By Amged B. Shwehdy

All over the world, governments are grappling with the identical query: how can we mobilise and defend the sources wanted to fund improvement in an period of shrinking fiscal area? Public budgets are underneath unprecedented stress as local weather shocks intensify, debt servicing prices rise, and international assist flows decline. But amid these challenges, a quiet transformation is going down. Nations are more and more turning to digital applied sciences as the brand new spine of tax reform and public monetary administration (PFM), strengthening their capability not solely to gather home income but in addition to safeguard it, allocate it transparently, and construct belief with residents.

Nowhere is that this shift extra seen than in Africa, the place governments are investing in know-how to handle long-standing structural bottlenecks in tax administration, public procurement, and expenditure oversight. As international debates intensify about how international locations can finance the Sustainable Improvement Targets, Africa presents highly effective classes on how digital innovation can improve state capability and create extra resilient fiscal techniques.

Expertise because the Basis of Trendy Fiscal States

Home useful resource mobilisation (DRM) is more and more recognised because the cornerstone of fiscal sovereignty. In keeping with the IMF, enhancing tax administration and digitalising income techniques can increase tax-to-GDP ratios by 2 to 4 share factors in creating international locations. That is important in areas the place tax-to-GDP ratios stay low; in North Africa, a number of international locations, together with Algeria, Egypt, Libya, Mauritania, and Sudan, acquire under 15% of GDP in taxes, in comparison with the OECD benchmark of 25–30%.

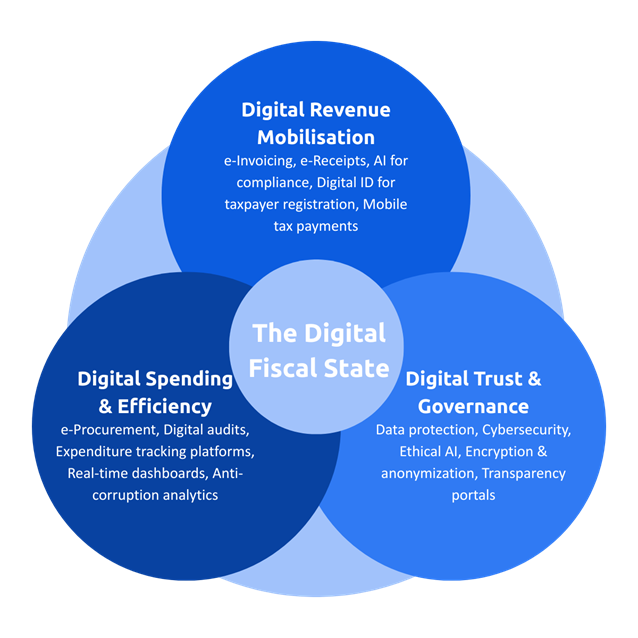

Digital transformation helps governments break this cycle by widening the tax base, enhancing compliance, decreasing leakages, and growing transparency. However the actual promise of know-how lies not solely in boosting how a lot governments acquire; it lies equally in making certain that sources are used effectively, ethically, and transparently.

Expertise for Each Income and Spending Effectivity

Expertise for Strengthening Tax Reform

Throughout Africa, governments are utilizing innovation to modernise their tax techniques:

- Algeria launched the Jibayatic digital tax platform and digital fiscal stamps to reinforce taxpayer authentication.

- Egypt has rolled out nationwide e-invoicing and e-receipt techniques supported by synthetic intelligence, enabling real-time information validation and enhancing compliance. The nation’s Medium-Time period Income Technique goals to extend tax income by 3% of GDP by 2027.

- Libya has begun constructing its first built-in digital tax roadmap, with help from the UN Financial Fee for Africa (UNECA).

- Morocco has digitised greater than 547 administrative companies, together with mobile-based tax submitting and digital invoicing for SMEs.

- Mauritania is increasing e-filing and digital funds nationwide.

- Tunisia has expanded digital tax declaration instruments and cellular tax funds, whereas integrating digital procurement to strengthen expenditure governance.

These reforms reveal how know-how can assist international locations broaden the tax base, scale back informality, and strengthen compliance, however they’re just one a part of the story.

Expertise for Public Spending Effectivity

Digital applied sciences are additionally reworking how governments handle, audit, and safeguard public sources, making certain that revenues collected don’t leak via inefficient procurement techniques or opaque spending channels.

Morocco: e-Procurement as a Transparency Engine

Morocco’s digital procurement ecosystem —together with the Ajal Observatory of Funds— supplies real-time monitoring of procurement processes and cost delays in State-owned enterprises. This method reduces alternatives for corruption, ensures well timed settlements, improves provider confidence, and expands entry for SMEs to authorities contracts. By digitalising tender publication, bidding, evaluations, and contract administration, Morocco has improved accountability and decreased administrative obstacles that after hindered competitors.

Egypt: Public e-Procurement System

Egypt is implementing a nationwide Public e-Procurement System designed to digitalise all phases of the procurement cycle. The system will increase transparency, reduces discretionary decision-making, and permits suppliers throughout the nation to compete on equal footing. By publishing tenders centrally and utilizing know-how to automate evaluations and contract awards, Egypt is decreasing leakages and enhancing the effectivity of public expenditure — a important complement to the nation’s tax digitalisation reforms. Early outcomes point out enhancements in effectivity, price financial savings, and enhanced oversight in large-scale public spending.

Collectively, these examples illustrate a broader shift: digital instruments are enabling African governments not solely to gather extra income, but in addition to guard and utilise that income extra successfully, closing long-standing governance gaps.

