Stock Performance and Market Context

The stock of Mangalam Industrial Finance, a company operating within the Non Banking Financial Company (NBFC) sector, has experienced a notable decline, with returns falling by 35.62% over the last thirteen days. This recent performance contrasts sharply with the broader market, where the Sensex closed at 85,395.97, down by 0.37% or 228.87 points from its previous close. Despite the Sensex trading near its 52-week high of 86,159.02 and maintaining levels above its 50-day and 200-day moving averages, Mangalam Industrial Finance’s shares have been trading below all key moving averages, including the 5-day, 20-day, 50-day, 100-day, and 200-day averages.

The stock’s underperformance today was marked by a decline of 4.08%, which was approximately 4.1% worse than the sector average. This divergence highlights the challenges faced by the company relative to its NBFC peers and the broader market environment.

Long-Term Price Movement and Valuation

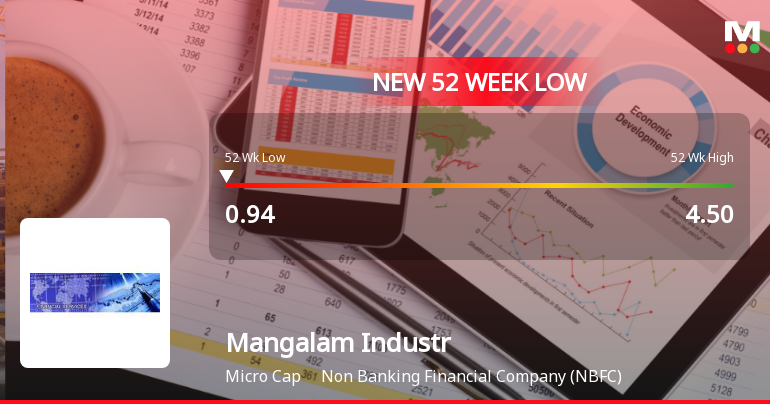

Over the past year, Mangalam Industrial Finance’s stock price has contracted by 73.82%, a stark contrast to the Sensex’s positive return of 4.52% during the same period. The stock’s 52-week high was recorded at Rs.4.50, indicating a substantial reduction in market value over the last twelve months.

Valuation metrics reveal that the company’s price-to-book value stands at 4.7, which is considered high relative to its peers. This elevated valuation comes despite the stock trading at a discount compared to the average historical valuations of similar companies within the sector. The company’s price-to-earnings growth (PEG) ratio is 3.9, reflecting the relationship between its price-to-earnings ratio and earnings growth rate.

Financial Metrics and Profitability

Mangalam Industrial Finance’s financial indicators over recent periods show subdued performance. The company’s average Return on Equity (ROE) is 1.90%, indicating limited profitability relative to shareholder equity. In the most recent quarter, the ROE was recorded at 4.2%, which remains modest in comparison to industry standards.

Net sales have exhibited an annual growth rate of 9.92%, reflecting some expansion in revenue, though this growth rate is relatively moderate for the sector. Quarterly earnings before depreciation, interest, and taxes (PBDIT) stood at Rs.0.31 crore, while profit before tax excluding other income (PBT less OI) was Rs.0.30 crore, both figures representing the lowest levels recorded in recent quarters.

Shareholding and Corporate Developments

Recent disclosures indicate a reduction in promoter shareholding, which now stands at 43.97%. This decrease in promoter stake may be viewed as a factor influencing market sentiment and stock performance.

Sector and Market Comparison

Within the NBFC sector, Mangalam Industrial Finance’s performance contrasts with broader market trends. While the Sensex maintains a bullish stance supported by moving averages, the company’s stock continues to trade below critical technical levels. This divergence underscores the challenges faced by the company in aligning with sectoral momentum.

Summary of Recent Price Action

The stock’s current price of Rs.0.94 represents a significant milestone as it marks the lowest level in the past 52 weeks. This price point is substantially below the stock’s 52-week high of Rs.4.50, reflecting a considerable contraction in market valuation. The continuous decline over thirteen trading sessions highlights a persistent trend that has yet to show signs of reversal.

Despite the broader market’s relative strength, Mangalam Industrial Finance’s share price remains under pressure, trading below all major moving averages. This technical positioning suggests that the stock is currently in a bearish phase, with resistance levels at the 5-day, 20-day, 50-day, 100-day, and 200-day moving averages.

Conclusion

Mangalam Industrial Finance’s stock reaching a 52-week low of Rs.0.94 underscores the challenges faced by the company in recent periods. The combination of subdued profitability metrics, moderate sales growth, and reduced promoter holding has coincided with a sustained decline in share price. While the broader market and sector indices maintain relatively stable or positive trends, the company’s stock continues to reflect a cautious market assessment.

Investors and market participants observing Mangalam Industrial Finance will note the divergence between the company’s performance and the overall market environment, as well as the technical indicators signalling continued downward momentum.

Limited Time Only! Upgrade now and get 1 Year of Stock of the week worth Rs. 14,999 for FREE. Don’t miss out on this exclusive offer. Claim Your Free Year →

Leave a Reply