Vacation gross sales have turn into a season of impulse buying, pushed by push notifications, app banners, and fee shortcuts that make overspending dangerously straightforward.

Nonetheless, Android’s ecosystem additionally presents a collection of instruments that may assist curb impulse shopping for and encourage intentional spending.

Over time, I’ve discovered that the important thing to navigating gross sales with out going overboard isn’t nearly self-discipline; it’s leveraging the best instruments on my Android telephone.

From worth trackers to budgeting apps, these instruments have remodeled the way in which I store, serving to me lower your expenses whereas nonetheless snagging the offers I would like.

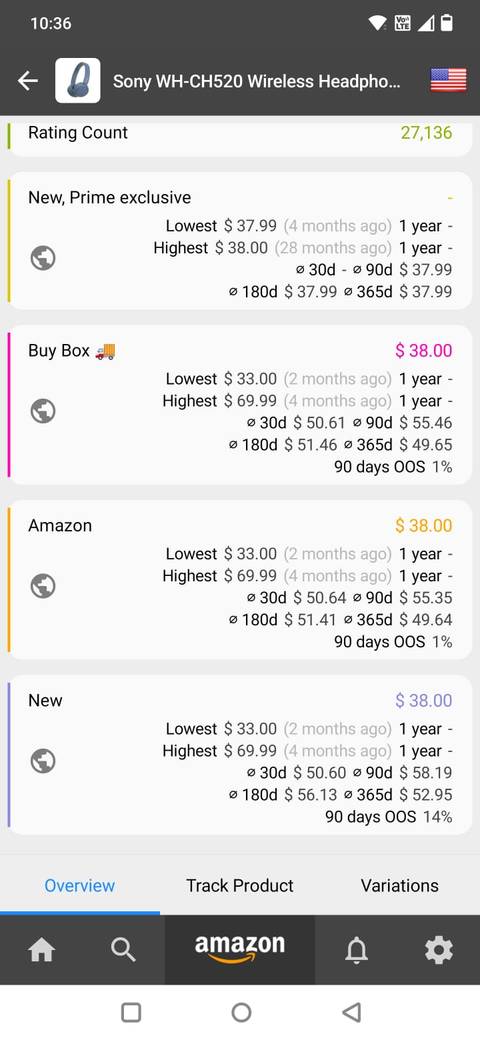

Value monitoring with Keepa

It screens Amazon costs, so I don’t need to

The primary rule of sensible vacation buying is understanding the precise worth of an merchandise.

Keepa has turn into indispensable for me. It tracks Amazon costs over time, exhibiting worth historical past charts so I can see whether or not one thing is definitely a deal or if the merchandise was quietly marked up final week.

If a product hits its 90-day low, I do know it’s doubtless a real deal. If the graph spikes and all of the sudden drops, I maintain off.

I set notifications for the merchandise I’m eyeing, and when a worth drops under a threshold I’m comfy with, I get an alert on my telephone. With out it, I’d doubtless impulse-buy on the first sale notification.

Keepa proves that many “limited-time” costs aren’t particular in any respect. This motion alone has prevented many panic purchases.

Digital wallets and budgeting apps

Flip your telephone into your monetary management middle

Vacation spending will get chaotic quick, particularly while you’re bouncing between shops, fee strategies, and impulse-driven sale banners.

What helped me achieve management was shifting extra of my purchases into digital wallets paired with strict budgeting apps.

Google Pockets permits me to view my latest transactions and supplies instantaneous notifications at any time when a fee is processed.

For precise budgeting, YNAB (You Want A Price range) has been the best system I’ve used. In contrast to fundamental expense trackers, YNAB forces you to present each greenback a job, which makes impulse spending really feel like stealing from a class you already deliberate for.

After I’m shopping a vacation sale and see one thing tempting, I open YNAB and test whether or not I’ve cash assigned to presents, electronics, or enjoyable purchases.

