The Delhi Excessive Courtroom on Wednesday (December 24) directed the GST Council to convene a gathering and determine the problem of reducing or abolishing of GST on air purifiers on the earliest protecting in thoughts the prevailing air high quality state of affairs in Delhi and close by areas.

The courtroom handed the order whereas listening to a PIL towards 18% GST imposed on air purifiers and to declare the identical as a medical gadget. Contemplating the operate carried out by air purifiers, the courtroom was of the prima facie view that GST of 5 p.c will be offered for air purifiers.

Earlier within the day the courtroom had orally remarked that the authorities should present exemption from GST on air purifiers, contemplating the air air pollution state of affairs within the nationwide capital as an “emergency.” The matter was adjourned for listening to at 2:30 PM, to allow the counsel showing for the Union Authorities to hunt directions.

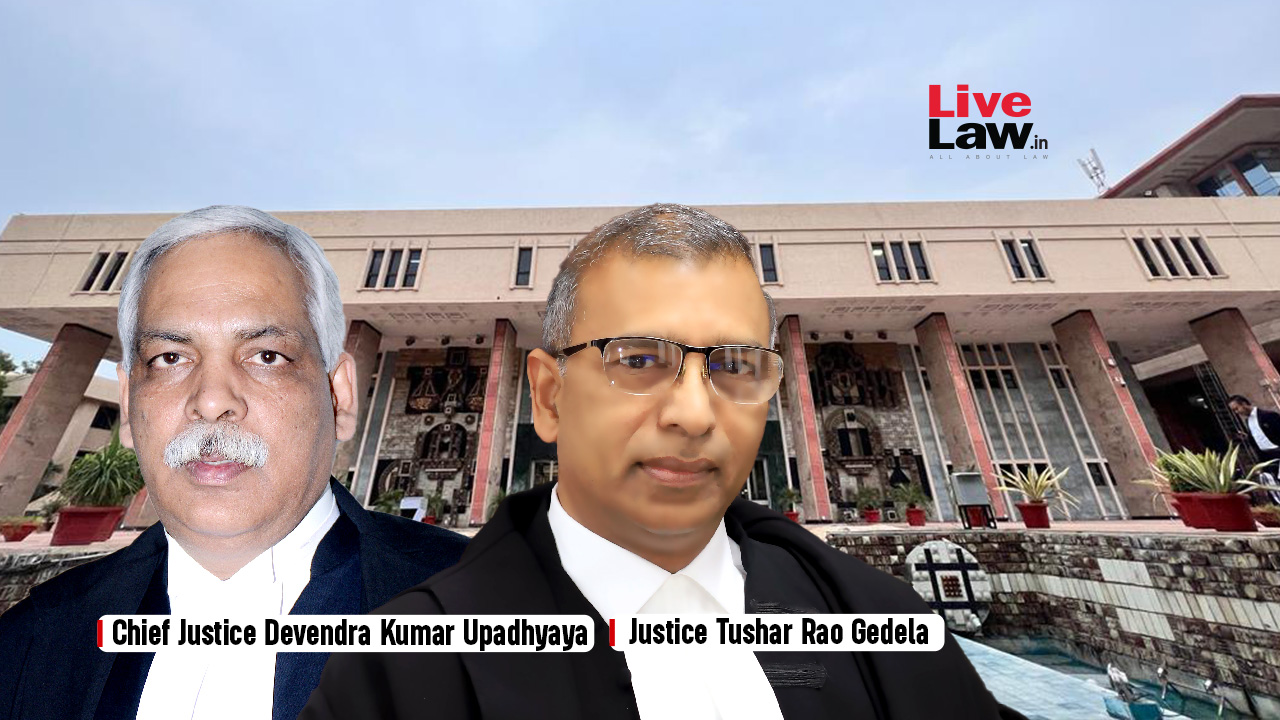

When the matter was taken up put up lunch, the counsel showing for the Union Authorities submitted earlier than a division bench of Chief Justice Devendra Kumar Upadhyaya and Justice Tushar Rao Gedela, “this can be a coverage determination to be taken for GST council. It includes of members of all States and Union”.

He mentioned that there was a set process prescribed.

In the meantime Senior Advocate Arvind Nayar representing the petitioner Kapil Madan mentioned, “There’s a notification of 2020. For ease of respiratory, they’ll very simply embrace air purifiers on this notification”.

To which the courtroom orally mentioned, “Then we should direct ministry of well being first after which based mostly on that GST council should contemplate. What we suggest to do at the moment is noting your issues, we’ll ask nodal officer to position all this earlier than GST council and inside which they’ll take a choice after which they’ll come again on Monday or day after tomorrow”.

The courtroom famous the petitioner’s rivalry that air purifiers qualify as medical gadget when it comes to the notification of February 2020 which has been issued beneath Sec 3 of Medicine and Cosmetics Act, 1940.

It was acknowledged additional that on medical gadgets, GST being charged is 5 p.c whereas it’s 18 p.c for air purifiers. The petitioner has sought a route to the respondents to think about charging 5 p.c on air purifiers as properly having regard to ever worsening air situation in Delhi and close by areas.

Issuing discover on the petition the courtroom directed:

“Our consideration is drawn to a report submitted by parliamentary standing committee (on local weather change) submitted to each homes. The standing committee has really helpful that the federal government shall both abolish or decrease GST on air purifiers. Having regards to the issues raised in petition and suggestion of committee, we direct that the problem of reducing or abolishing of GST on air purifiers shall be determined by GST council at earliest”

“We’re knowledgeable by the counsel for Respondent 2 that GST council is a pan india physique, and thus convening the assembly might take a while. We’re aware of the configuration of GST council and we additionally recognize that convening assembly might take time. Nevertheless, bearing in mind the air high quality state of affairs in Delhi and close by areas, it is going to be acceptable to require the GST council to fulfill on the earliest,” the courtroom added.

The courtroom additional noticed that if the council assembly is just not attainable bodily, the identical will be convened via VC.

“We’re knowledgeable that the GST charged on gadgets enlisted within the February 2020 notification is 5 p.c, and contemplating the features carried out by air purifiers, prima facie, we do not discover any cause why GST of 5 p.c based mostly on the notification may also not be offered for (air purifiers),” the courtroom mentioned.

The courtroom listed the matter on December 26 to allow the counsel representing Respondent 2 to hunt directions as to how early the council can meet and take an acceptable determination.

Case Title: Kapil Madan v. Union of India & Ors

Leave a Reply