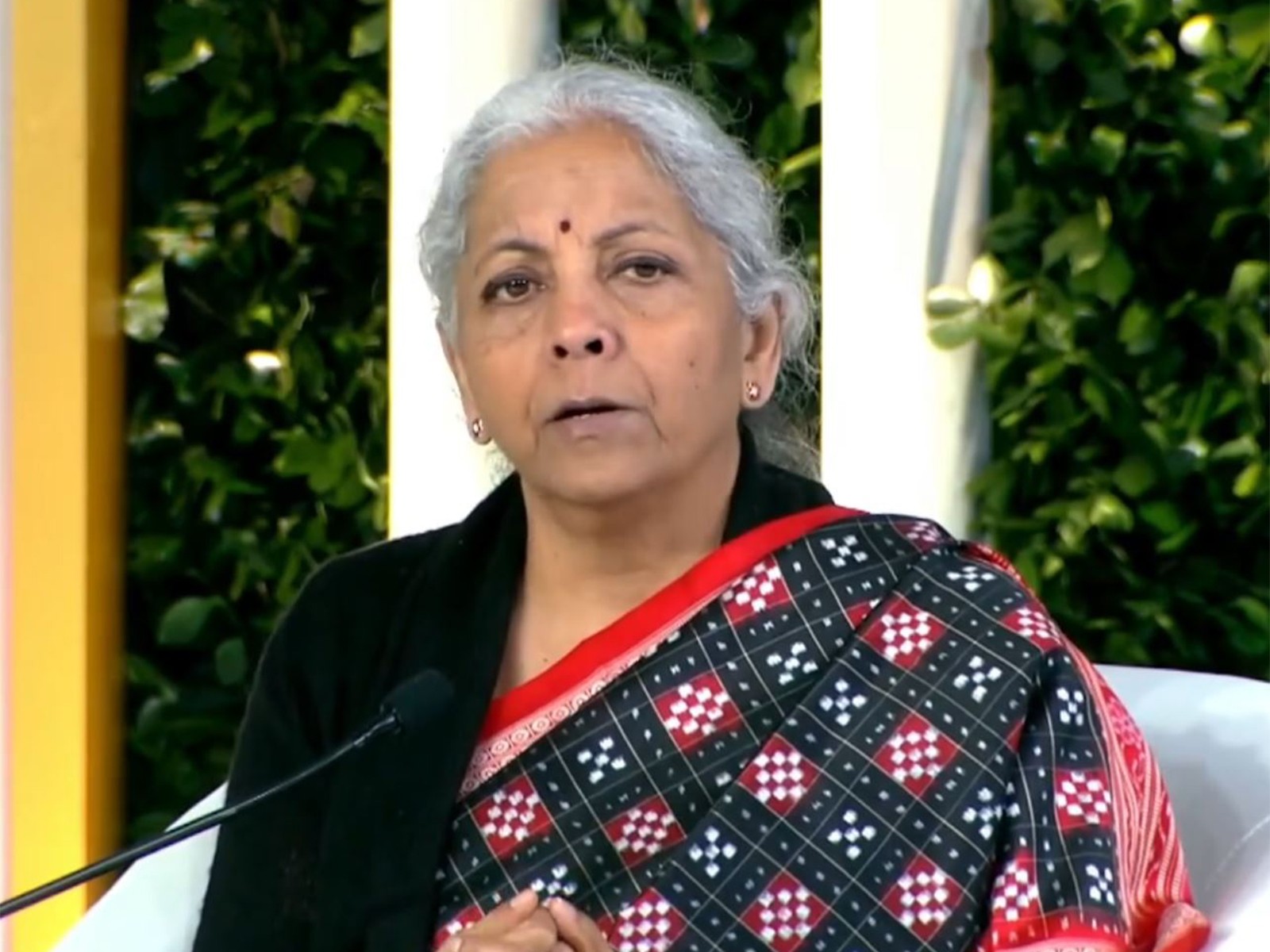

Union Finance Minister Nirmala Sitharaman has announced that several major changes will soon be made to the customs system. This will be the government’s next biggest reform. Its purpose is to simplify rules so that businesses and traders don’t face difficulties.

Over the past two years, duty rates have been gradually reduced and now there will be focus on items that still have high duties. This reform is a step towards strengthening the economy, where transparency will increase and compliance will become easier.

What does customs reform mean?

The customs system is the body that collects tariffs and regulates the import-export of goods. This includes control of vehicles, personal belongings and even dangerous items. Sitharaman said that currently this system is a bit tough, which makes it difficult for people to comply.

Their plan is to simplify it, to bring transparency and speed up the process. It has also been announced to match the standards of the World Customs Organization. Duty rates have been continuously reduced in the last two years, but some items where rates are still above optimal will also see cuts.

‘We need to make customs very simple’

The Finance Minister said, ‘Many things remain, but the customs system will be completely changed before the budget. We need to make customs very simple so that people don’t feel it is exhausting or burdensome. Rules for compliance need to be made transparent.’ She gave the example of income tax reforms, where earlier there were issues like “tax terrorism” due to administration. Now the process has become clean with faceless assessments.

Sitharaman said, ‘Income tax rates were not the problem, the problem was with administration. The same challenge exists in customs – streamlining the process while also stopping illegal goods.’ She emphasized relying more on scanning technology to reduce direct contact between cargo and officials and decrease discretion.

Reforms will increase foreign investment

India’s economic reforms journey is old. The changes that came in income tax, like the faceless system. The same model will now apply to customs. Sitharaman explained that we always match World Customs Organization benchmarks. Duty cuts in the last two years have provided relief to traders, but rates are still high in some sectors.

This overhaul is part of broader economic reforms, where the government’s focus is on making administration painless. Experts believe this will improve the business environment and increase foreign investment.

How will trade and business benefit?

This reform will boost trade. Simple rules will make compliance easier, benefiting small and medium businesses. Duty cuts will make imported goods cheaper, providing relief to consumers. Additionally, focus on scanning will maintain strong security.

Sitharaman warned that the challenge is dual – making the process easier and preventing illegal trade. In the long term, this will help make India a global trade hub. Before the budget, the plan is to complete this ‘cleaning up assignment’, which will support economic growth rate.

What is Customs Duty?

This is a tax levied on imports and exports, which generates revenue and protects local industry. In India, basic customs duty is 10%, but it’s higher on some items. Reforms will bring rates to optimal levels.

Leave a Reply