More often than not, that actuality test is sufficient to shut down the urge.

Value comparability and barcode scanning

Immediate worth checks at your fingertips

After I’m buying in-store or shopping on-line, Android’s barcode scanning options are a lifesaver. Apps like Google Lens permit me to scan a product in seconds and examine costs throughout a number of retailers.

I open my digital camera app, faucet the Lens icon on the backside, and level it on the product or barcode. Inside seconds, I get an inventory of matches throughout on-line shops.

It reveals pictures, product titles, and approximate pricing, and it’s surprisingly good at figuring out even generic gadgets.

For instance, this Black Friday, I used to be eyeing a pair of wi-fi headphones in an area retailer. A fast scan in Google Lens revealed the identical headphones had been 20% cheaper on-line.

With out that rapid comparability, I’d have purchased it impulsively, believing the in-store low cost was unbeatable.

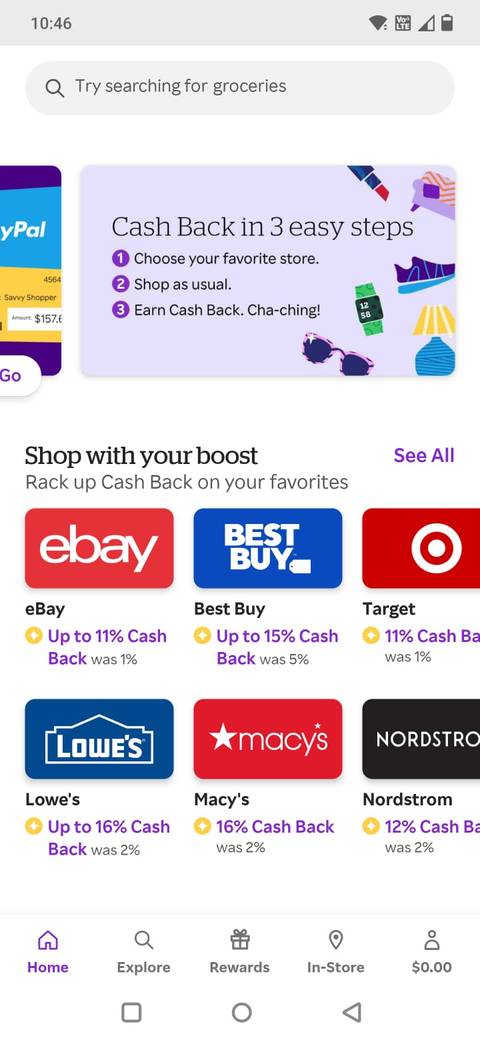

Cashback and rewards monitoring

Turning on a regular basis purchases into actual financial savings

One other behavior that helps me management my vacation spending is monitoring cashback presents and rewards factors earlier than making any purchases. Apps like Rakuten and Ibotta assist earn a reimbursement on purchases.

Rakuten is helpful for vacation buying as a result of it robotically applies cashback at main retailers like Greatest Purchase, Walmart, and Goal.

Ibotta is more practical for in-store purchases and groceries, which is essential when internet hosting events, shopping for elements, or making ready for the season.

How I hold my vacation buying below management

A number of overspending comes from shopping for gadgets you didn’t intend to. To fight this, I keep curated buying lists in Google Preserve.

I keep three lists year-round: Family necessities, To switch quickly, and Would love, however not pressing. When sale season arrives, these lists turn into my guardrails.

As a substitute of scrolling by offers within the hope of discovering one thing helpful, I first test my lists. If it’s on the record, I contemplate shopping for it. If it’s not, I skip the temptation completely.

This easy tactic helps me keep away from including pointless gadgets to my cart throughout a sale.

