-

Orman recommends shopping for solely wants as an alternative of needs for six months to remodel funds.

-

Automate financial savings by splitting paychecks between checking and financial savings accounts.

-

Maximize 401(okay) contributions as much as employer match restrict to double retirement funding.

-

When you’re fascinated by retiring or know somebody who’s, there are three fast questions inflicting many People to understand they’ll retire sooner than anticipated. take 5 minutes to be taught extra right here

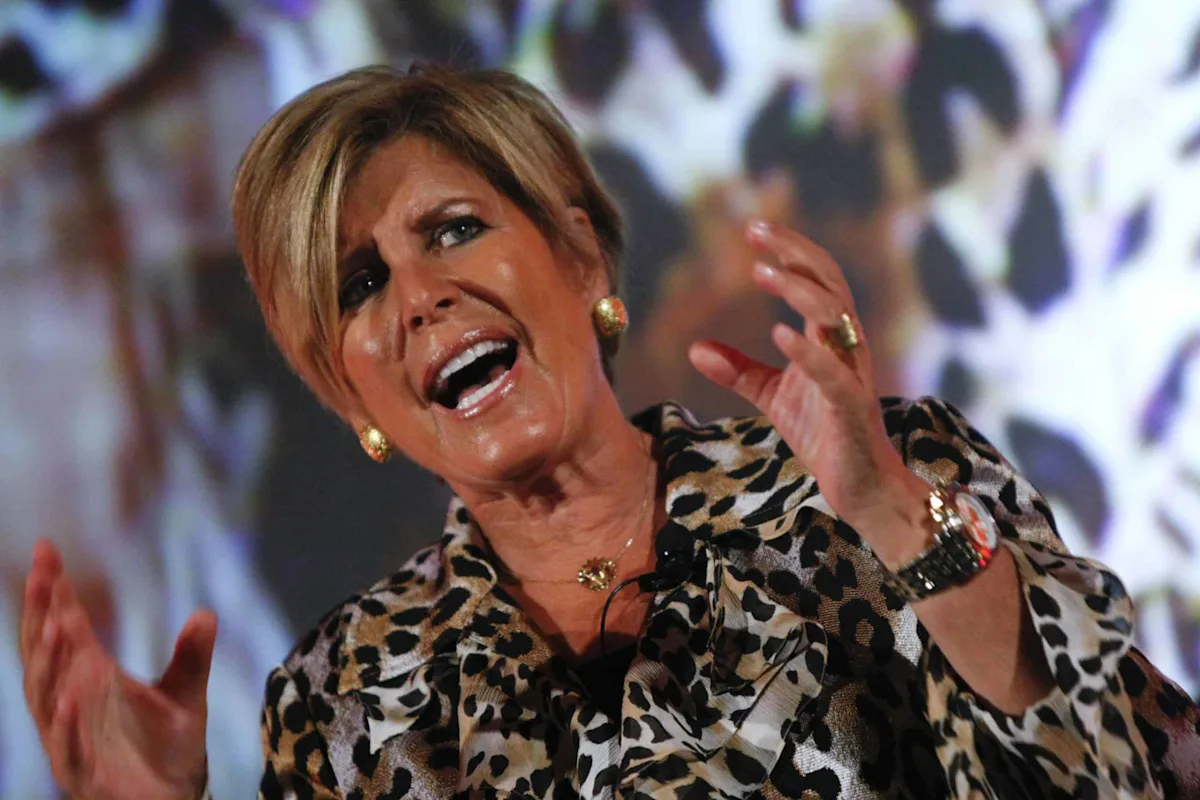

Finance knowledgeable Suze Orman warns a typical mistake can value you huge cash in retirement.

That features focusing extra on needs than what you want, as she explains on this video.

In reality, based on Orman, she may afford to purchase a costlier condominium, however she didn’t want it. And if folks apply that mind-set of wants as an alternative of needs, their lives may dramatically change. The monetary guru additionally challenged folks to purchase solely the issues they want and never need for the subsequent six months to see a powerful transformation.

Wants are belongings you and your loved ones can’t stay with out. That features meals, water, shelter, clothes, treatment, and bathroom paper, which got here beneath substantial demand a number of years in the past.

Desires are your needs, which aren’t actually wanted to outlive.

I’d love to purchase a black Lamborghini, which might value about $230,000. However I don’t want it. Plus, I’m not a giant fan of getting in a automobile and sitting on the ground basically. And certain, you want meals to perform. However you don’t want a Ruth Chris steak each night time of the week, which might set you again about $150 an evening. It’d be good to have, nevertheless it’s not a prime want.

Briefly, by slicing again in your needs, you might have far more cash in your pocket.

Suze Orman additionally believes crucial factor to do is stay under your means and inside your means. Whereas budgeting and creating an inventory are sometimes steered, Orman says she’s not a fan of budgeting. She finds them to be ineffective.

As an alternative, she argues it is best to automate the method of saving cash. Prepare for an automated switch so that each time you’re paid, a portion goes to checking and a portion goes instantly into financial savings. By doing so, you may assist construct your general financial savings and even create an emergency fund account, which many individuals don’t have.

You’ll be able to even reap the benefits of your employer’s 401(okay) match program.

You probably have an employer that can match your 401(okay), maximize your contributions as much as the quantity your employer will match. In case your employer will match as much as 6% of your wage, maximize that. When you earn $75,000 a 12 months, and also you contribute 1%, that’s $750 for retirement. In case your employer matches that, you might have $1,500 for retirement per 12 months. When you contribute 6% and your employer matches that, that’s about $6,750 in retirement per 12 months.

Leave a Reply