Interview with: Dr. Leonardo Aguilera, CEO, Banreservas

Leonardo Aguilera assumed the chief presidency of Banreservas, the biggest monetary establishment within the Dominican Republic, in August 2025. He holds a PhD in economics, has greater than 20 years of college educating expertise, and is the founding father of the Cibao Financial Centre. Between 2020 and 2025, he headed the Dominican Petroleum Refinery (Refidomsa). Following his appointment, Dr. Aguilera spoke with World Finance about Banreservas’ basic function within the Dominican economic system and the financial institution’s priorities for the long run.

Banreservas reported a speedy improve in lending in recent times in contrast with prior intervals. How has this benefited the nationwide economic system?

Better entry to credit score has enabled each giant firms and SMEs to diversify their choices, enhance operational effectivity, and in the end enhance job creation and incomes. As well as, the provision of financial institution financing – delivered by executives with deep experience in tailoring constructions to every mission – helps appeal to overseas funding. In tourism, a key pillar of the economic system, financing has been important to creating core infrastructure: inns and resorts, airways, cruise ports, transport networks and points of interest. Credit score has additionally broadened and strengthened provide chains. By financing suppliers and repair suppliers that help tourism – native meals producers, artisans, and transport companies – banks reinforce the general ecosystem.

We presently maintain the primary place within the bank card market

In the meantime, client lending has performed, and can proceed to play, a central function in stimulating home tourism by giving individuals entry to inexpensive financing for journey and leisure.

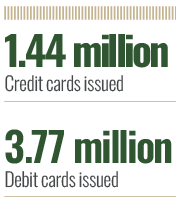

The ripple results are constructive for retail, hospitality and agriculture. We presently maintain the primary place within the bank card market. Thus far, Banreservas has issued 1.44 million bank cards and three.77 million debit playing cards, a mixed year-over-year improve of 24.5 p.c. We additionally lead the cost platform for social help programmes, serving roughly 855,000 beneficiaries, and we help retailers with a spread of annual promotions.

What function is Banreservas enjoying as we speak in advancing monetary inclusion, for instance by training?

Considered one of our most vital initiatives is the PUEDO programme – our first large-scale effort, in partnership with the Ministry of Training, to ship monetary training in public faculties. Via PUEDO, we have now reached 4,300 college students in 17 public faculties throughout a number of provinces, specializing in these within the ultimate years of main and secondary faculty. We at the moment are scaling to hundreds extra establishments, extending monetary training to greater than 7,800 faculties nationwide in addition to to academics. We not too long ago convened with greater than 1,000 college students from the southern area – principally in early grades – and had been inspired by their enthusiasm for studying about cash administration and the significance of saving for emergencies and future wants.

In the meantime, by our ‘Banking is the Nation’ programme, we have now introduced greater than 900,000 Dominicans – many from weak communities – into the formal monetary system by combining digital accounts, authorities payrolls, and social subsidies. This effort is supported by greater than 4,000 monetary literacy workshops.

Banreservas is implementing an internationalisation technique to increase entry to monetary companies for Dominicans residing overseas. What has been achieved to this point?

We proceed to take necessary steps to attach the Dominican diaspora with the nationwide monetary system. Our compatriots within the US and Europe – greater than 2.5 million individuals – ship over $10bn in remittances yearly, a significant supply of help for our economic system. The institution of three consultant workplaces – Madrid, New York and Miami – fulfills a dedication made by President Luis Abinader and makes Banreservas the primary Dominican financial institution with a presence in each Spain and the US. These workplaces have already served greater than 60,000 purchasers, processed greater than 25,000 financial savings account openings, and dealt with mortgage purposes totalling over RD$3bn.

Within the close to time period, our focus is to strengthen this presence and provide Dominicans overseas extra choices for dynamic engagement, permitting them to profit from Banreservas’ footprint in these markets and stay intently related to their homeland. Via worldwide real-estate gala’s held in New York, Lawrence and Madrid in 2024 and 2025, we have now showcased a broad vary of residential tasks to Dominican communities overseas. Working with main builders and real-estate brokers within the Dominican market, we offer personalised recommendation, preferential financing, and the peace of mind that comes with Banreservas being current of their group.

Slightly than viewing Dominicans overseas merely as remittance senders, we see them as energetic companions in nationwide development. Wanting forward, we’re creating much more modern digital options that may enable them to handle their whole monetary lives remotely, rapidly, and securely. These efforts additionally align with the President’s commitments to Dominican communities overseas – commitments Banreservas embraces because the financial institution with the strongest ties to our diaspora.

