Credit score: Carlos Reyes

Creator: Alejandro Valenzuela, Chairman, Banco Azteca and Azteca Servicios Financieros

In international finance, the phrase ‘innovation’ typically evokes digital platforms, premium companies or algorithmic fashions. But probably the most transformative advances in banking are usually not technological in isolation. They’re structural: designing merchandise, processes and methods that increase entry, resilience and belief.

This has been Banco Azteca’s mission from the beginning. In Mexico, monetary exclusion was as soon as handled as inevitable. By embedding inclusion into its very structure, the financial institution has constructed a mannequin that’s each commercially strong and socially related. The popularity by World Finance because the ‘Most Progressive Firm within the Banking Business 2025’ displays not a single app or function, however a system-wide dedication to innovation as infrastructure.

Banco Azteca’s inclusive product design demonstrates that innovation can lengthen far past know-how. Guardadito, the financial institution’s foundational financial savings account, stays the primary formal monetary software for hundreds of thousands of Mexicans, with greater than 24 million lively accounts. SOMOS, created by ladies for ladies, integrates financial savings with entry to authorized, medical and psychological assist, now serving over 680,000 ladies. Guardadito Amigo and Sin Fronteras, tailor-made for migrants, refugees and their households, have grown to greater than 150,000 accounts by mid-2025.

These merchandise are usually not pilots. They’re regulated, everlasting and obtainable in each department nationwide. Their impression reveals that innovation additionally means permanence: turning exclusion into participation by making inclusion a part of the core banking system.

Digital at scale, however not alone

Expertise performs a important function, however it’s a part of a wider ecosystem. Banco Azteca’s app has change into one of many largest digital banking platforms within the nation, with greater than 23 million customers. Two-thirds of all transactions and greater than half of financial savings account openings now occur digitally.

The app was designed from the bottom up for first-time customers: intuitive, hybrid and linked to 2,000 branches that stay open 12 months a yr. This hybrid method means shoppers can transfer seamlessly between digital and bodily channels. For a lot of, the app is their first interplay with a proper monetary establishment, but they know they’ll nonetheless depend on face-to-face assist if wanted. What makes this digital mannequin progressive is just not know-how in isolation, however the way it enhances human-centred infrastructure to scale belief.

Banco Azteca’s app has change into one of many largest digital banking platforms within the nation

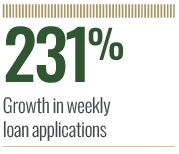

Innovation additionally extends to how credit score is originated and serviced. The Unified Mortgage Origination Course of, launched prior to now yr, has standardised functions throughout bodily and digital channels. Weekly mortgage functions have grown 231 %, with digital origination up 75 %, and in the present day 68 % of all loans originate digitally. Greater than half of repayments are made instantly within the app. By simplifying processes, embedding real-time monitoring and permitting compensation with out value or journey, the financial institution has redefined entry to credit score for hundreds of thousands of households. Right here once more, innovation is not only technological; it’s behavioural, designed round how individuals really stay and work.

Belief as institutional innovation

Banco Azteca’s Apoyar Nos Toca programme illustrates that innovation is just not restricted to merchandise or know-how. It will probably additionally imply rethinking how a financial institution builds legitimacy and social resonance. By supporting merit-based causes reminiscent of Mexico’s Physics Olympiad delegation, rural college students in Oaxaca, and excellent artists, the initiative generated over 50 million natural impacts in 2025. What distinguishes it isn’t philanthropy, however a brand new mannequin of reputational technique, one which transforms selective sponsorships into scalable trust-building infrastructure, linking institutional function with nationwide delight.

Banco Azteca’s mannequin suggests a broader lesson for international finance. Innovation is just not solely outlined by apps, nor by short-lived pilots. It’s about permanence, replicability and resilience. At Banco Azteca, inclusion is designed as infrastructure: merchandise that final, processes that scale, digital channels that join, and programmes that construct belief.

In an period the place know-how is reshaping monetary companies at unprecedented velocity, the problem is to make sure that it empowers reasonably than excludes. Banco Azteca’s expertise reveals that innovation is strongest when it combines digital transformation with inclusive product design, resilient processes and trust-building initiatives.

Goal makes know-how significant, turning innovation into infrastructure for fairness. Essentially the most important innovation in banking, due to this fact, is just not measured by options alone, however by the size of lives it brings into the monetary system.

Leave a Reply