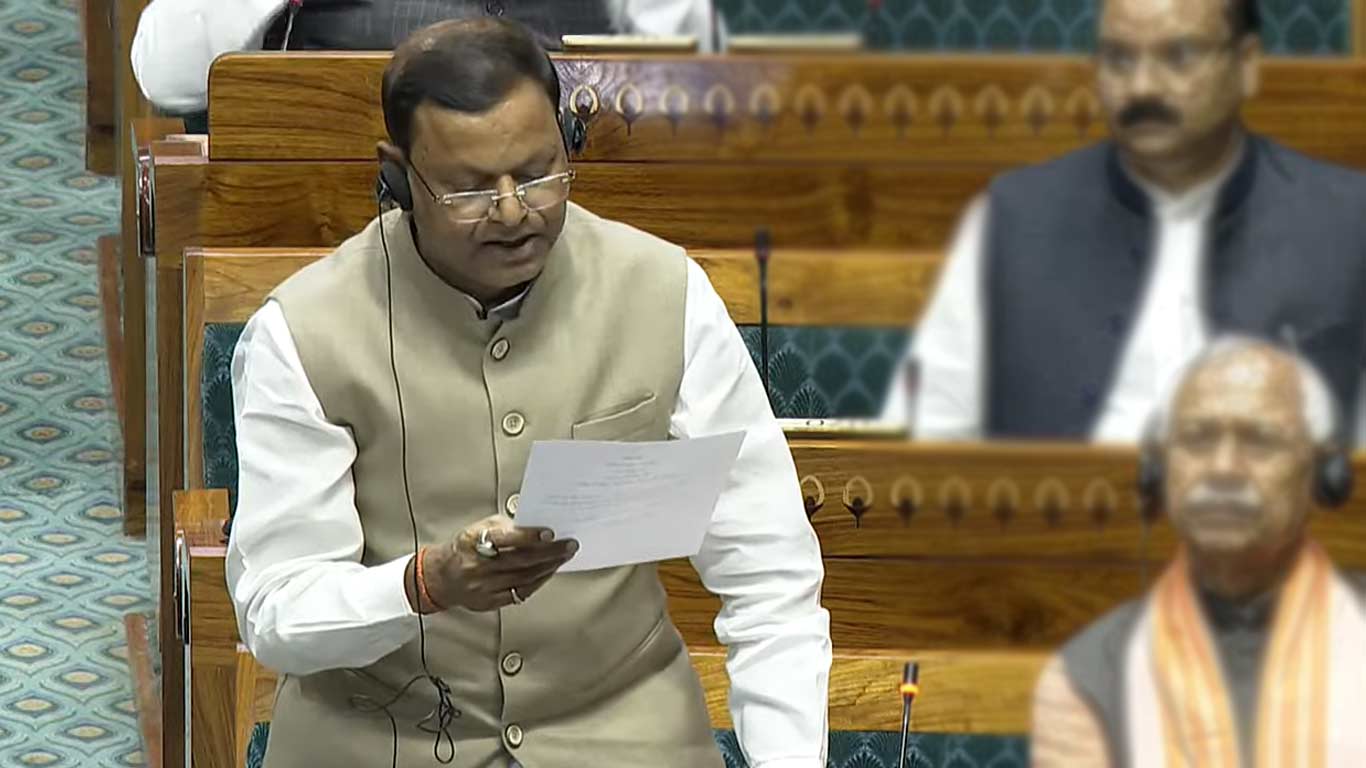

New Delhi, Dec 10 (KNN) The nation has achieved important progress in monetary inclusion, with 99.91 % of villages now gaining access to banking shops, together with financial institution branches, enterprise correspondents (BCs), and India Put up Funds Financial institution (IPPB) inside a 5-kilometre radius, Minister of State for Finance, Pankaj Chaudhary, knowledgeable the Lok Sabha.

Monitoring Banking Entry

The supply of banking shops is tracked by way of the Jan Dhan Darshak (JDD) app, a GIS-based platform that collects knowledge from banks to make sure protection throughout the nation.

Whereas knowledge on the entire inhabitants with out financial institution accounts shouldn’t be centrally maintained, efforts to develop banking entry in uncovered areas are ongoing beneath the steerage of State and Union Territory Stage Bankers’ Committees (SLBCs/UTLBC).

Banks take into account RBI directions, enterprise plans, and industrial viability, usually conducting surveys earlier than opening new shops.

Monetary Inclusion Initiatives

The federal government frequently conducts consciousness campaigns on the grassroots degree to advertise flagship monetary inclusion schemes, together with the Pradhan Mantri Jan Dhan Yojana (PMJDY), Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), Pradhan Mantri Suraksha Bima Yojana (PMSBY), and Atal Pension Yojana (APY).

Launched in 2014, PMJDY goals to supply common banking entry to unbanked households and was prolonged in 2018 to cowl each unbanked grownup.

Current Efforts to Enhance Penetration

From July 1 to October 31, 2025, a Gram Panchayat-level saturation marketing campaign was carried out nationwide to additional improve the attain of monetary inclusion schemes.

The initiative aligns with the federal government’s guiding rules of ‘banking the unbanked, securing the unsecured, funding the unfunded, and serving the underserved’, making certain equitable entry to monetary providers throughout India.

(KNN Bureau)

Leave a Reply