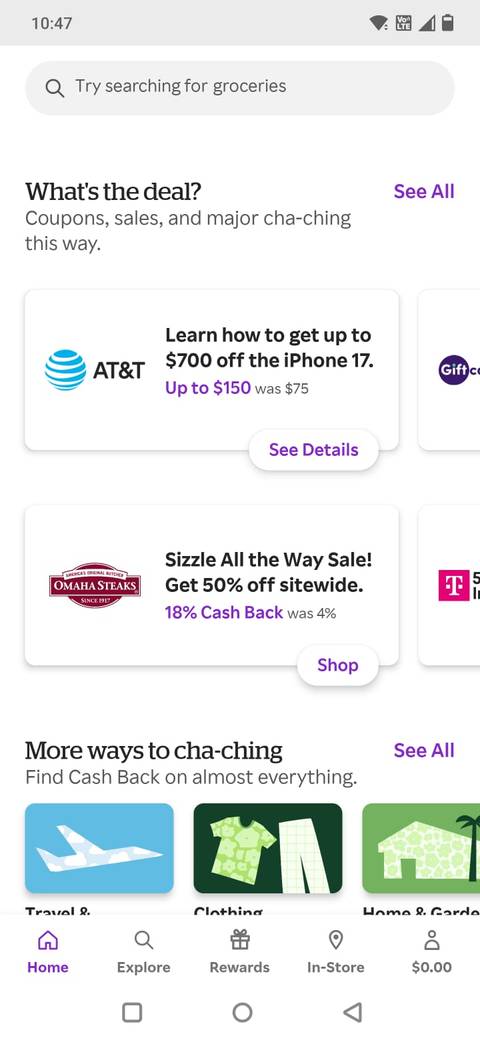

Deal alert notifications

Keep forward of vacation worth drops

Many retailers and apps allow you to subscribe to deal alerts, and I’ve realized to make use of them strategically. Most buying apps supply notifications for upcoming gross sales or worth drops.

Moderately than continuously shopping for offers, I depend on these notifications to alert me when the gadgets go on sale. I pair this with my price-tracking apps to ensure the low cost is worth it earlier than committing.

The mix saves me hours of shopping and prevents impulsive spending triggered by limited-time banners.

Analytics to your spending habits

The spending insights that stored me trustworthy

Widgets from budgeting apps can show your remaining month-to-month price range, present class breakdowns, or point out how shut you might be to overspending in particular areas akin to eating out or impulse buying.

