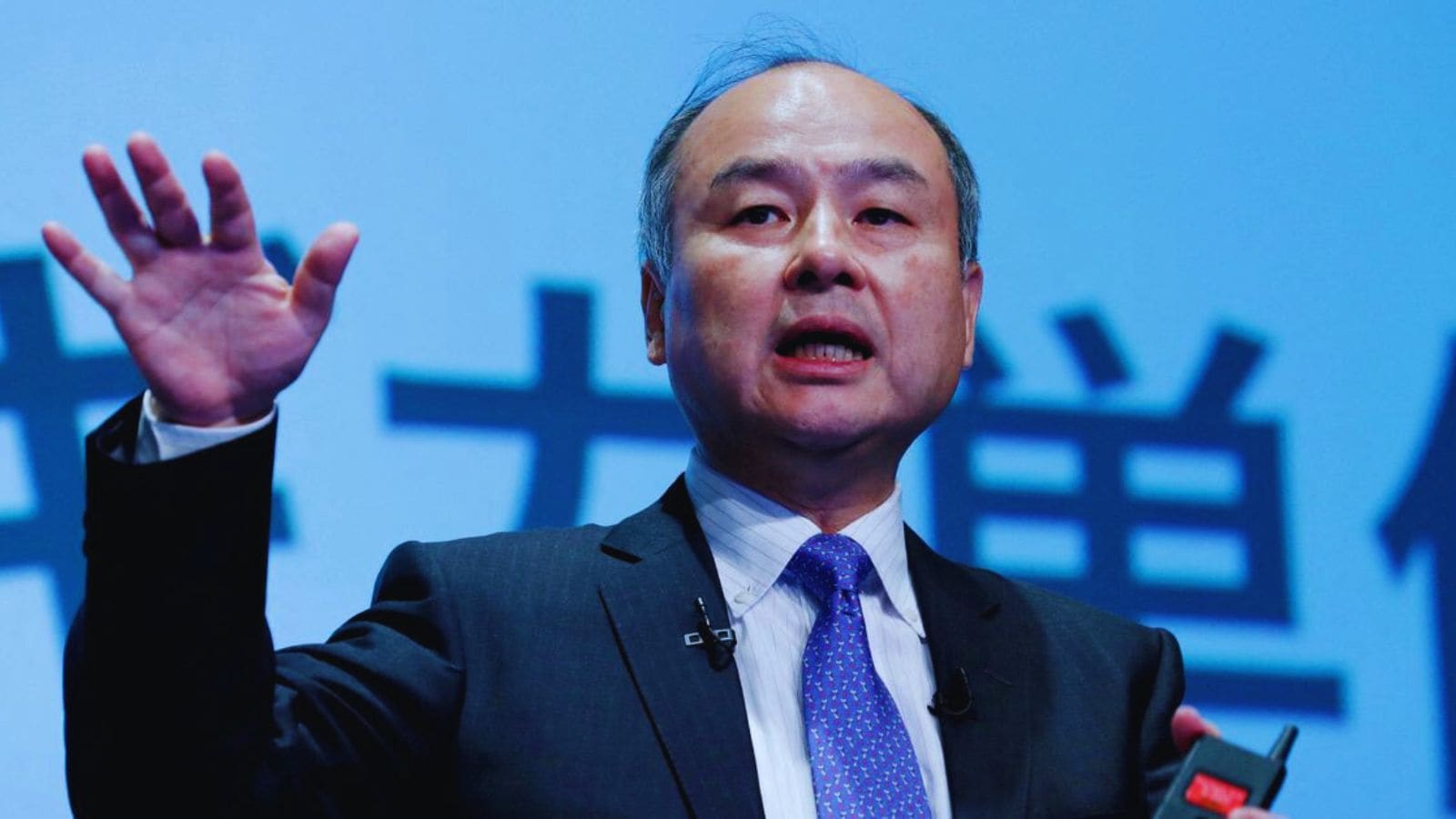

Days after Softbank Group cashed out its entire $5.8 billion stake in Nvidia, Masayoshi Son, the CEO and chairman of the Japanese investment giant, has finally addressed the move that rattled markets, at the time, and intensified speculation of an AI bubble.

Son revealed for the first time that he was forced to offload the conglomerate’s entire Nvidia stake in order to bankroll its big bet on OpenAI as well as other AI investments and data centre projects.

“I don’t want to sell a single share. I just had more need for money to invest in OpenAI and other projects […] I was crying to sell Nvidia shares,” Son said during the FII Priority Asia forum held in Tokyo, Japan, earlier this week.

At about $181.58 per share, SoftBank exited just 14 per cent below Nvidia’s all-time high of $212.19. It marks the company’s second complete exit from the US-based AI chip darling. In 2019, Softbank sold a $4 billion stake in the company for $3.6 billion, which proved costly since those shares would have been worth more than $150 billion a few years later.

However, this time, Softbank is selling its position in order to double down on other AI bets. For instance, the company has made a $30 billion commitment to OpenAI and is reportedly looking to invest in a $1 trillion AI manufacturing hub in Arizona. In February, 2025, Son joined US President Donald Trump,OpenAI CEO Sam Altman, and Oracle CEO Larry Ellison in announcing a major investment of up to $500 billion in a project to develop artificial intelligence called Stargate.

Even though Softbank’s exit from Nvidia was a strategic move and not aimed at reducing its exposure to AI, as pointed out by several analysts, the sell-off triggered a market reaction with Nvidia shares dropping by three per cent following the disclosure.

Speaking about a potential AI market bubble, Son said that those who talk about an AI bubble are “not smart enough”, CNBC report. According to Son, artificial superintelligence and AI-powered robots will generate at least 10 per cent of global GDP (gross domestic product) over the long term, outweighing trillions of dollars of investment into the technology.

Story continues below this ad

The Tokyo-based company is also looking to increase its investment in OpenAI depending on the performance of the ChatGPT maker and the valuation of further rounds, as per the report. Last month, Softbank reported that its second-quarter net profit more than doubled to 2.5 trillion yen ($16.6 billion), driven by valuation gains in its OpenAI holdings.

Leave a Reply