Intraday Buying and selling Dynamics

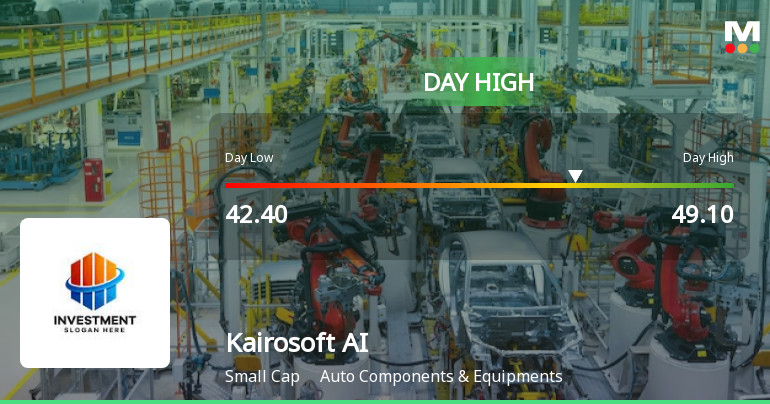

On the buying and selling day, Kairosoft AI Options opened with a spot up of two.89%, signalling early bullish momentum. The inventory exhibited vital volatility, with an intraday value vary spanning from ₹42.4 at its low level to ₹49.1 at its peak, representing a 7.32% weighted common value volatility. This stage of value motion underscores energetic participation from market members all through the session.

The closing day change stood at 7.07%, considerably outperforming the Sensex, which registered a 0.46% acquire on the identical day. Moreover, Kairosoft AI Options outperformed its sector by 5.05%, highlighting its relative energy inside the Auto Elements & Equipments section.

Over the previous two buying and selling classes, the inventory has recorded consecutive good points, accumulating an 8.25% return. This latest upward pattern contrasts with the broader market’s extra modest actions, indicating a centered buying and selling curiosity within the inventory.

Transferring Averages and Technical Positioning

Kairosoft AI Options’ present value stage is positioned above its 5-day and 20-day transferring averages, indicating short-term value energy. Nevertheless, it stays under the 50-day, 100-day, and 200-day transferring averages, suggesting that longer-term value developments have but to align with the latest good points. This combined technical image displays a inventory in transition, with short-term momentum contrasting with longer-term value resistance ranges.

Market Context and Sector Efficiency

The broader market surroundings on 12 Dec 2025 was constructive, with the Sensex opening 232.90 factors increased and buying and selling at 85,205.56, a 0.46% improve. The index was buying and selling near its 52-week excessive of 86,159.02, simply 1.12% away, supported by bullish transferring averages the place the 50-day DMA is above the 200-day DMA. Mid-cap shares led the market rally, with the BSE Mid Cap index gaining 0.73% on the day.

Inside this context, Kairosoft AI Options’ outperformance of each the Sensex and its sector friends highlights its distinct buying and selling behaviour amid a typically constructive market backdrop.

Efficiency Over Varied Timeframes

Analyzing Kairosoft AI Options’ efficiency over a number of intervals reveals a fancy image. The inventory’s 1-day acquire of seven.07% contrasts with the Sensex’s 0.46% rise. Over the previous week, the inventory has recorded a 15.82% return, whereas the Sensex declined by 0.59%. The 1-month return for Kairosoft AI Options stands at 5.44%, in comparison with the Sensex’s 0.88% acquire.

Nevertheless, longer-term returns present a special pattern. Over three months, the inventory’s worth has declined by 32.58%, whereas the Sensex gained 4.04%. The 1-year and year-to-date returns for Kairosoft AI Options are detrimental at -73.73% and -70.03% respectively, whereas the Sensex posted good points of 4.82% and 9.05% over the identical intervals. The three-year and 10-year returns additionally mirror vital underperformance relative to the benchmark index.

Buying and selling Volatility and Value Vary

The intraday value vary of Kairosoft AI Options on 12 Dec 2025 was notably large, with a low of ₹42.4 and a excessive of ₹49.1. This 15.7% unfold between the day’s high and low factors underscores the inventory’s heightened volatility. Such value swings may be attributed to energetic buying and selling curiosity and fast shifts in market sentiment in the course of the session.

Market Capitalisation and Business Placement

Kairosoft AI Options operates inside the Auto Elements & Equipments sector, a section that has seen assorted efficiency in latest months. The corporate holds a market capitalisation grade of three, indicating a mid-sized presence inside its business. Regardless of the latest intraday surge, the inventory’s longer-term efficiency metrics recommend challenges in sustaining sustained development relative to broader market indices.

Abstract of Key Metrics

To summarise, Kairosoft AI Options’ buying and selling session on 12 Dec 2025 was marked by:

- A day’s excessive of ₹49.1, representing a 9.82% improve intraday

- A closing day acquire of seven.07%, outperforming the Sensex by 6.61 proportion factors

- Opening hole up of two.89%

- Intraday volatility of seven.32%

- Consecutive good points over two days totalling 8.25%

These figures spotlight the inventory’s robust intraday momentum and energetic buying and selling surroundings inside the Auto Elements & Equipments sector.

Broader Market Implications

The constructive efficiency of Kairosoft AI Options aligns with a typically bullish market temper, as mirrored by the Sensex’s proximity to its 52-week excessive and the management of mid-cap shares. Nevertheless, the inventory’s longer-term returns point out a necessity for cautious evaluation when contemplating its total market trajectory.

Conclusion

Kairosoft AI Options’ notable intraday surge on 12 Dec 2025, reaching a excessive of ₹49.1 and shutting with a 7.07% acquire, underscores a day of robust buying and selling exercise and volatility. Whereas the inventory outperformed each the Sensex and its sector friends on the day, its longer-term efficiency metrics current a extra nuanced image. Buyers and market watchers will doubtless proceed to observe the inventory’s value actions and technical positioning within the context of broader market developments.

Just for Rs. 14,999 – Get Entry to 2 Years + 6 Months of All Premium Options on MarketsMojo. As little as ₹500/month! Declare 83% OFF →

Leave a Reply