Inventory Worth Motion and Market Context

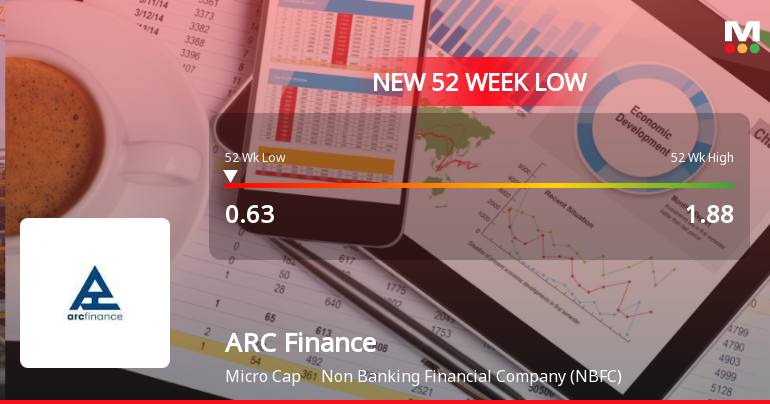

On 17 Dec 2025, ARC Finance’s share worth touched Rs.0.63, marking its lowest degree prior to now 52 weeks. This worth level stands in stark distinction to its 52-week excessive of Rs.1.88, indicating a considerable discount in market worth. The inventory underperformed its sector by 1.1% on the day, with a day change of -1.54%. Moreover, ARC Finance is buying and selling under all key transferring averages, together with the 5-day, 20-day, 50-day, 100-day, and 200-day averages, signalling a persistent downward development in worth momentum.

Compared, the broader market index, Sensex, skilled a unstable session. After opening 176.40 factors greater, it declined by 296.61 factors to shut at 84,559.65, down 0.14%. The Sensex stays near its 52-week excessive of 86,159.02, buying and selling 1.89% under that peak. Notably, the Sensex is positioned above its 50-day transferring common, which itself is above the 200-day transferring common, indicating a usually bullish development within the broader market contrasting with ARC Finance’s efficiency.

Monetary Efficiency Overview

ARC Finance’s monetary indicators over the previous 12 months reveal challenges in sustaining progress and profitability. The corporate’s one-year inventory efficiency reveals a decline of 64.25%, whereas the Sensex gained 4.80% over the identical interval. This divergence highlights the relative underperformance of ARC Finance throughout the broader market context.

The corporate’s long-term return on fairness (ROE) stands at a median of two.52%, which is modest for the Non Banking Monetary Firm sector. Working revenue has proven a contraction at an annual fee of 214.05%, indicating a major discount in earnings from core operations. The quarter ending September 2025 reported a revenue earlier than tax (PBT) much less different revenue of Rs.0.17 crore, reflecting a decline of 96.28% in comparison with earlier intervals.

Profitability and Valuation Issues

ARC Finance’s earnings earlier than curiosity, taxes, depreciation, and amortisation (EBITDA) have been destructive, which raises issues concerning the firm’s skill to generate money flows from its operations. Over the previous 12 months, earnings have fallen by 133.5%, underscoring the monetary pressure the corporate is experiencing. The inventory is taken into account dangerous relative to its historic valuation averages, which can be contributing to the subdued investor sentiment and worth stress.

Shareholding Sample and Market Place

The vast majority of ARC Finance’s shares are held by non-institutional traders, which can affect the inventory’s liquidity and buying and selling dynamics. The corporate operates throughout the NBFC sector, which has confronted various levels of regulatory and financial headwinds in recent times. These sectoral elements, mixed with company-specific monetary metrics, have contributed to the present valuation ranges.

Abstract of Key Metrics

To summarise, ARC Finance’s inventory worth at Rs.0.63 represents a major decline from its 52-week excessive of Rs.1.88. The corporate’s monetary outcomes over the previous 12 months present a contraction in working revenue and a pointy fall in profitability metrics. The inventory’s buying and selling under all main transferring averages displays ongoing downward momentum. In the meantime, the broader market, as represented by the Sensex, maintains a extra constructive trajectory, highlighting the divergence in efficiency.

These elements collectively illustrate the challenges confronted by ARC Finance within the present market atmosphere. The corporate’s monetary information and market positioning present a factual foundation for understanding the inventory’s current worth actions and valuation ranges.

Solely ₹14,999 – Get MojoOne + Inventory of the Week for two Years PLUS 6 Months FREE Declare 83% OFF →

Leave a Reply