Robust Momentum Drives Consecutive Positive aspects

The inventory has demonstrated sturdy momentum, registering beneficial properties for 5 consecutive buying and selling days. Over this era, Brijlaxmi Leasing & Finance has delivered returns of roughly 91.48%, underscoring a outstanding rally inside a brief timeframe. At present’s session opened with a spot up of 9.99%, sustaining the opening worth all through the day and reaching an intraday excessive of Rs.16.85.

This upward trajectory has positioned the inventory nicely above its key transferring averages, together with the 5-day, 20-day, 50-day, 100-day, and 200-day averages, signalling a powerful technical stance. Such alignment throughout a number of transferring averages typically signifies sustained shopping for curiosity and constructive worth motion inside the market.

Outperformance Inside Sector and Market Context

Compared to its sector friends, Brijlaxmi Leasing & Finance outperformed the Non Banking Monetary Firm (NBFC) sector by 9.32% at this time. This outperformance is especially notable given the broader market surroundings, the place the Sensex opened larger at 85,051.03 factors, gaining 232.90 factors or 0.27%. The Sensex presently trades near its personal 52-week excessive, roughly 1.31% shy of the height at 86,159.02 factors.

Mid-cap shares are main the market rally, with the BSE Mid Cap index gaining 0.69% at this time. Brijlaxmi Leasing & Finance’s efficiency aligns with this development, reflecting power within the mid-cap section and investor concentrate on corporations demonstrating strong worth momentum.

12 months-Lengthy Efficiency and Valuation Context

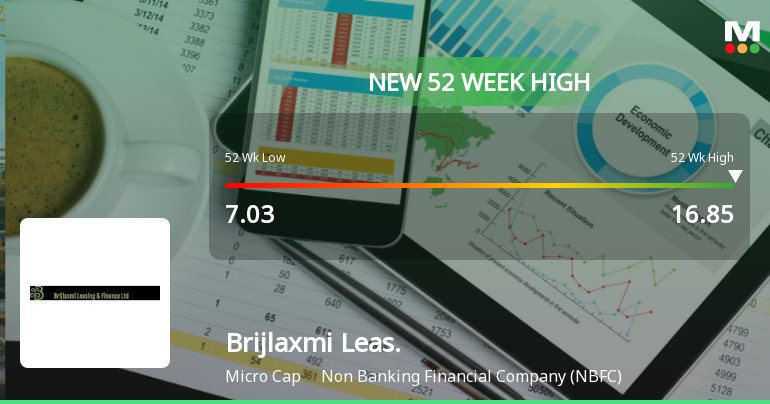

Over the previous 12 months, Brijlaxmi Leasing & Finance has recorded a worth motion of 73.53%, considerably outpacing the Sensex’s 4.61% change throughout the identical interval. The inventory’s 52-week low was Rs.7.03, highlighting the extent of its worth appreciation to the present excessive of Rs.16.85.

This substantial worth vary displays a interval of appreciable volatility and restoration, with the latest rally marking a continuation of constructive worth traits. The market capitalisation grade of 4 signifies a mid-sized firm inside its sector, which frequently attracts consideration for progress potential and sectoral dynamics.

Technical Indicators and Market Positioning

Technical evaluation reveals that Brijlaxmi Leasing & Finance is buying and selling comfortably above all main transferring averages, an element that usually helps sustained worth power. The inventory’s means to take care of its opening worth all through the buying and selling day suggests sturdy demand and restricted promoting strain at present ranges.

Moreover, the Sensex’s place above its 50-day and 200-day transferring averages, with the 50 DMA buying and selling above the 200 DMA, signifies a broadly bullish market surroundings. This backdrop gives a supportive context for shares like Brijlaxmi Leasing & Finance to take care of upward momentum.

Sectoral and Trade Concerns

Brijlaxmi Leasing & Finance operates inside the NBFC sector, a section that performs a vital position in India’s monetary ecosystem by offering credit score and leasing providers outdoors conventional banking channels. The sector’s efficiency typically correlates with broader financial traits and credit score demand.

The inventory’s latest worth motion could mirror shifts in market evaluation and investor concentrate on corporations demonstrating resilience and progress inside this sector. The present market surroundings, with mid-cap shares main beneficial properties, additional contextualises Brijlaxmi Leasing & Finance’s rally as a part of a broader sectoral momentum.

Abstract of Key Worth Metrics

To summarise, Brijlaxmi Leasing & Finance’s key worth metrics as of at this time embrace:

- New 52-week excessive: Rs.16.85

- Day’s excessive and opening worth: Rs.16.85

- Consecutive achieve interval: 5 days

- Returns over final 5 days: 91.48%

- Outperformance versus NBFC sector at this time: 9.32%

- 52-week low: Rs.7.03

These figures spotlight the inventory’s sturdy worth momentum and its place inside the present market panorama.

Market Outlook and Broader Indices

The Sensex’s present buying and selling close to its 52-week excessive and its constructive technical indicators present a constructive surroundings for shares exhibiting sturdy momentum. Mid-cap shares, together with Brijlaxmi Leasing & Finance, have been on the forefront of market beneficial properties, reflecting a rotation in direction of corporations with progress traits inside this section.

Whereas the broader market exhibits indicators of cautious optimism, Brijlaxmi Leasing & Finance’s latest worth motion stands out as a noteworthy improvement inside the NBFC sector and mid-cap area.

Conclusion

Brijlaxmi Leasing & Finance’s attainment of a brand new 52-week excessive at Rs.16.85 marks a big milestone in its worth journey. Supported by consecutive beneficial properties, sturdy technical positioning, and sectoral outperformance, the inventory’s latest rally displays a interval of sustained momentum. This improvement happens inside a broader market context the place mid-cap shares and the Sensex itself are buying and selling close to multi-month highs, underscoring a constructive market surroundings for corporations demonstrating sturdy worth motion.

Just for Rs. 14,999 – Get Entry to 2 Years + 6 Months of All Premium Options on MarketsMojo. As little as ₹500/month! Declare 83% OFF →

Leave a Reply