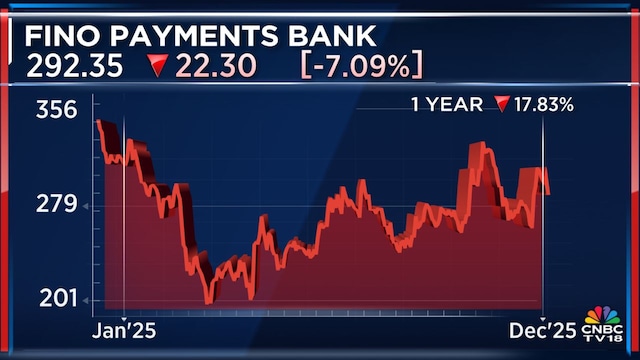

Fino Payments Bank has a market capitalisation of ₹2,434.97 crore, and its shares have declined more than 17% in the past year.

For the full interview, watch the accompanying video

Catch all the latest updates from the stock market here

Leave a Reply