A New Fiscal Imaginative and prescient Rising From North Africa

On the UNECA Intergovernmental Committee of Senior Officers and Consultants (ICSOE) held in November 2025 in Rabat, North African international locations converged round a shared fiscal imaginative and prescient formed by the accelerating function of know-how in governance. The discussions highlighted not solely coverage reforms but in addition a broader shift in how governments perceive income, spending, and public belief within the digital age.

1. A Digital-First Strategy to Fiscal Techniques

Nations are recognising that digital transformation is not an auxiliary reform; it’s the core structure of future fiscal resilience. Governments agreed on the necessity to speed up e-tax techniques, broaden digital funds, strengthen monetary inclusion, and combine applied sciences that improve compliance and scale back informality. This shift alerts a broader acknowledgement: efficient home useful resource mobilisation will more and more hinge on digital capabilities, not conventional administrative enlargement.

2. Constructing Expertise Sovereignty, Not Dependency

A second perception was the rising emphasis on know-how sovereignty. Reasonably than relying solely on imported platforms, international locations highlighted the significance of constructing nationwide innovation ecosystems, from digital infrastructure to native analysis capabilities and homegrown digital options. This method permits international locations to tailor techniques to their realities, scale back long-term prices, and guarantee increased ranges of safety, adaptability, and belief. Expertise, on this context, turns into a strategic asset, not solely a improvement device.

3. Embedding Digital Belief Into Fiscal Governance

Maybe essentially the most highly effective thought was the consensus that digital fiscal techniques can solely succeed if constructed on sturdy citizen belief. Nations emphasised the necessity to align tax digitalisation with strong information safety, moral AI use, cybersecurity, and transparency in public spending. This displays a deeper shift: governments are starting to deal with information safety, fiscal transparency, and digital accountability as fiscal fundamentals quite than governance add-ons. Belief, transparency, and know-how have gotten intertwined pillars of fiscal reform.

Collectively, these insights level towards a extra built-in mannequin of DRM and PFM; one which makes use of know-how not solely to mobilise sources however to create fairer, extra clear, and extra citizen-centric public finance techniques, mirroring a world shift, the place international locations—from Latin America to Southeast Asia—are more and more treating digital infrastructure and belief frameworks as fiscal foundations quite than technical upgrades.

The Digital Fiscal State Framework, by Amged B Shwehdy

A World Crucial: Financing the Future Via Expertise

Africa’s experiences present that digital transformation in fiscal governance isn’t merely an administrative improve; it’s a strategic funding in nationwide resilience. By combining stronger income techniques with clear, technology-enabled public spending mechanisms, international locations can unlock the sources wanted to fund local weather adaptation, infrastructure, well being techniques, and human improvement.

This isn’t an African problem alone. All over the world, governments are on the lookout for methods to rebuild fiscal area, strengthen belief, and finance long-term improvement. The teachings rising from North Africa — rooted in innovation, transparency, and digital belief — provide a roadmap for international locations navigating fiscal uncertainty.

Expertise is turning into the brand new spine of the fashionable fiscal state. When paired with sturdy governance and citizen belief, it has the facility to remodel the social contract and assist international locations finance a extra resilient, sustainable, and equitable future.

Reference Record

African Tax Administration Discussion board (ATAF). (2021). The Position of Expertise in Africa’s Tax Administrations: Enhancing Compliance and Broadening the Base.

Financial Fee for Africa (ECA). (2025). Affect of Local weather Change on GDP in Africa (forthcoming).

Financial Fee for Africa – Subregional Workplace for North Africa (ECA/SRO-NA). (2025).

Idea Observe: Advert Hoc Knowledgeable Group Assembly on Enhancing Home Useful resource Mobilisation via Digital Applied sciences in North Africa.

ICSOE 2025 Idea Observe.

Actions Report 2024–2025.

Egyptian Tax Authority. (2023). Case research: Digital Transformation of the Egyptian Tax System via e-Invoicing and e-Receipts. Microsoft Buyer Story.

Gopinath, G., Gourinchas, P.-O., Presbitero, A.F., & Topalova, P. (2025). Altering World Linkages: A New Chilly Conflict? Journal of Worldwide Economics, 153.

GSMA. (2022). State of the Trade Report on Cell Cash 2022.

Worldwide Financial Fund (IMF).

(2021). Tax Capability and Development: Is There a Manner Ahead Via Digitalisation?

(2023). Mauritania: Workers Report for the 2023 Article IV Session.

Microsoft. (2022). Egyptian Tax Authority Modernises Tax Submitting System with Microsoft Applied sciences. (Official case research.)

Moroccan Authorities / Ministry of Digital Transition and Administration Reform. Information on e-services, e-procurement, and digital platforms, together with the Ajal Observatory of Funds.

OECD. (2022). Tax Administration 2022: Comparative Data on OECD and Different Superior and Rising Economies.

Shang, Q., & Value, A. (2019). A Blockchain-Based mostly Land Titling Mission within the Republic of Georgia: Rebuilding Public Belief. Improvements: Expertise, Governance, Globalisation, 12(3–4), 72–78.

UNCTAD. (2020). Tackling Illicit Monetary Flows for Sustainable Improvement in Africa. (Estimate: Africa loses $88.6 billion yearly to IFFs.)

World Financial institution. (2023). Egypt Public Expenditure Assessment: Constructing Fiscal Resilience for Sustainable Development.

World Financial institution. (2018). Public Sector Financial savings and Income from Identification Techniques: Alternatives and Constraints. (Information on digital ID and income features.)

World Meteorological Organisation (WMO). (2024). State of the Local weather in Africa Report 2023.

———————————————-

This text was first printed by ECA on December 11th, 2025.

The creator, Amged B. Shwehdy, is an ECA Fellow with the North Africa Subregional Workplace

Comply with him on https://shwehdy.ly/ and https://www.linkedin.com/in/abshwehdy/

Leave a Reply