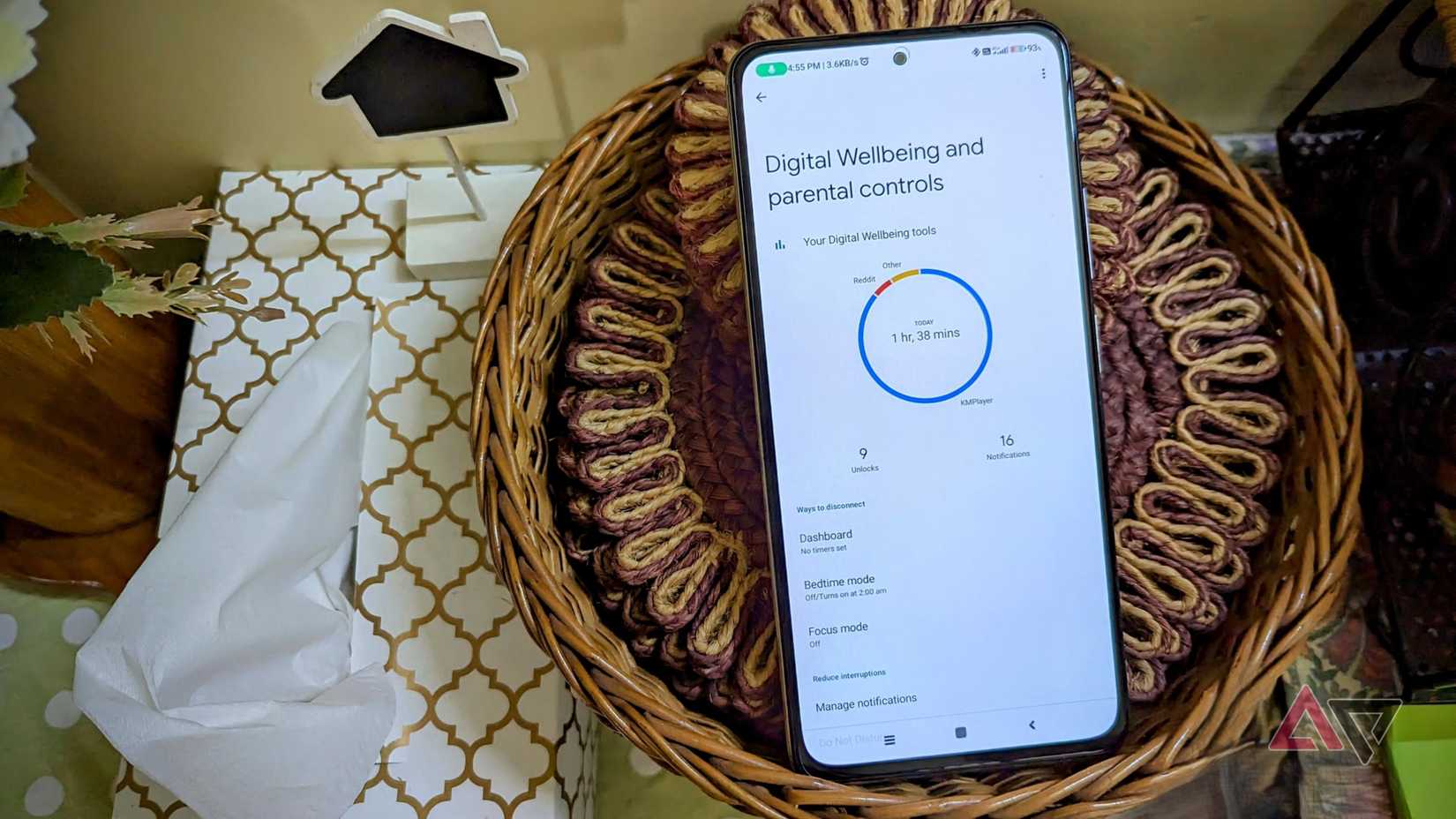

Android additionally enables you to monitor app utilization and notifications, which will be surprisingly helpful for budgeting.

By checking Digital Wellbeing within the Settings app, I can see how typically I go to buying apps and whether or not my time on them correlates with overspending. For instance, I seen I used to be visiting trend apps late at evening and infrequently making impulsive purchases.

Merely being conscious of this sample allowed me to regulate my conduct. I typically flip off notifications or set app timers to forestall late-night splurges.

How these habits stick past the vacations

What stunned me most about constructing a extra intentional buying system is that it didn’t fade after the vacation chaos ended.

Value-drop alerts turned a everlasting filter that stopped me from impulse-buying issues simply because they had been on sale.

My buying lists developed into long-term planning paperwork for house upgrades and journey gear, serving to me distinguish between short-term desires and wishes.

Budgeting apps additionally nudged me towards more healthy habits. Even once I wasn’t actively attempting to economize, the every day and weekly insights inspired me to contemplate whether or not a purchase order was value it.

Cashback trackers and reward dashboards made me extra conscious of the worth I used to be leaving on the desk. Now, I hardly ever take a look at with out first scanning for rewards or bonus presents.

Vacation buying doesn’t have to empty your pockets

The vacation season doesn’t need to imply reckless spending. By utilizing Android instruments strategically, you can also make knowledgeable purchases, monitor your price range in actual time, and keep away from impulsive choices.

From worth monitoring and cashback functions to alerts and lists, every instrument contributes to my intention behind spending. Mixed, they create a digital security web that protects my pockets throughout vacation buying chaos.

Leave a Reply