What are Banreservas’ principal priorities and targets by 2030?

We have now three priorities. First, deepen our digital transformation. We are going to proceed to increase our digital capabilities to ship sooner, safer, and extra personalised options for company and retail purchasers. That features optimising cost platforms, cash-management, and financing companies with a powerful give attention to consumer expertise and regional interoperability.

Second, optimise capital to fund innovation and growth. Following the capital improve authorised by Legislation 13-24, Banreservas now has a considerably stronger capital place. We are going to leverage this to speed up technological innovation, increase banking infrastructure, and improve our suite of transactional merchandise – investing in cybersecurity, course of automation, new digital channels, and growth into key regional markets.

Third, increase monetary inclusion. We are going to drive initiatives in underserved communities by integrating accessible digital options and strategic partnerships to broaden the attain of our transactional companies. We are going to proceed creating merchandise that assist micro and small companies develop – facilitating entry to credit score, trendy cost strategies, and monetary instruments that enhance sustainability and competitiveness.

In September 2025, the financial institution introduced RD$7bn to finance nationwide productive sectors at preferential charges. Which sectors will profit?

These funds are focused on the nation’s principal productive sectors: building, commerce, manufacturing, exports, well being and agriculture.

Banreservas not too long ago reported that its CREE programme – which helps entrepreneurs and modern tasks – has channelled greater than RD$72m in fairness investments since 2015. What function will this programme play going ahead?

CREE will stay Banreservas’ flagship initiative for backing innovation. By combining fairness funding with specialised mentorship, it contributes to nationwide socioeconomic improvement. We anticipate CREE to broaden its attain, supporting extra founders on the early and development levels whereas strengthening enterprise fashions.

The imaginative and prescient is to cement CREE as an engine of innovation – turning concepts into high-impact tasks that handle social and financial challenges and assist construct a extra affluent future for all Dominicans.

What else is the financial institution doing to help entrepreneurs and SMEs?

Fomenta Pymes gives versatile financing, technical recommendation, and specialised help to strengthen administration and competitiveness amongst SMEs. The programme facilitates entry to credit score, supplies coaching instruments, and connects entrepreneurs with help networks – serving to companies develop sustainably, create jobs, and enhance native economies.

How is the digitalisation of banking companies progressing, and what are the important thing targets on this space for the subsequent 5 years?

With the launch of the TuBanco Personas platform, we have now modernised on-line banking for people, delivering a sooner, extra intuitive, and safer expertise. Our AI-powered digital assistant, Alma, has turn into a key self-service channel. We have now additionally redesigned the Personas app to offer prospects better autonomy in managing merchandise reminiscent of accounts, time deposits, playing cards and loans. The Banreservas MIO Digital Account has expanded entry for historically underserved segments, whereas digital onboarding permits new prospects to hitch with out in-person visits. As well as, Banreservas Pockets enhances Apple Pay and Google Pay, providing extra contactless choices.

We are going to proceed creating merchandise that assist micro and small companies develop

For enterprise purchasers, we have now applied options that optimise cash-management and digital transactions, together with Automated Deposit Vaults and a direct interconnection platform with company ERP techniques that allows computerized reconciliation of huge transaction volumes. We additionally provide a Digital Token for companies to modernise authentication throughout digital channels – changing bodily units with a safer, environment friendly resolution aligned with worldwide cybersecurity requirements. Collectively, these options reinforce Banreservas’ management within the sector.

Over the subsequent 5 years, our digitalisation technique centres on 4 pillars.

1) �one hundred pc digital onboarding and companies: guaranteeing that each people and companies can open, handle, and shut merchandise by digital channels, supported by superior biometrics and safety controls.

2) �AI-powered hyper-personalisation: leveraging AI and information analytics to ship extra contextual, proactive monetary options.

3) �Cloud scalability and resilience: consolidating migration to cloud platforms for better agility in responding to regulatory change, demand spikes, and new product launches.

4) �Growth into digital ecosystems and BaaS: deepening partnerships with fintechs, firms, and authorities entities by Banking-as-a-Service fashions that increase innovation and self-service.

With this roadmap, Banreservas seeks not solely to modernise its digital channels but additionally to redefine how prospects work together with monetary companies – inserting innovation, accessibility and inclusion on the centre of the financial institution’s technique.

Leave a Reply