SkyWater Technology (SKYT) just put a fresh universal shelf registration in place, giving it flexible options to issue stock, debt, or hybrid securities as it leans into recent growth and the Fab 25 acquisition.

See our latest analysis for SkyWater Technology.

Those moves come after record Q3 results and the Fab 25 deal, and the market has been warming up, with a 90 day share price return of 62.86 percent and a 1 year total shareholder return of 92.92 percent. This suggests positive momentum rather than a short lived bounce.

If SkyWater has you rethinking where growth could come from next, it might be worth exploring high growth tech and AI stocks as a way to spot other semiconductor and chip related ideas riding similar themes.

With shares nearly doubling over the past year and trading only modestly below analyst targets, is SkyWater still quietly undervalued, or are investors already paying up for all that future growth?

Most Popular Narrative Narrative: 14.4% Undervalued

Compared to the last close at $17.98, the most followed narrative sees fair value closer to $21, implying more upside if its assumptions play out.

SkyWater’s expansion into quantum computing and advanced packaging, including the upcoming rollout of a superconducting platform and Florida advanced packaging operations, positions the company at the forefront of high-growth technology segments supported by national security and industrial policy trends laying the foundation for above-market revenue growth and long-term margin expansion.

Want to see what kind of revenue surge and margin reset could justify that higher value, and how long it might take? The full narrative reveals the playbook behind those projections, from growth ramp to profitability inflection, and the valuation multiple it says the market will eventually accept.

Result: Fair Value of $21 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, rising debt from the Fab 25 deal and prolonged margin pressure from integration costs could challenge the otherwise upbeat growth and valuation story.

Find out about the key risks to this SkyWater Technology narrative.

Another Take on Valuation

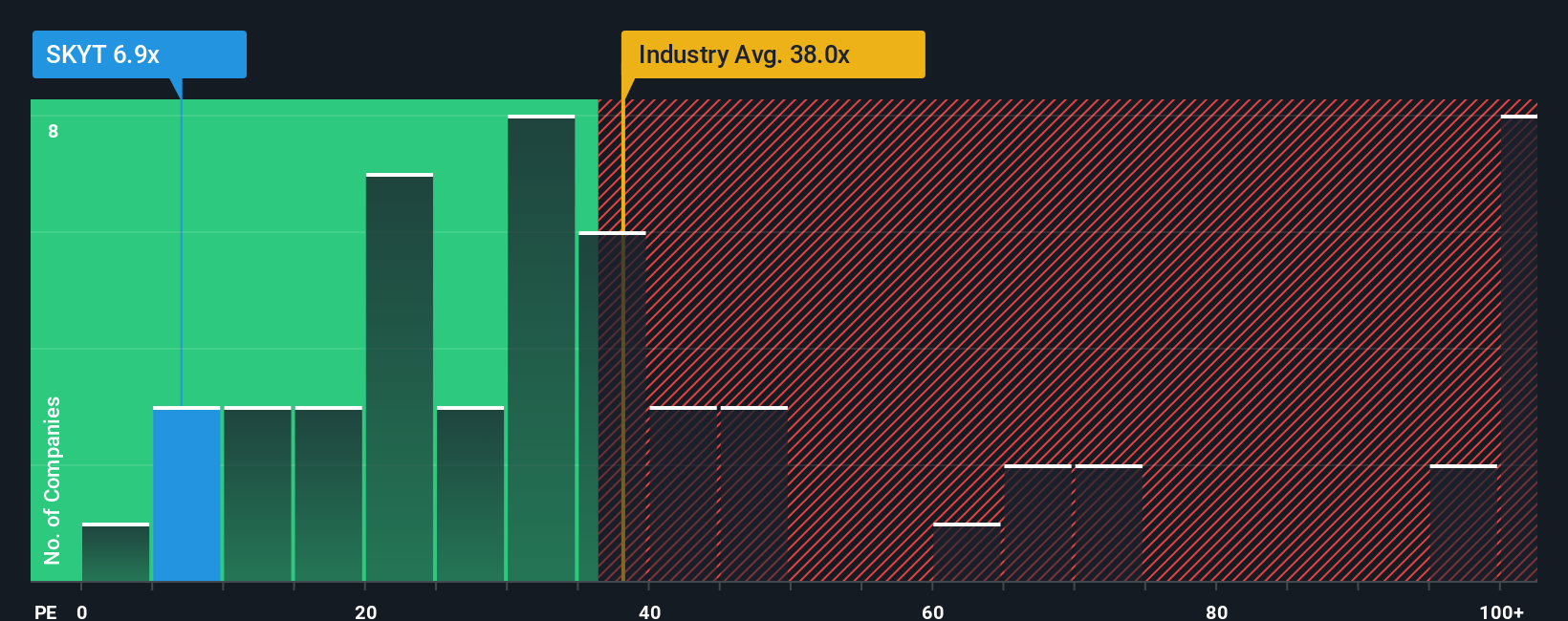

On earnings, SkyWater looks cheap at 6.9 times versus 37.5 times for the US semiconductor group and a peer average of 55.5 times. But that same P E is rich versus a 4.1 times fair ratio, hinting more downside risk if sentiment cools than easy upside.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own SkyWater Technology Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in just minutes, Do it your way.

A great starting point for your SkyWater Technology research is our analysis highlighting 3 key rewards and 5 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with a single compelling narrative. Use the Simply Wall Street Screener to pinpoint stocks that match your strategy before the market fully catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Leave a Reply